Wall St struggles for direction as Trump's auto tariffs sap sentiment

Wall Street seesawed between marginal gains and losses on Thursday, as investors grappled with President Donald Trump's latest trade gambit that sent auto stocks into a tailspin, all while digesting a myriad of economic data.

In a late-night announcement on Wednesday, Trump unveiled his plan to implement 25% tariffs on imported cars and light trucks effective next week, while those on auto parts are expected to begin from May 3.

Trump's mercurial trade policies have injected a dose of uncertainty into markets, as investors fret over potential disruptions to supply chains, hampered investment, and the specter of inflationary pressures threatening global economic growth.

"We believe that he's using (auto tariffs) as a trade negotiation. The markets are jittery because nobody really knows what's going to happen and what will come out in future," said Nicolas Lin, chairman and interim CEO of Aether Holdings.

Automakers faced significant pressure, with General Motors

GM

plummeting 7.7% and Ford

F

declining 3%. Car-parts manufacturers such as Aptiv

APTV

and BorgWarner

BWA

each experienced a 5.5% drop.

Tesla

TSLA

defied the trend, rising 4.6%, bolstering the consumer discretionary sector

S5COND

. Analysts highlighted that the electric vehicle maker might remain unscathed by the auto tariffs.

Other EV stocks Rivian

RIVN

and Lucid

LCID

rose 6.1% and 1.7%, respectively.

Trump has also pledged to impose reciprocal tariffs on trade partners in early April, though he has intimated that these policies might be subject to flexibility.

Investors fled to safe-haven assets, driving gold

GOLD

to record levels. Bullion miners such as Newmont

At 11:54 a.m. ET, the Dow Jones Industrial Average

DJI

fell 138.42 points, or 0.33%, to 42,316.37, the S&P 500

SPX

lost 7.53 points, or 0.13%, to 5,704.67 and the Nasdaq Composite

IXIC

lost 22.41 points, or 0.13%, to 17,876.61. 32.

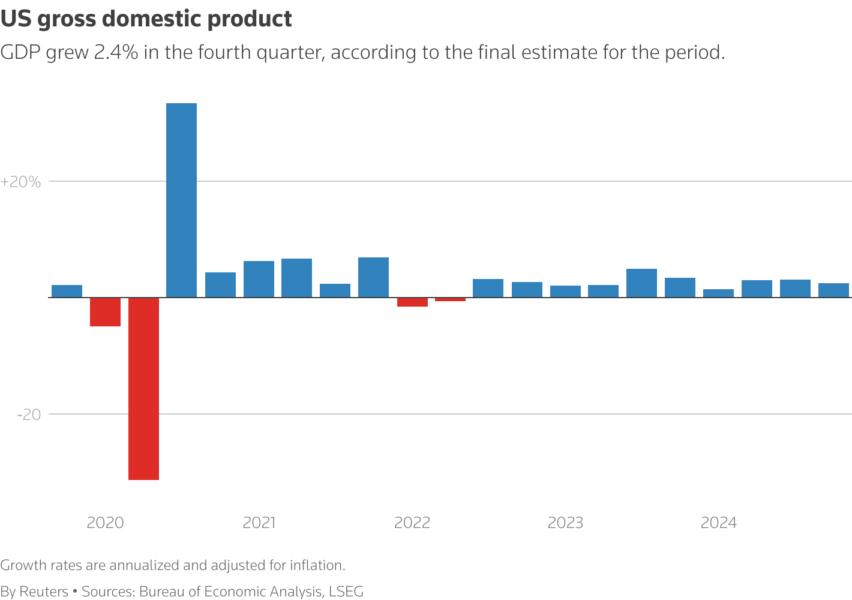

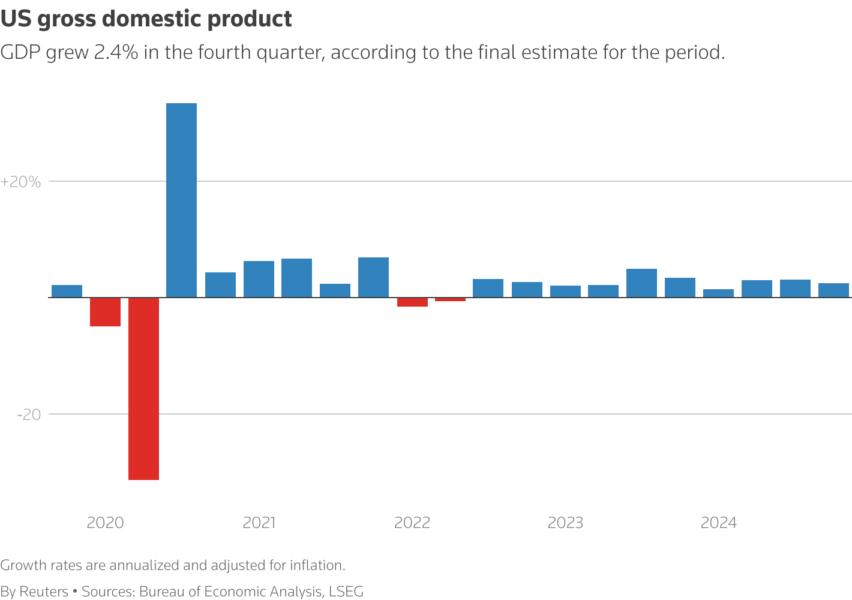

A final estimate showed gross domestic product (GDP) increased by a more than expected 2.4%, while weekly jobless claims were broadly in line with estimates.

The highlight of the week's economic indicators is the personal consumption expenditures price index — the Federal Reserve's favored inflation gauge — scheduled for release on Friday.

Investors have trimmed their exposure to U.S. equities, dragging both the S&P 500

SPX

and the Nasdaq

IXIC

down by 10% from their record peaks earlier in the month, thus entering technical correction territory.

Both indices are on course to conclude the first quarter of 2025 in negative territory, with the benchmark index poised for its first quarterly decline in six quarters, while the tech-centric index braces for its largest quarterly drop in nearly two years.

Fed policymakers including Susan Collins and Thomas Barkin are anticipated to share their economic insights later on Thursday.

Among other stocks, Advanced Micro Devices

AMD

lost 3.5% after Jefferies downgraded the chip stock to "hold" from "buy", sending the broader chip index

SOX

down 2.3%.

Declining issues outnumbered advancers by a 1.37-to-1 ratio on the NYSE and by a 1.19-to-1 ratio on the Nasdaq.

The S&P 500 posted 14 new 52-week highs and five new lows, while the Nasdaq Composite recorded 28 new highs and 152 new lows.