3 Reasons AVTR is Risky and 1 Stock to Buy Instead

Shareholders of Avantor would probably like to forget the past six months even happened. The stock dropped 38.1% and now trades at $15.67. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Avantor, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even with the cheaper entry price, we're cautious about Avantor. Here are three reasons why you should be careful with AVTR and a stock we'd rather own.

Why Is Avantor Not Exciting?

With roots dating back to 1904 and embedded in virtually every stage of scientific research and production, Avantor (NYSE:AVTR) provides mission-critical products, materials, and services to customers in biopharma, healthcare, education, and advanced technology industries.

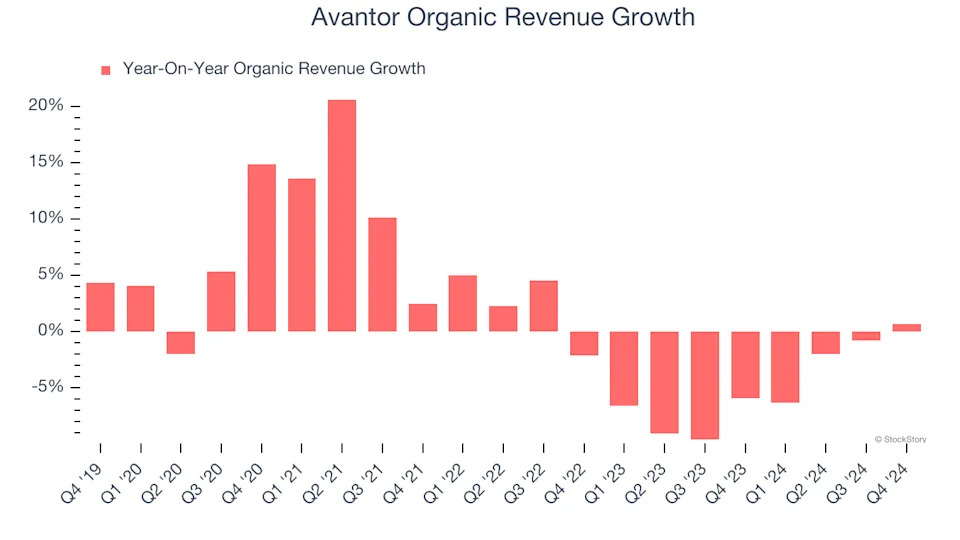

1. Core Business Falling Behind as Demand Declines

In addition to reported revenue, organic revenue is a useful data point for analyzing Research Tools & Consumables companies. This metric gives visibility into Avantor’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Avantor’s organic revenue averaged 4.9% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Avantor might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Avantor’s revenue to drop by 2.1%. Although this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

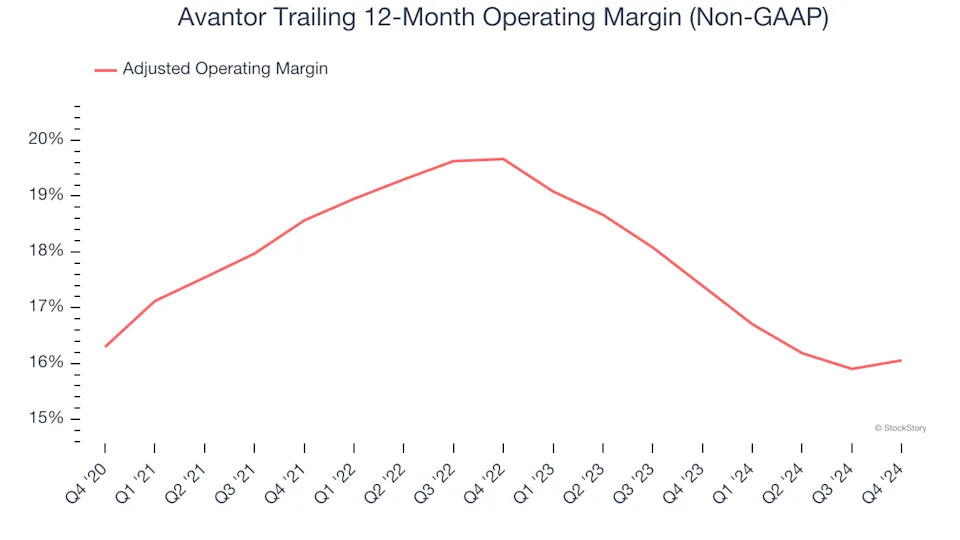

3. Shrinking Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Analyzing the trend in its profitability, Avantor’s adjusted operating margin decreased by 3.6 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 16.1%.