3 Reasons to Sell PLXS and 1 Stock to Buy Instead

Plexus has followed the market’s trajectory closely. The stock is down 18.5% to $110.51 per share over the past six months while the S&P 500 has lost 13.7%. This might have investors contemplating their next move.

Is there a buying opportunity in Plexus, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Despite the more favorable entry price, we're swiping left on Plexus for now. Here are three reasons why you should be careful with PLXS and a stock we'd rather own.

Why Is Plexus Not Exciting?

With over 20,000 team members across 26 global facilities, Plexus (NASDAQ:PLXS) designs, manufactures, and services complex electronic products for companies in aerospace/defense, healthcare, and industrial sectors.

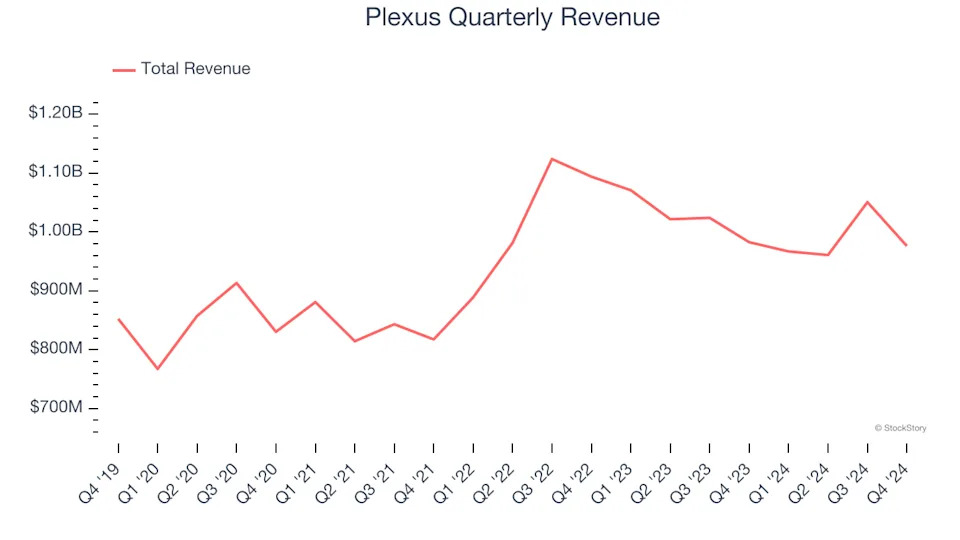

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Plexus’s sales grew at a tepid 4% compounded annual growth rate over the last five years. This was below our standard for the business services sector.

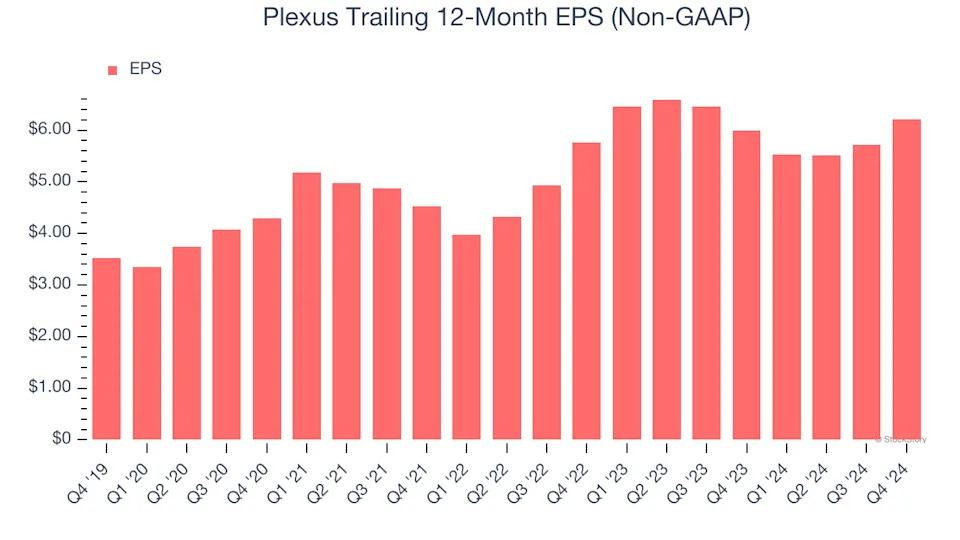

2. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Plexus’s EPS grew at a weak 3.9% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 1.6% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

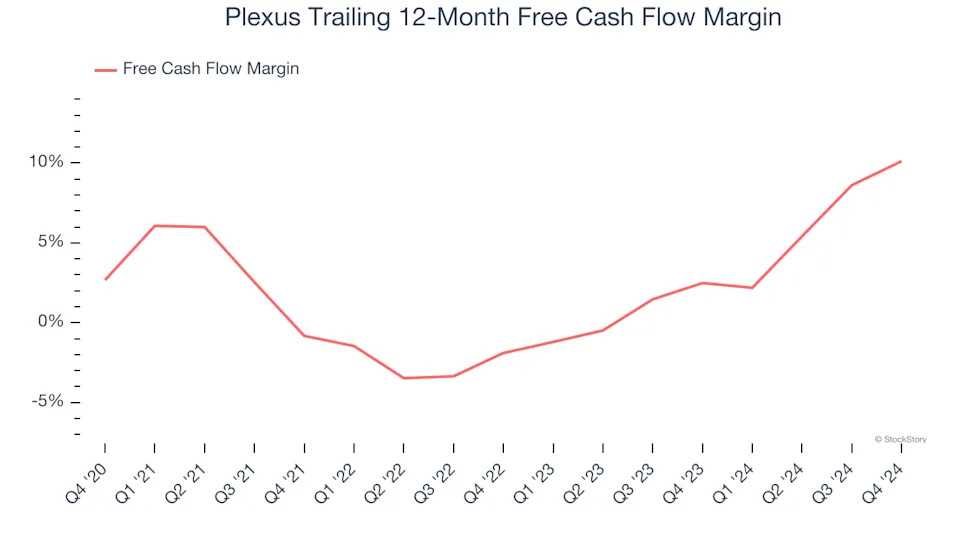

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Plexus has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.6%, subpar for a business services business.

Final Judgment

Plexus isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 15.1× forward price-to-earnings (or $110.51 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy .