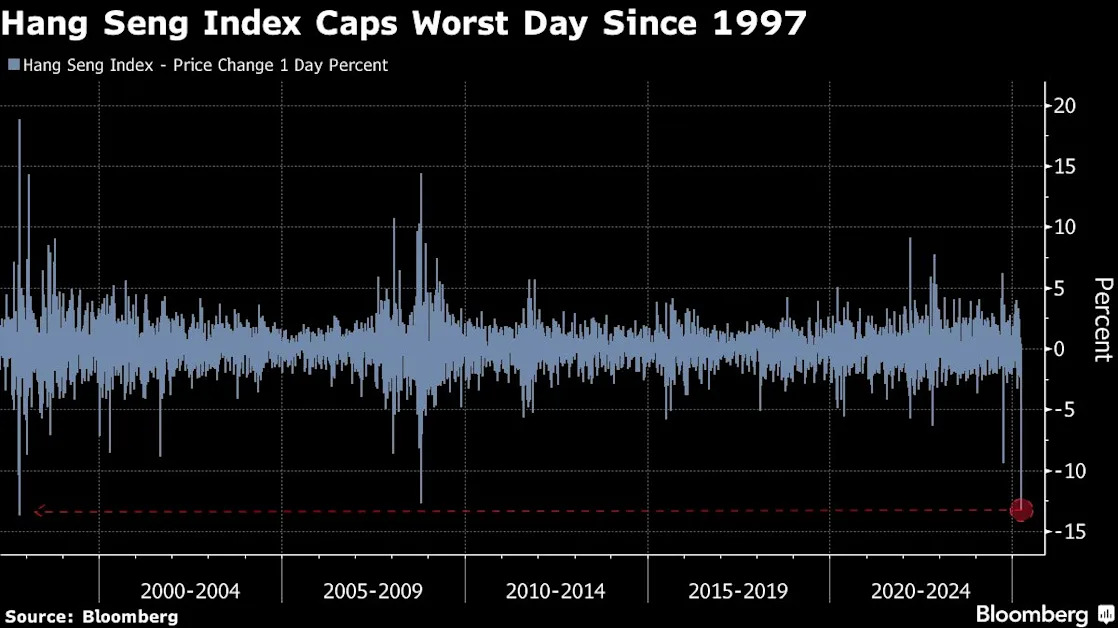

Tariff War Sparks Hong Kong Stocks’ Worst Implosion Since 1997

(Bloomberg) -- For stock traders in Hong Kong, Monday’s mayhem was one for the history books.

Most Read from Bloomberg

As the global market meltdown worsened on Monday, the tumult in Hong Kong stood out. The city’s benchmark Hang Seng Index plunged 13%, the most since 1997, with the session concluding with the highest equity turnover ever amid what was described as “indiscriminate selling.”

Margin calls and forced selling were rampant, underscoring just how quickly the mood had deteriorated. China’s retaliation against US President Donald Trump’s sweeping tariffs forced investors to face a new reality: the long-feared trade conflict has ratcheted up into a full-blown confrontation. Hong Kong’s free capital market and a blistering rally earlier this year also made its stocks a prime candidate for profit taking.

“For me, I replayed the my experience during March 2020, and September 2008, and other crises going back to the crash of 1987,” said Rajeev de Mello, global macro portfolio manager at Gama Asset Management. “Today’s market moves definitely reminded me of those.”

There was no shortage of superlatives for the swoon in the Asia financial hub. Its biggest exchange-traded fund tracking the Hang Seng Index tumbled by the most ever. An index tracking Chinese tech stocks also plunged a record 17%. Another gauge of the biggest mainland companies listed in the city fell into a bear market.

“It’s a tough day,” said Patrick Pan, China equity strategist at Daiwa Capital Markets Hong Kong Ltd. “It feels like as if China market ran into a perfect storm under both profit-taking pressure since the DeepSeek rally and the growing concerns amid a full blown tit-for-tat tariff wars.”

Even seasoned traders bracing for an ugly selloff were caught off guard by the scale of the wealth destruction. Now with Trump resisting pressure to reverse the tariffs and risks for a global recession rising, there’s no end in sight for the market turmoil.

“I did not sleep well during the long weekend after witnessing the losses in US stocks,” said Li Xuetong, a 15-year market veteran at Shenzhen Enjoy Investment Management Co., referring to China and Hong Kong’s holiday on Friday. He had anticipated a maximum 5% to 6% drop at the Monday open.

Li is now watching for the stop-loss threshold of 20% for some of his products. “Another day like today and we might be forced to cut positions,” he said.