Paychex (NASDAQ:PAYX) Reports Q1 In Line With Expectations

Payroll and human resources software provider, Paychex (NASDAQ:PAYX) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 4.8% year on year to $1.51 billion. Its non-GAAP profit of $1.49 per share was 0.7% above analysts’ consensus estimates.

Is now the time to buy Paychex? Find out in our full research report .

Paychex (PAYX) Q1 CY2025 Highlights:

Company Overview

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

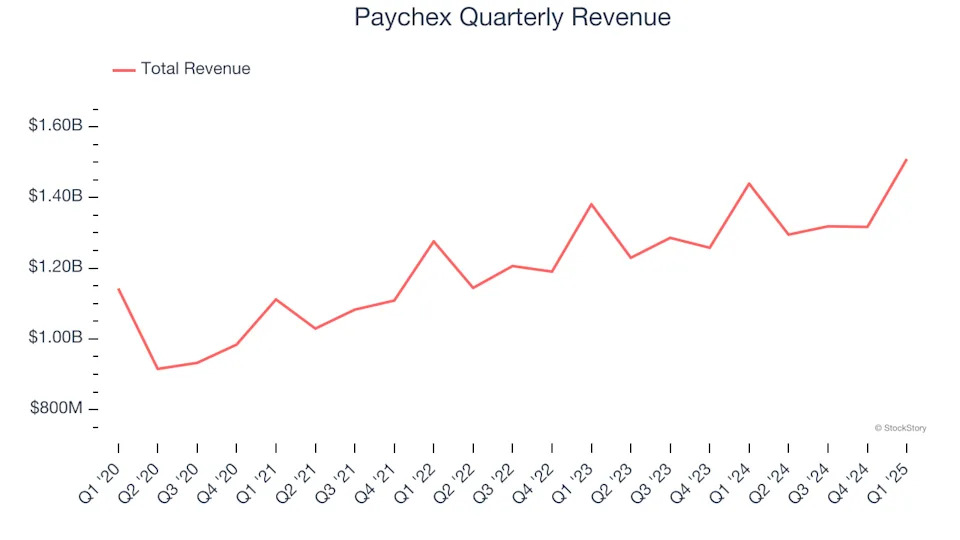

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Paychex’s 6.6% annualized revenue growth over the last three years was weak. This was below our standard for the software sector and is a tough starting point for our analysis.

This quarter, Paychex grew its revenue by 4.8% year on year, and its $1.51 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and indicates its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories .