Immuno-Oncology Stocks Q4 In Review: Exact Sciences (NASDAQ:EXAS) Vs Peers

Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Exact Sciences (NASDAQ:EXAS) and its peers.

Over the next few years, immuno-oncology companies, which harness the immune system to fight illnesses such as cancer, faces strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 4 immuno-oncology stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 3.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12.6% since the latest earnings results.

Exact Sciences (NASDAQ:EXAS)

With a mission to detect cancer earlier when it's more treatable, Exact Sciences (NASDAQ:EXAS) develops and markets cancer screening and diagnostic tests, including its flagship Cologuard stool-based colorectal cancer screening test.

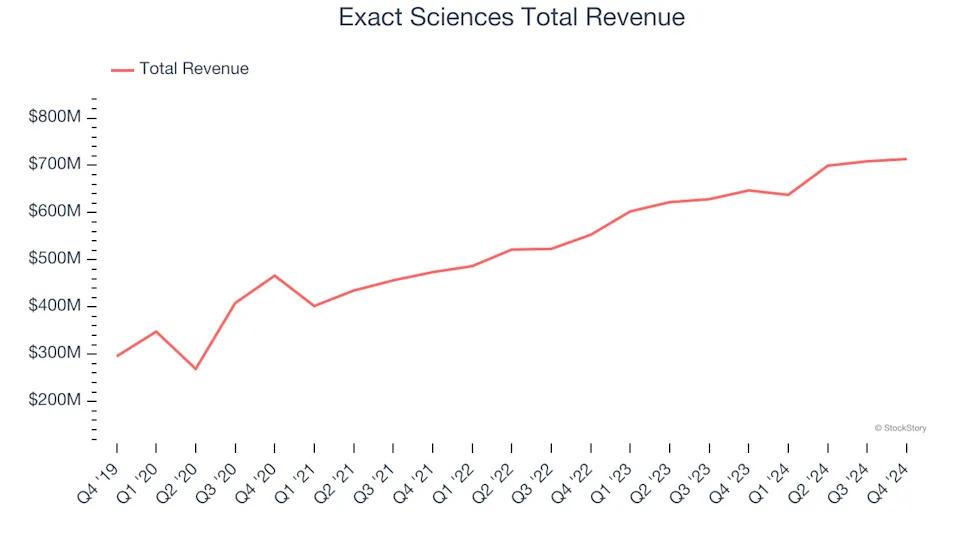

Exact Sciences reported revenues of $713.4 million, up 10.3% year on year. This print exceeded analysts’ expectations by 1.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ constant currency revenue estimates and a solid beat of analysts’ EPS estimates.

“The Exact Sciences team is off to a good start in 2025, building on the momentum we created in the fourth quarter,” said Kevin Conroy, Chairman and CEO of Exact Sciences.

Exact Sciences delivered the slowest revenue growth and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 11.4% since reporting and currently trades at $44.69.

Is now the time to buy Exact Sciences? Access our full analysis of the earnings results here, it’s free .

Best Q4: Natera (NASDAQ:NTRA)

Founded in 2003 as Gene Security Network before rebranding in 2012, Natera (NASDAQ:NTRA) develops and commercializes genetic tests for prenatal screening, cancer detection, and organ transplant monitoring using its proprietary cell-free DNA technology.

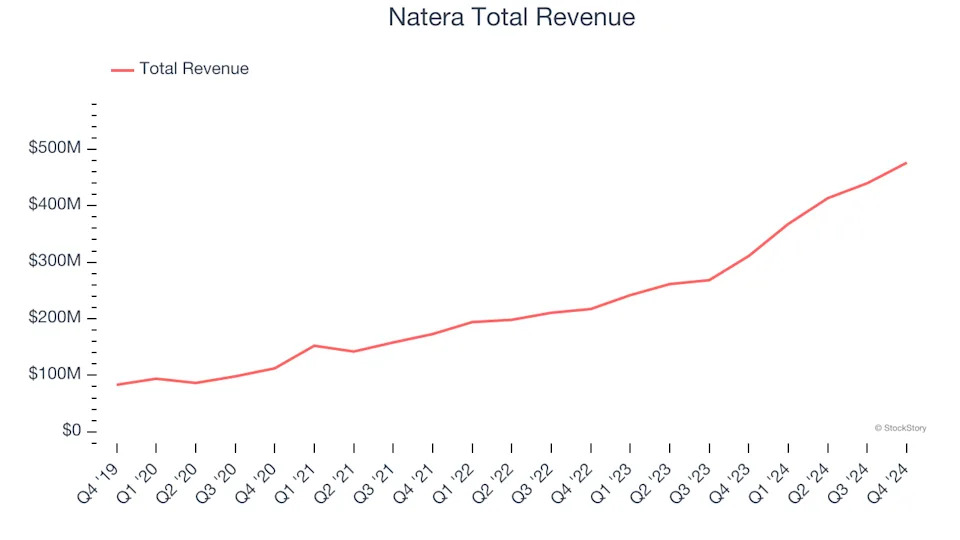

Natera reported revenues of $476.1 million, up 53% year on year, outperforming analysts’ expectations by 8.6%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

Natera pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 5.6% since reporting. It currently trades at $147.91.