3 Reasons to Avoid BALL and 1 Stock to Buy Instead

Ball has gotten torched over the last six months - since September 2024, its stock price has dropped 23.6% to $51.53 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Ball, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why there are better opportunities than BALL and a stock we'd rather own.

Why Do We Think Ball Will Underperform?

Started with a $200 loan in 1880, Ball (NYSE:BLL) manufactures aluminum packaging for beverages, personal care, and household products as well as aerospace systems and other technologies.

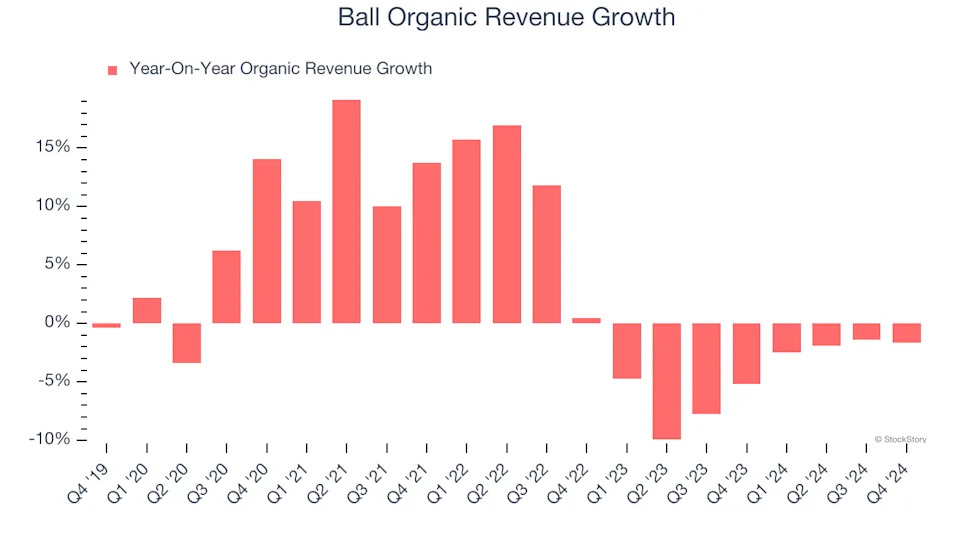

1. Core Business Falling Behind as Demand Declines

We can better understand Industrial Packaging companies by analyzing their organic revenue. This metric gives visibility into Ball’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Ball’s organic revenue averaged 4.4% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Ball might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Ball’s revenue to rise by 2.8%. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

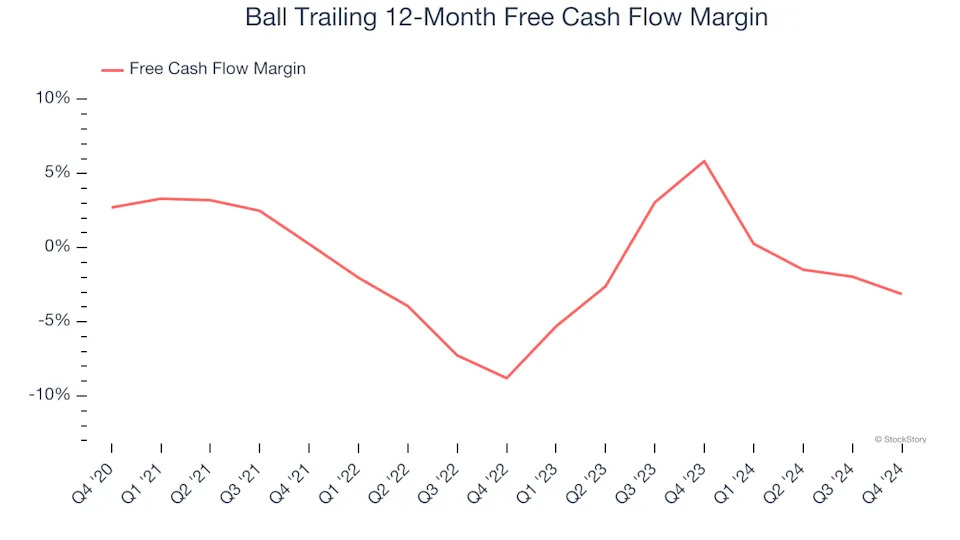

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Ball’s margin dropped by 5.8 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Ball’s free cash flow margin for the trailing 12 months was negative 3.1%.