Aerospace and Defense Stocks Q4 Highlights: Byrna (NASDAQ:BYRN)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Byrna (NASDAQ:BYRN) and the best and worst performers in the aerospace and defense industry.

Emissions and automation are important in aerospace, so companies that boast advances in these areas can take market share. On the defense side, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression toward Taiwan–have highlighted the need for consistent or even elevated defense spending. As for challenges, demand for aerospace and defense products can ebb and flow with economic cycles and national defense budgets, which are unpredictable and particularly painful for companies with high fixed costs.

The 31 aerospace and defense stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.8% above.

In light of this news, share prices of the companies have held steady as they are up 1.7% on average since the latest earnings results.

Byrna (NASDAQ:BYRN)

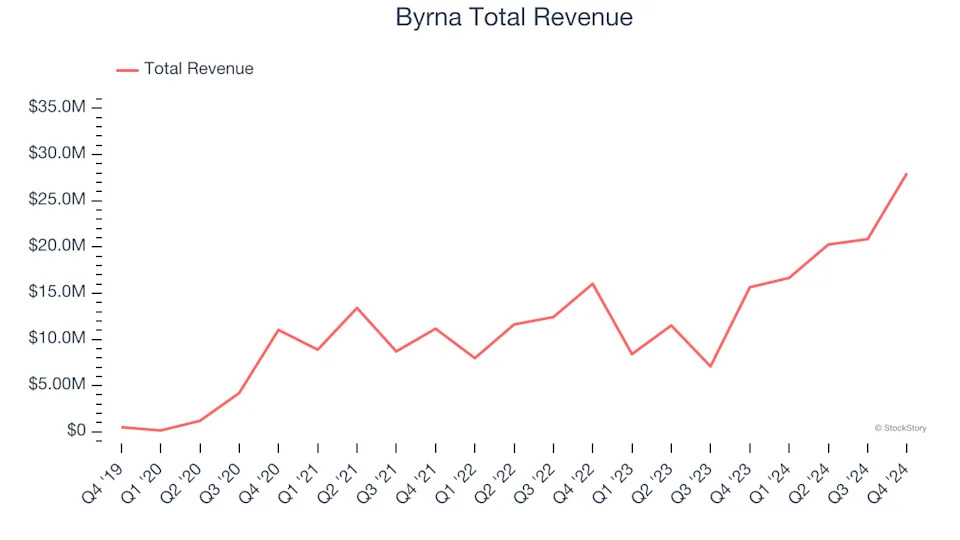

Providing civilians with tools to disable, disarm, and deter would-be assailants, Byrna (NASDAQ:BYRN) is a provider of non-lethal weapons.

Byrna reported revenues of $27.98 million, up 78.9% year on year. This print was in line with analysts’ expectations, and overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Management CommentaryByrna CEO Bryan Ganz stated: “The fourth quarter was the culmination of a remarkable year for Byrna. We successfully generated a record $28.0 million in revenue while also expanding our gross margins to 62.8%. This success allowed us to deliver a 101% increase in revenue from the full year 2023 to 2024 and underscores the overall growth in brand recognition and normalization of the less-lethal space.

The stock is down 30.6% since reporting and currently trades at $19.08.

Best Q4: Mercury Systems (NASDAQ:MRCY)

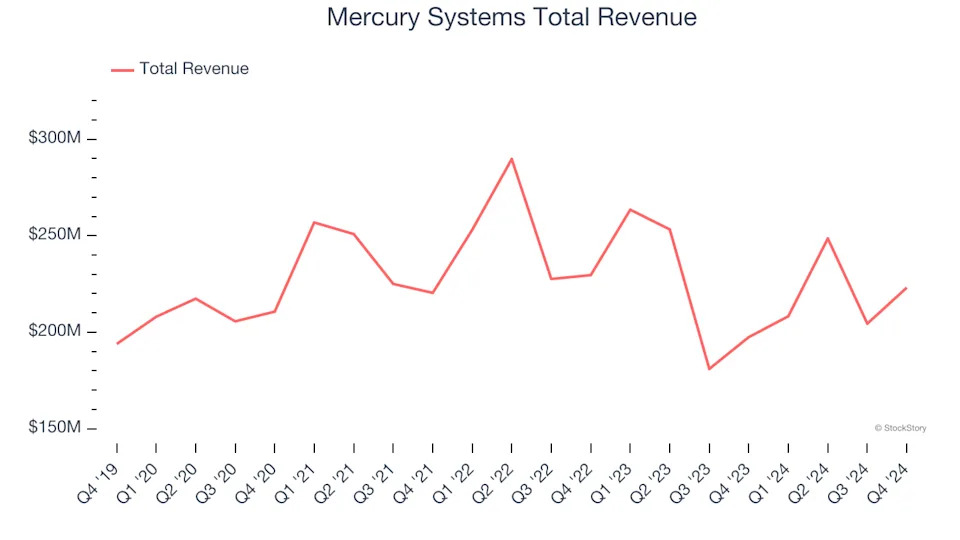

Founded in 1981, Mercury Systems (NASDAQ:MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $223.1 million, up 13% year on year, outperforming analysts’ expectations by 23.9%. The business had an incredible quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.