Market Strategists Upgrade Europe After Years of Caution

(Bloomberg) -- The financial industry is abandoning caution and chasing the rally in European stocks, hiking their targets and looking to the upside.

Most Read from Bloomberg

Nearly half of the strategists in a monthly Bloomberg survey have raised their forecasts for the Stoxx Europe 600 Index since last month — when about two thirds of strategists were expecting downside ahead.

The new estimates raised the median target by over 6% to 566 from 533 last month. While the average implies little upside from Wednesday’s close, strategists are overwhelmingly positive, with less than a third of respondents now expecting a pullback for the rest of the year.

“Seismic policy shifts in Europe could eventually increase the region’s long term earnings-per-share growth trajectory and therefore boost longer term returns,” said Citigroup Inc. strategist Beata Manthey, who correctly predicted European stocks would rally this year. “Our once bullish targets have little upside left.”

The region is benefiting from several factors that are luring investors. German lawmakers passed a landmark spending package this week, unlocking hundreds of billions of euros for defense and infrastructure and ending decades of budget austerity. That could be followed by further fiscal stimulus from the European Union.

There’s also a boost from the monetary policy outlook. Markets expect two more interest-rate cuts from the European Central Bank this year, taking its key rate to the 2% mark. That will keep a wide gap with the Federal Reserve, favoring borrowers in Europe and drawing money into stocks. Finally, there are rising expectations that the war in Ukraine will come to an end.

“The outlook has shifted materially for Europe in a short space of time,” said UBS Group AG strategist Gerry Fowler, who sees the region’s economic growth potentially accelerating in coming years to draw money away from the US. “After several years of zero earnings growth, European equities should now be able to deliver positive growth and justify higher valuations to reflect this.”

There’s still a wide range of forecasts. Strategists at Barclays Plc, JPMorgan Chase & Co., Pictet Wealth Management and UniCredit SpA were among those raising targets this month. CMC Markets Plc are now the biggest bulls in the poll, with a 620 target, implying 12% gains. By contrast Bank of America Corp. strategists are the most bearish, with a 500 target.

“Markets have started to price softening global growth, but that process has further to go,” said Bank of America strategists led by Sebastian Raedler, pointing to European markets being too optimistic on the economy. “If global growth slows instead, as we expect, this would imply over 10% further downside for European equities, leaving us negative on the market.”

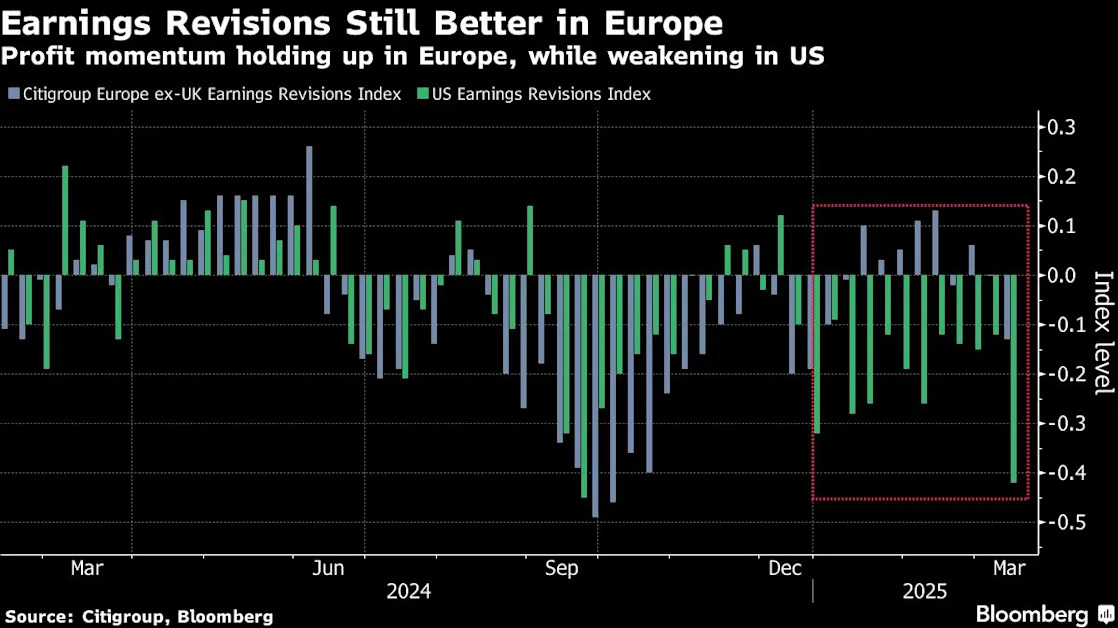

The economic momentum in Europe does remain strong, especially in comparison to the US. The region’s economic surprises have been positive, while a Citigroup gauge of earnings revisions has fared better this year. Consequently, European stocks have resisted the major pullback seen in the US. Now strategists lifting targets is likely to feed investors’ optimism.

There’s already been a record rotation out of the US and into European equities, according to Bank of America’s fund manager survey published this week. A net 39% of respondents were overweight European equities relative to global markets, up from 12% last month and the biggest overweight position since mid-2021.

With the Stoxx Europe 600 up nearly 9% this year so far, investor bullishness has cooled somewhat, with two-thirds projecting upside over the coming 12 months, down from three-quarters in last month’s survey. Citigroup’s Manthey pointed to short term risks from tariffs or a US slowdown.

In the fixed-income market, focus is also shifting to US trade restrictions in the near term. After a strong rally earlier this month, the euro is falling as banks including Morgan Stanley say the April 2 levies limit the room for further gains. Meanwhile, the selloff in European bonds is cooling, as concern about the impact of tariffs on the economy make the case for interest rates to keep falling.

Still, for Frederic Dodard, State Street Global Advisors Ltd’s head of asset allocation, the region’s price momentum and sentiment have improved materially. He sees balance sheets as healthy, valuations as more attractive than other regions despite the recent rally, and the politics as promising.

“Political uncertainty in France and Germany has come down,” he said. “The prospects for a cease-fire in Ukraine, potentially a resolution of the war in the future, and the recent under-performance of US equities are making European equities more attractive now than they have been since spring 2024.”

--With assistance from Alison David, Sagarika Jaisinghani, Jan-Patrick Barnert and Greg Ritchie.

(Updates with fixed-income market view in 13th paragraph.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.