Winners And Losers Of Q4: Cadre (NYSE:CDRE) Vs The Rest Of The Aerospace and Defense Stocks

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at aerospace and defense stocks, starting with Cadre (NYSE:CDRE).

Emissions and automation are important in aerospace, so companies that boast advances in these areas can take market share. On the defense side, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression toward Taiwan–have highlighted the need for consistent or even elevated defense spending. As for challenges, demand for aerospace and defense products can ebb and flow with economic cycles and national defense budgets, which are unpredictable and particularly painful for companies with high fixed costs.

The 31 aerospace and defense stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.8% above.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Cadre (NYSE:CDRE)

Originally known as Safariland, Cadre (NYSE:CDRE) specializes in manufacturing and distributing safety and survivability equipment for first responders.

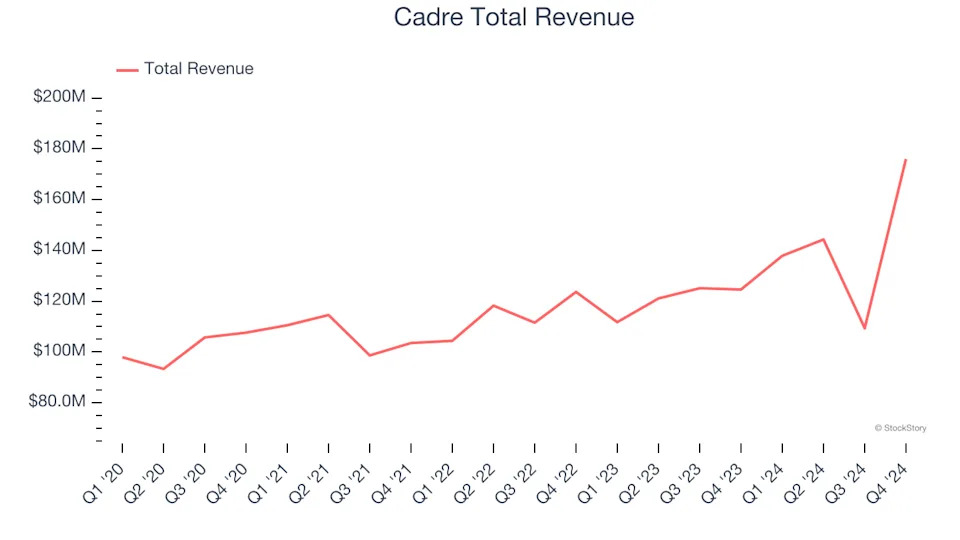

Cadre reported revenues of $176 million, up 41.3% year on year. This print exceeded analysts’ expectations by 2.5%. Despite the top-line beat, it was still a slower quarter for the company with full-year revenue guidance missing analysts’ expectations.

“2024 was another record year, as our teams continued to leverage the Cadre operating model and capitalize on positive demand trends for our best-in-class, mission-critical safety equipment,” said Warren Kanders, CEO and Chairman.

The stock is down 3.7% since reporting and currently trades at $32.28.

Read our full report on Cadre here, it’s free .

Best Q4: Mercury Systems (NASDAQ:MRCY)

Founded in 1981, Mercury Systems (NASDAQ:MRCY) specializes in providing processing subsystems and components for primarily defense applications.

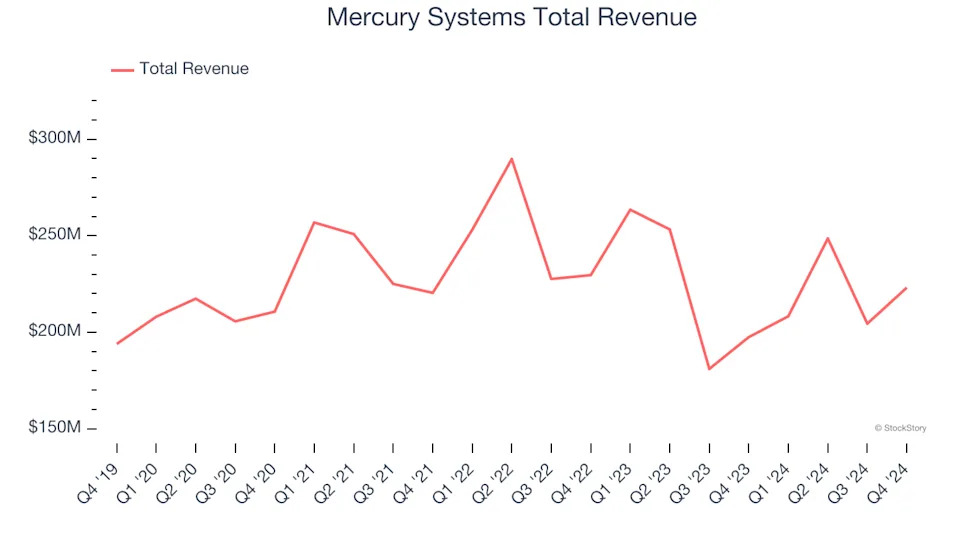

Mercury Systems reported revenues of $223.1 million, up 13% year on year, outperforming analysts’ expectations by 23.9%. The business had an incredible quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.

Mercury Systems achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 8.8% since reporting. It currently trades at $45.81.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free .