3 Reasons TWLO is Risky and 1 Stock to Buy Instead

While the broader market has struggled with the S&P 500 down 14.2% since October 2024, Twilio has surged ahead as its stock price has climbed by 12.2% to $76.98 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Twilio, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Despite the momentum, we don't have much confidence in Twilio. Here are three reasons why there are better opportunities than TWLO and a stock we'd rather own.

Why Is Twilio Not Exciting?

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio (NYSE:TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

1. Weak Billings Point to Soft Demand

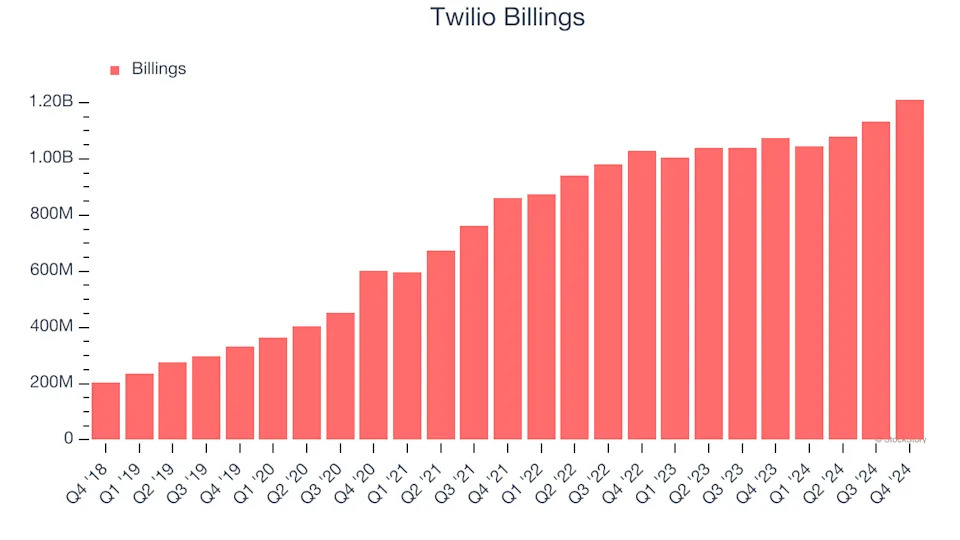

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Twilio’s billings came in at $1.21 billion in Q4, and over the last four quarters, its year-on-year growth averaged 7.4%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Twilio’s revenue to rise by 8.1%, a deceleration versus its 16.2% annualized growth for the past three years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

3. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Twilio, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Twilio’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 51.1% gross margin over the last year. That means Twilio paid its providers a lot of money ($48.88 for every $100 in revenue) to run its business.