3 Reasons UHS is Risky and 1 Stock to Buy Instead

Although the S&P 500 is down 9.9% over the past six months, Universal Health Services’s stock price has fallen further to $178.59, losing shareholders 16.7% of their capital. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Universal Health Services, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even with the cheaper entry price, we don't have much confidence in Universal Health Services. Here are three reasons why UHS doesn't excite us and a stock we'd rather own.

Why Is Universal Health Services Not Exciting?

With a network spanning 39 states and three countries, Universal Health Services (NYSE:UHS) operates acute care hospitals and behavioral health facilities across the United States, United Kingdom, and Puerto Rico.

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Universal Health Services grew its sales at a mediocre 6.8% compounded annual growth rate. This was below our standard for the healthcare sector.

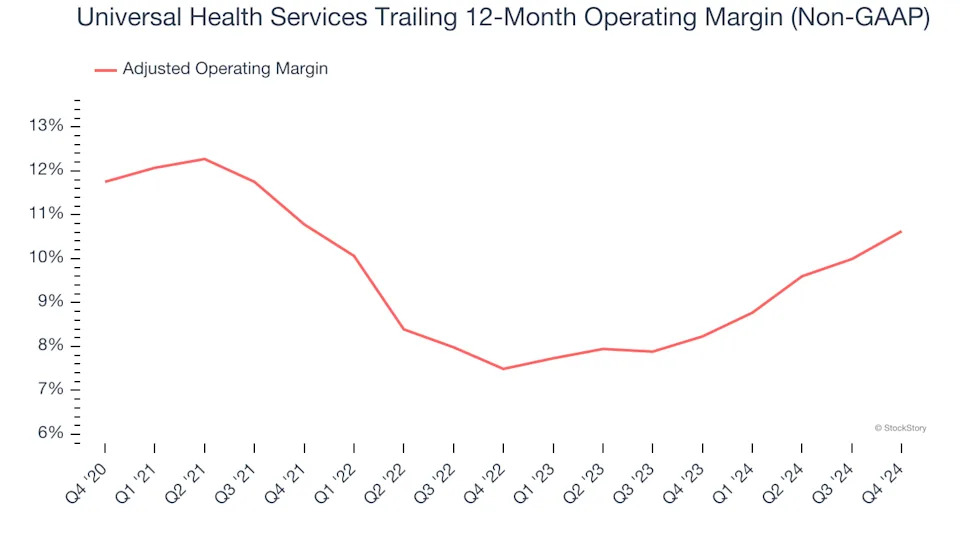

2. Shrinking Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Analyzing the trend in its profitability, Universal Health Services’s adjusted operating margin decreased by 1.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Universal Health Services’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was 10.6%.

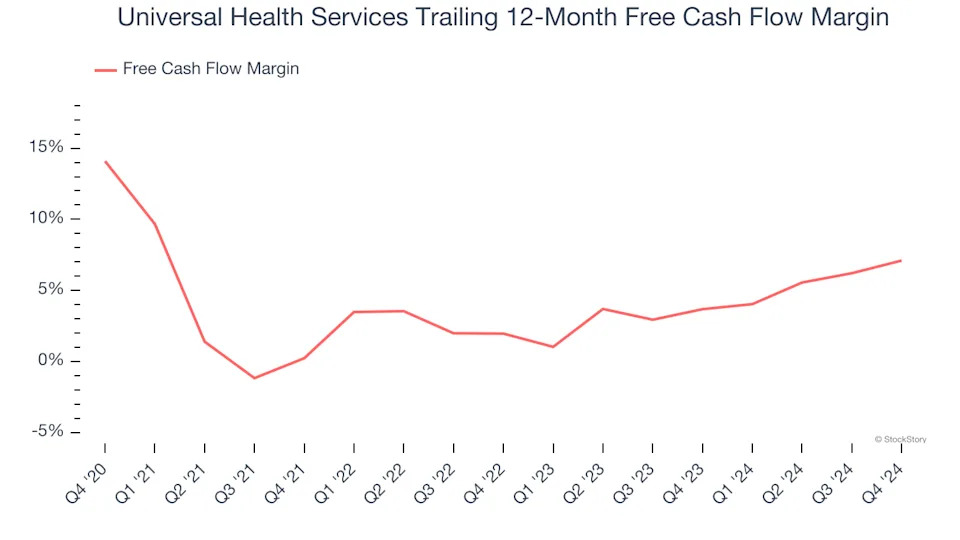

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Universal Health Services’s margin dropped by 7 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Universal Health Services’s free cash flow margin for the trailing 12 months was 7.1%.