3 Reasons to Sell SSNC and 1 Stock to Buy Instead

SS&C has been treading water for the past six months, recording a small loss of 4.6% while holding steady at $71.17. However, the stock is beating the S&P 500’s 13.9% decline during that period.

Is there a buying opportunity in SS&C, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

Despite the relative momentum, we don't have much confidence in SS&C. Here are three reasons why you should be careful with SSNC and a stock we'd rather own.

Why Is SS&C Not Exciting?

Founded in 1986 as a bridge between technology and financial services, SS&C Technologies (NASDAQ:SSNC) provides software and software-enabled services that help financial firms and healthcare organizations automate complex business processes.

1. Weak Billings Growth Points to Soft Demand

Billings is a non-GAAP metric that sheds light on SS&C’s demand characteristics. This metric is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period - different from reported revenue, which must be recognized in pieces over the length of a contract.

SS&C’s billings came in at $1.55 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 4.5%. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy.

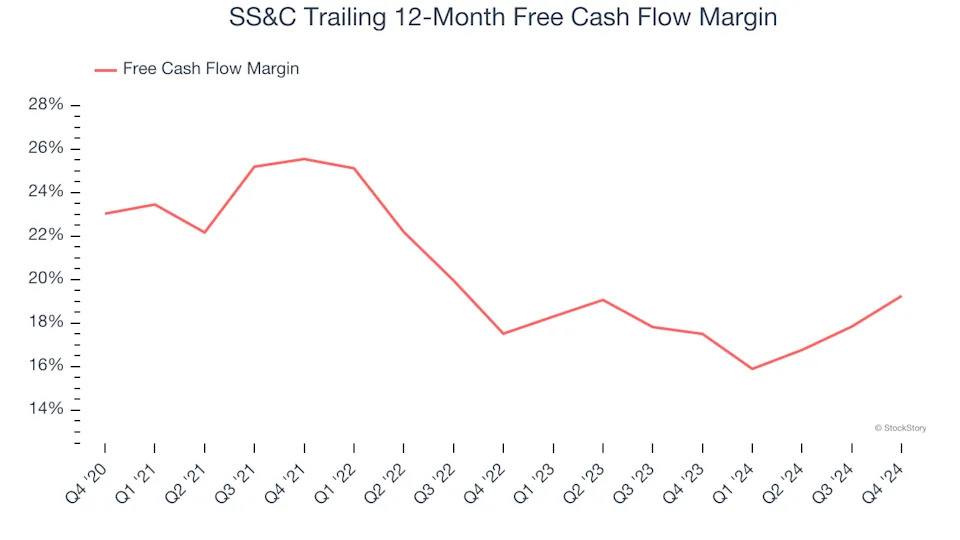

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, SS&C’s margin dropped by 3.8 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. SS&C’s free cash flow margin for the trailing 12 months was 19.3%.

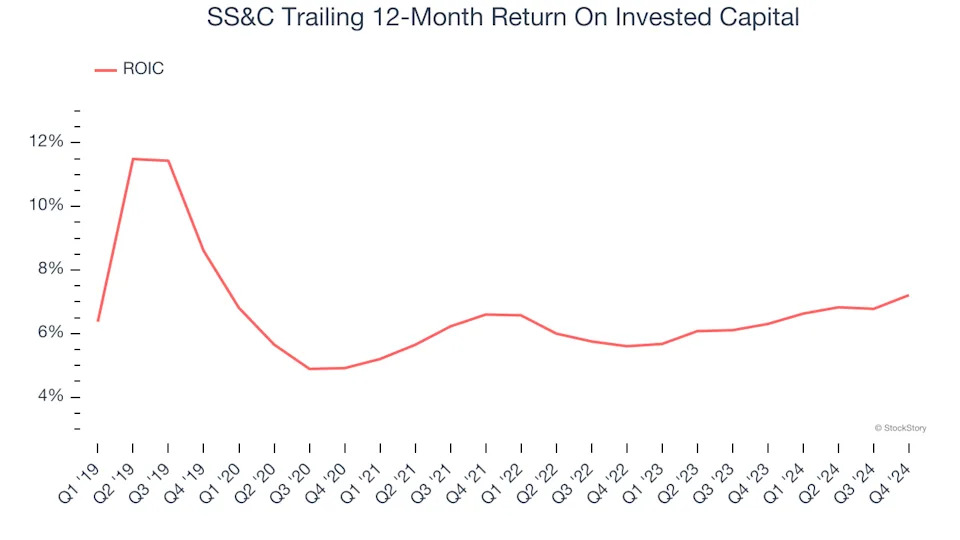

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

SS&C historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.1%, somewhat low compared to the best business services companies that consistently pump out 25%+.

Final Judgment

SS&C isn’t a terrible business, but it isn’t one of our picks. Following its recent outperformance amid a softer market environment, the stock trades at 12.5× forward price-to-earnings (or $71.17 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward one of our all-time favorite software stocks .