3 Reasons to Sell CZR and 1 Stock to Buy Instead

Shareholders of Caesars Entertainment would probably like to forget the past six months even happened. The stock dropped 30.2% and now trades at $28.10. This may have investors wondering how to approach the situation.

Is now the time to buy Caesars Entertainment, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Even though the stock has become cheaper, we're cautious about Caesars Entertainment. Here are three reasons why you should be careful with CZR and a stock we'd rather own.

Why Is Caesars Entertainment Not Exciting?

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ:CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

1. Lackluster Revenue Growth

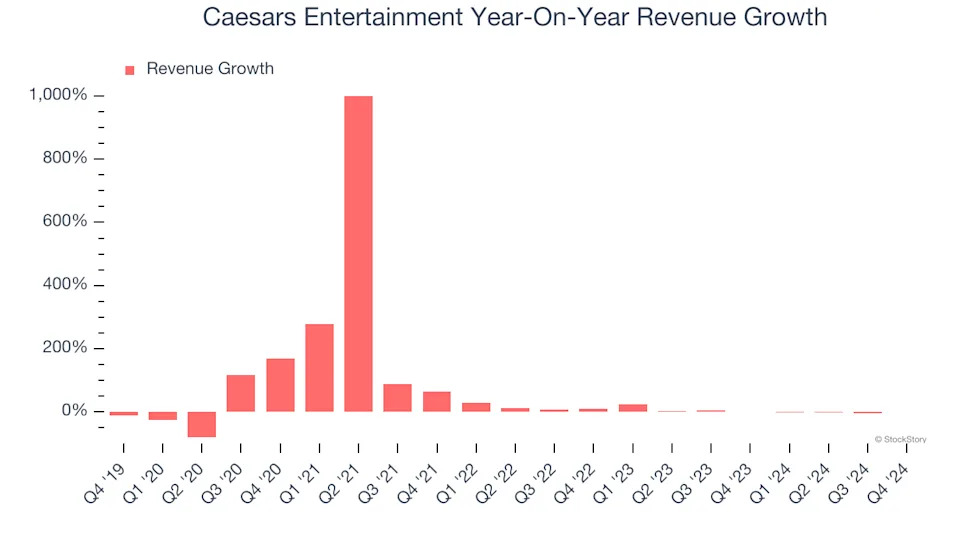

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Caesars Entertainment’s recent history shows its demand has slowed significantly as its annualized revenue growth of 1.9% over the last two years was well below its five-year trend. Note that COVID hurt Caesars Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

2. EPS Trending Down

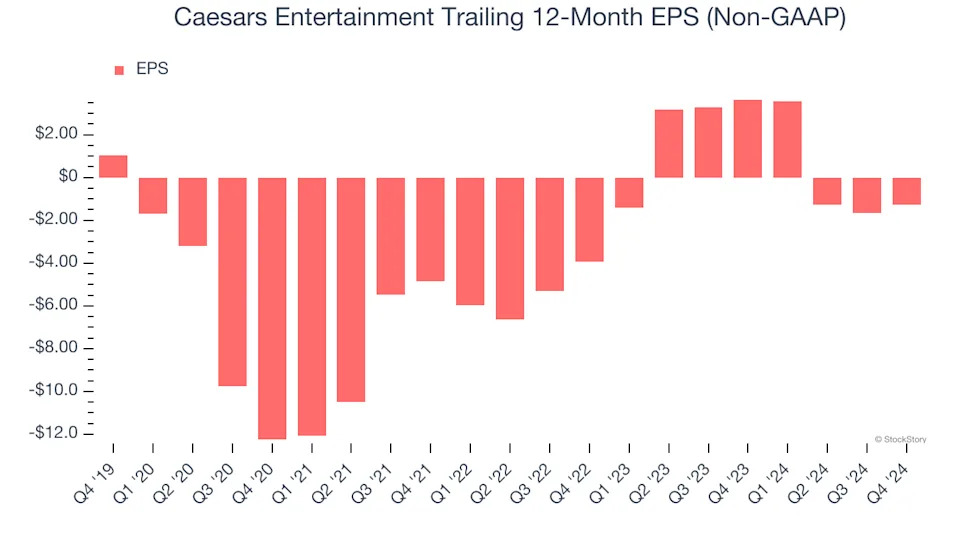

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Caesars Entertainment, its EPS declined by 26.4% annually over the last five years while its revenue grew by 34.8%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

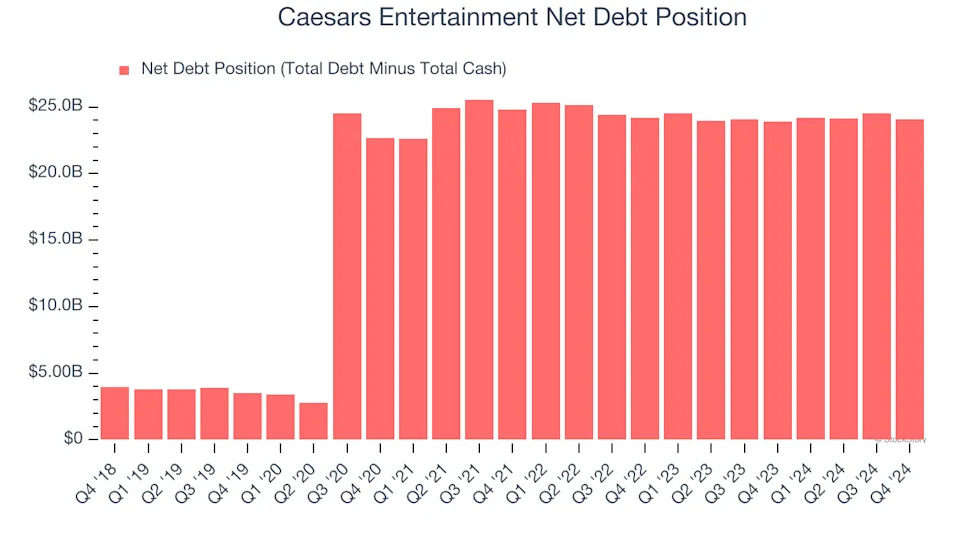

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Caesars Entertainment burned through $221 million of cash over the last year, and its $25.04 billion of debt exceeds the $961 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Caesars Entertainment’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.