Q4 Earnings Review: Toys and Electronics Stocks Led by Mattel (NASDAQ:MAT)

Let’s dig into the relative performance of Mattel (NASDAQ:MAT) and its peers as we unravel the now-completed Q4 toys and electronics earnings season.

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

The 4 toys and electronics stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.5% since the latest earnings results.

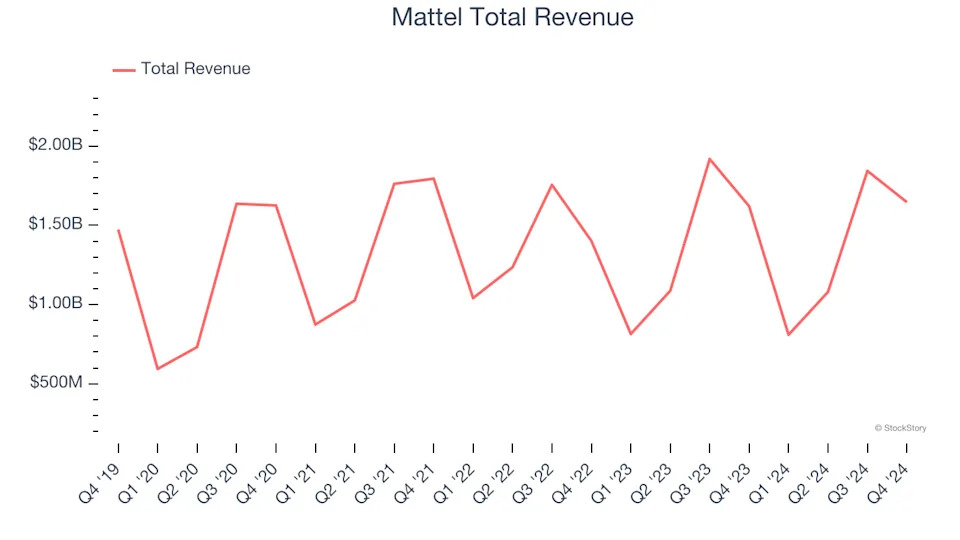

Best Q4: Mattel (NASDAQ:MAT)

Known for the creation of iconic toys such as Barbie and Hotwheels, Mattel (NASDAQ:MAT) is a global children's entertainment company specializing in the design and production of consumer products.

Mattel reported revenues of $1.65 billion, up 1.6% year on year. This print exceeded analysts’ expectations by 1.2%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Ynon Kreiz, Chairman and CEO of Mattel, said: “2024 was a year of strong operational excellence for Mattel with topline growth in the fourth quarter. Our priorities for the year were to grow profitability, expand gross margin, and generate strong free cash flow and we achieved all three objectives, well ahead of expectations. As we progress through 2025, our 80th anniversary year, we look forward to growing both top and bottom line and continuing to successfully execute our multi-year strategy.”

Mattel pulled off the fastest revenue growth of the whole group. The stock is up 15.2% since reporting and currently trades at $20.81.

Is now the time to buy Mattel? Access our full analysis of the earnings results here, it’s free .

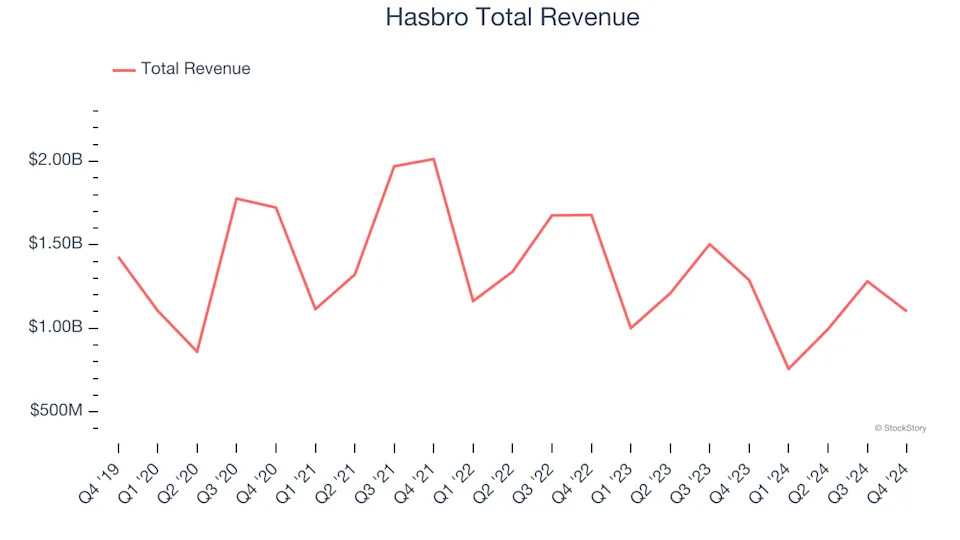

Hasbro (NASDAQ:HAS)

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ:HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.