3 Reasons to Sell GDEN and 1 Stock to Buy Instead

Over the last six months, Golden Entertainment shares have sunk to $26.44, producing a disappointing 14.8% loss - worse than the S&P 500’s 1.7% drop. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Golden Entertainment, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than GDEN and a stock we'd rather own.

Why Is Golden Entertainment Not Exciting?

Founded in 2001, Golden Entertainment (NASDAQ:GDEN) is a gaming company operating casinos, taverns, and distributed gaming platforms.

1. Revenue Spiraling Downwards

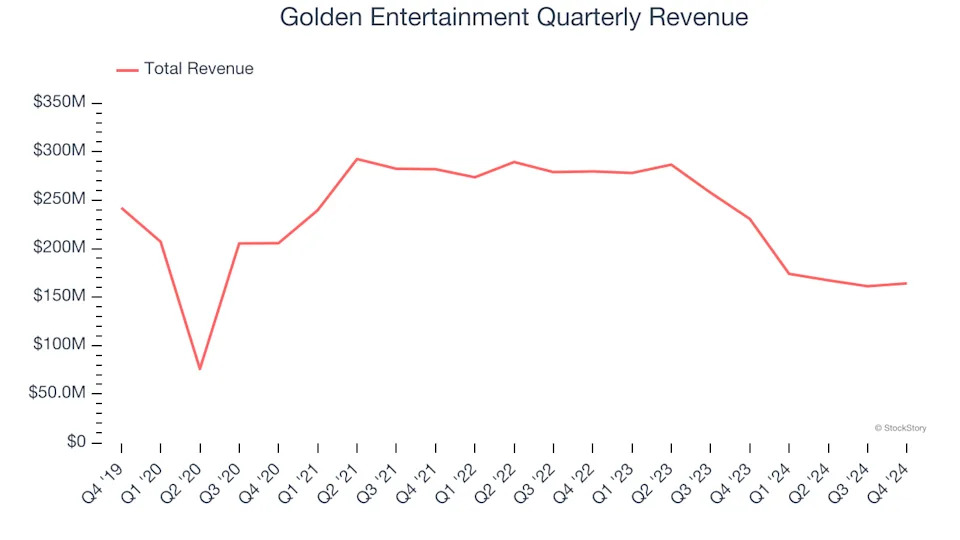

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Golden Entertainment’s demand was weak and its revenue declined by 7.3% per year. This wasn’t a great result and signals it’s a lower quality business.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Golden Entertainment’s revenue to stall. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

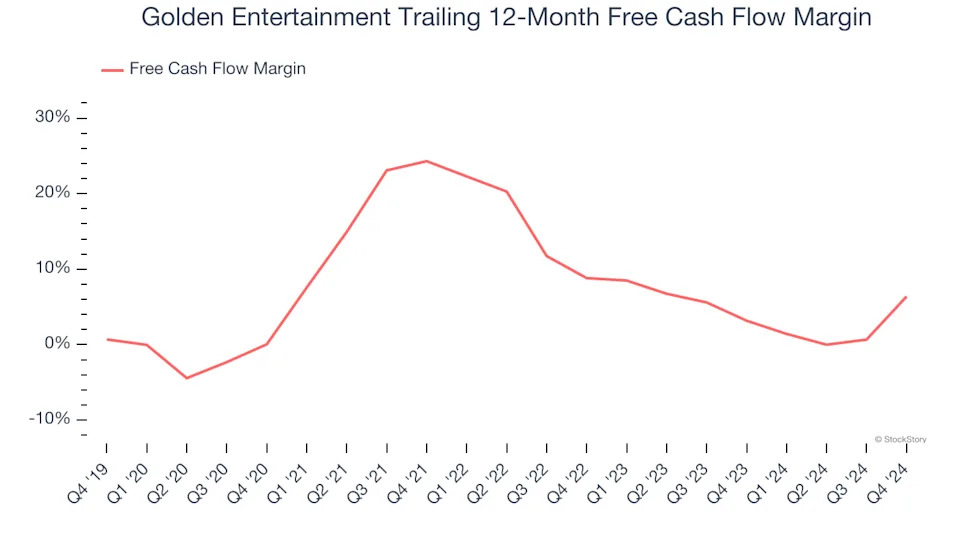

Golden Entertainment has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.4%, lousy for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Golden Entertainment to make large cash investments in working capital and capital expenditures.

Final Judgment

Golden Entertainment isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 23.1× forward price-to-earnings (or $26.44 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy .