3 Reasons to Avoid CBZ and 1 Stock to Buy Instead

CBIZ has been treading water for the past six months, recording a small return of 2.4% while holding steady at $69.40.

Is now the time to buy CBIZ, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

We're cautious about CBIZ. Here are three reasons why CBZ doesn't excite us and a stock we'd rather own.

Why Is CBIZ Not Exciting?

With over 120 offices across 33 states and a team of more than 6,700 professionals, CBIZ (NYSE:CBZ) provides accounting, tax, benefits, insurance brokerage, and advisory services to help small and mid-sized businesses manage their finances and operations.

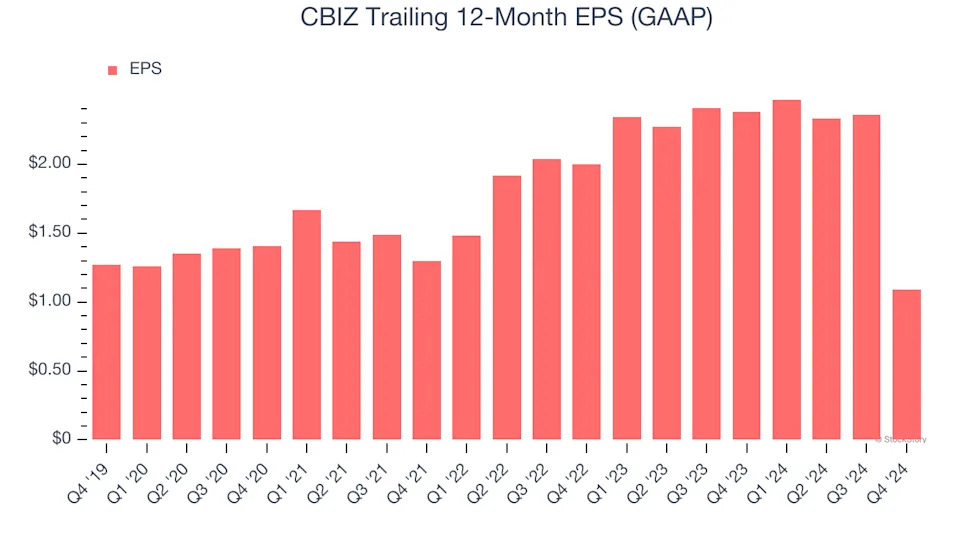

1. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

CBIZ’s full-year EPS dropped 16%, or 3% annually, over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, CBIZ’s low margin of safety could leave its stock price susceptible to large downswings.

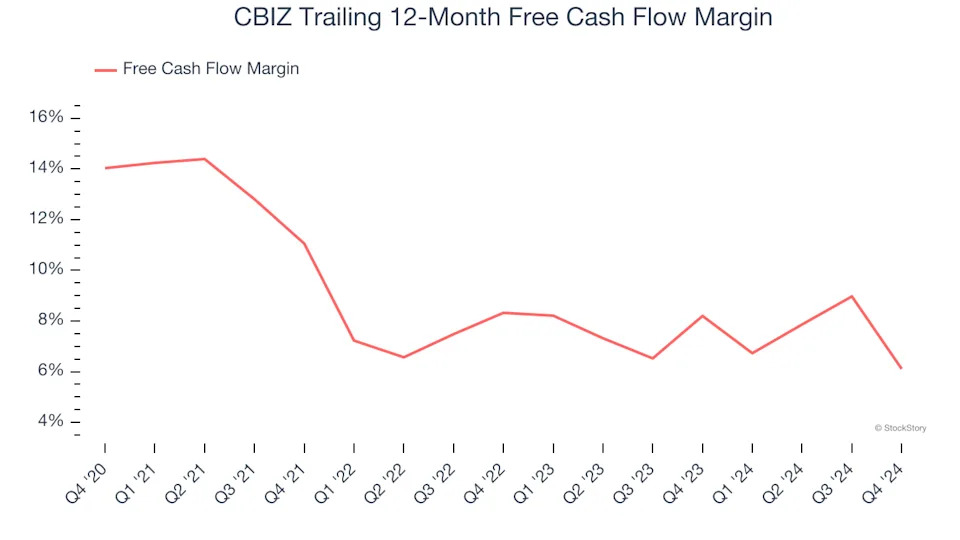

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, CBIZ’s margin dropped by 7.9 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. CBIZ’s free cash flow margin for the trailing 12 months was 6.1%.

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

CBIZ’s $1.46 billion of debt exceeds the $13.83 million of cash on its balance sheet. Furthermore, its 10× net-debt-to-EBITDA ratio (based on its EBITDA of $146.5 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. CBIZ could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.