Q4 Earnings Outperformers: Agilysys (NASDAQ:AGYS) And The Rest Of The Vertical Software Stocks

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at vertical software stocks, starting with Agilysys (NASDAQ:AGYS).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 20.7% since the latest earnings results.

Agilysys (NASDAQ:AGYS)

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ:AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

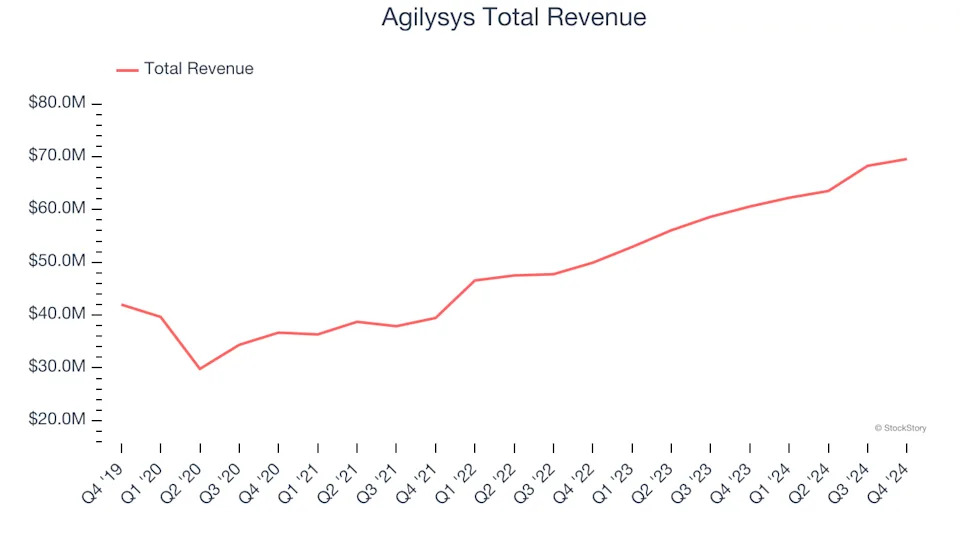

Agilysys reported revenues of $69.56 million, up 14.9% year on year. This print fell short of analysts’ expectations by 5.2%. Overall, it was a slower quarter for the company with full-year revenue guidance missing analysts’ expectations.

Agilysys delivered the weakest performance against analyst estimates of the whole group. The stock is down 44.8% since reporting and currently trades at $69.54.

Read our full report on Agilysys here, it’s free .

Best Q4: Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business, Upstart (NASDAQ:UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

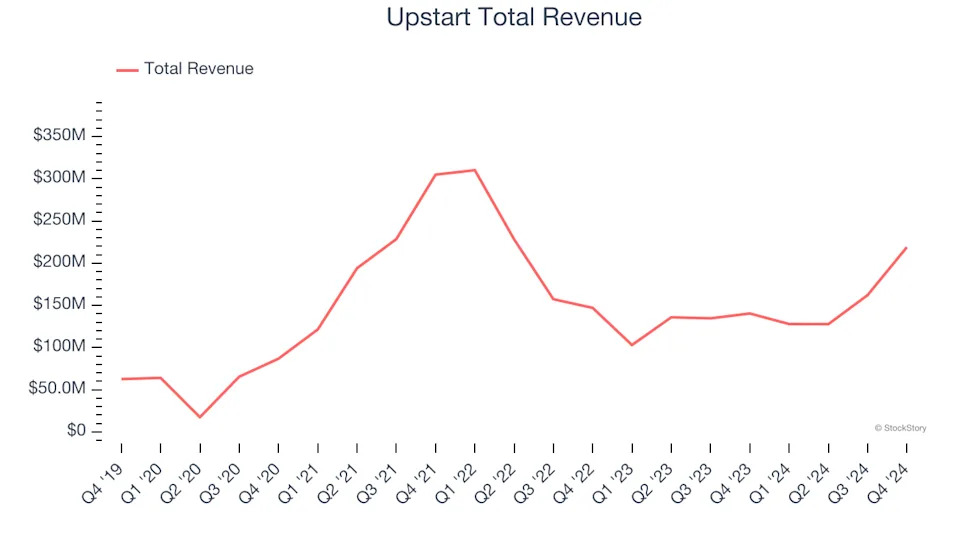

Upstart reported revenues of $219 million, up 56.1% year on year, outperforming analysts’ expectations by 20.1%. The business had an exceptional quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

Upstart pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 42.5% since reporting. It currently trades at $38.70.

Is now the time to buy Upstart? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.