Q4 Earnings Outperformers: Monster (NASDAQ:MNST) And The Rest Of The Beverages, Alcohol, and Tobacco Stocks

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at beverages, alcohol, and tobacco stocks, starting with Monster (NASDAQ:MNST).

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 15 beverages, alcohol, and tobacco stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 0.6% below.

While some beverages, alcohol, and tobacco stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.5% since the latest earnings results.

Monster (NASDAQ:MNST)

Founded in 2002 as a natural soda and juice company, Monster Beverage (NASDAQ:MNST) is a pioneer of the energy drink category, and its Monster Energy brand targets a young, active demographic.

Monster reported revenues of $1.81 billion, up 4.7% year on year. This print exceeded analysts’ expectations by 0.7%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA estimates and a miss of analysts’ EPS estimates.

Hilton H. Schlosberg, Vice Chairman and Co-Chief Executive Officer, said, “We recorded strong operating results on an adjusted basis in the 2024 fourth quarter and for the 2024 full year.

Interestingly, the stock is up 11.4% since reporting and currently trades at $57.80.

Is now the time to buy Monster? Access our full analysis of the earnings results here, it’s free .

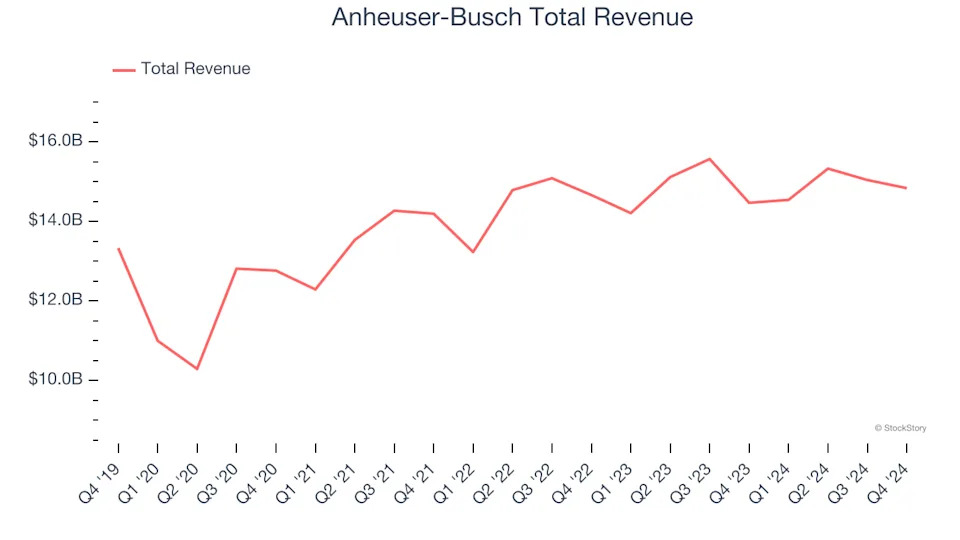

Best Q4: Anheuser-Busch (NYSE:BUD)

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE:BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

Anheuser-Busch reported revenues of $14.84 billion, up 2.5% year on year, outperforming analysts’ expectations by 5.5%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.