3 Reasons to Avoid LTH and 1 Stock to Buy Instead

Even during a down period for the markets, Life Time has gone against the grain, climbing to $31.72. Its shares have yielded a 25.7% return over the last six months, beating the S&P 500 by 34.7%. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Life Time, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Despite the momentum, we're sitting this one out for now. Here are three reasons why there are better opportunities than LTH and a stock we'd rather own.

Why Is Life Time Not Exciting?

With over 150 locations and gyms that include saunas and steam rooms, Life Time (NYSE:LTH) is an upscale fitness club emphasizing holistic well-being and fitness.

1. Same-Store Sales Falling Behind Peers

We can better understand Leisure Facilities companies by analyzing their same-store sales. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Life Time’s underlying demand characteristics.

Over the last two years, Life Time’s same-store sales averaged 14% year-on-year growth. This performance slightly lagged the sector and suggests it might have to change its strategy or pricing, which can disrupt operations.

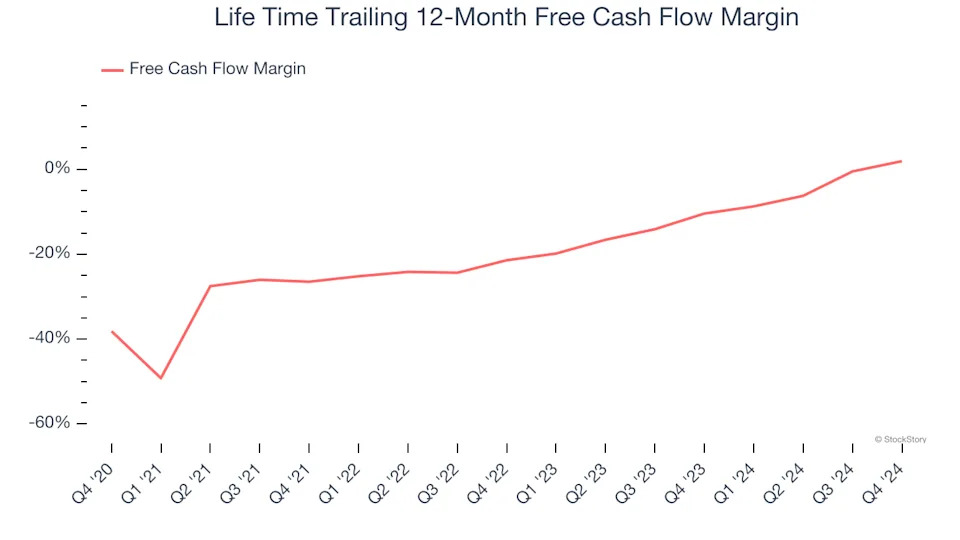

2. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Life Time posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Life Time’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 3.7%, meaning it lit $3.73 of cash on fire for every $100 in revenue.

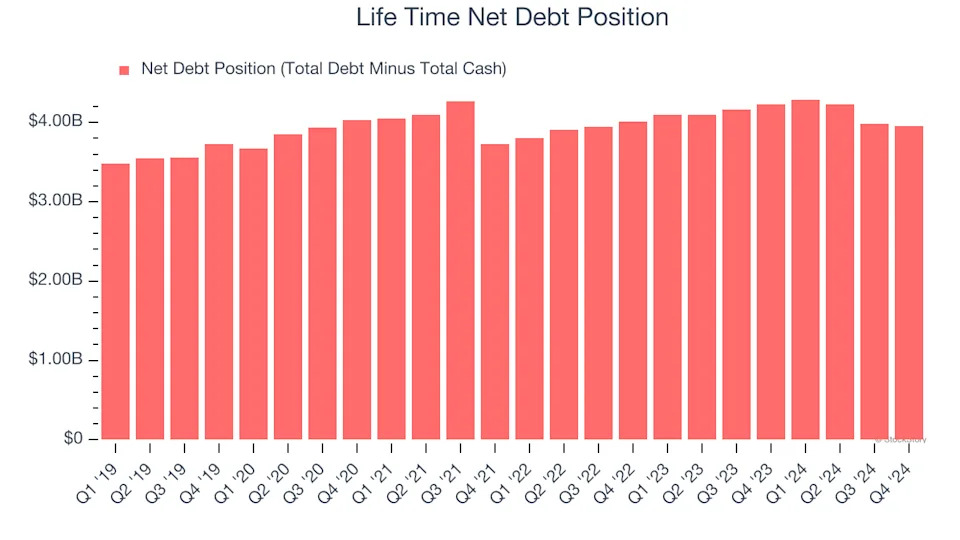

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Life Time’s $3.99 billion of debt exceeds the $27.88 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $676.8 million over the last 12 months) shows the company is overleveraged.