Corporate Insiders’ Buying Burst Gives Confidence to S&P Bulls

(Bloomberg) -- US stock bulls searching for signs that the worst of the market rout is over are looking to one group of in-the-know investors: company executives.

Most Read from Bloomberg

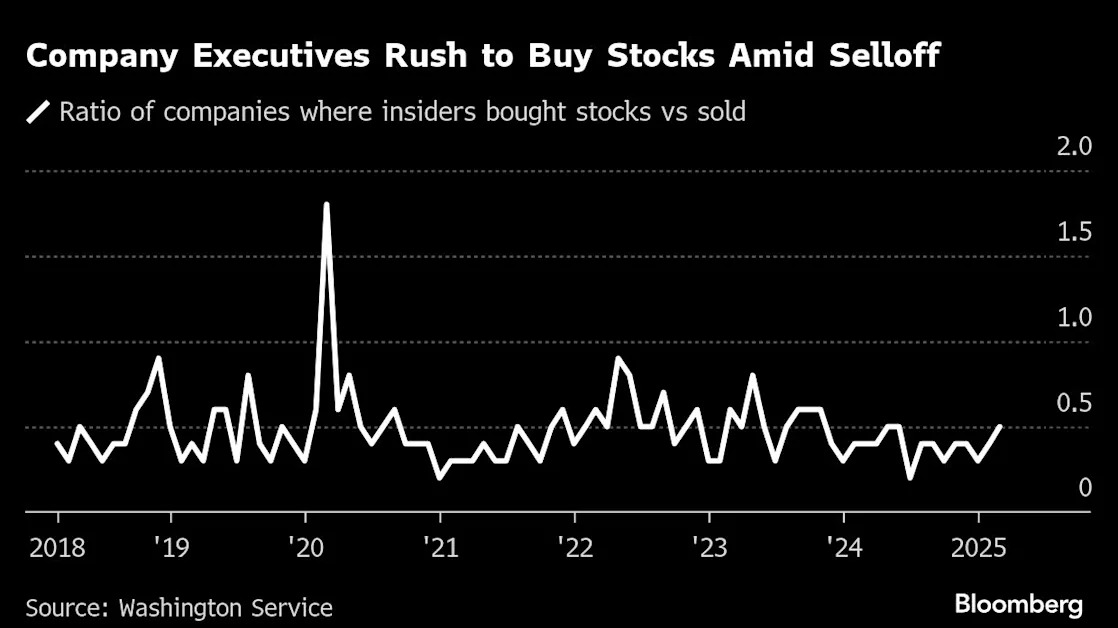

While stocks were getting hammered into a brief correction last week, driving the S&P 500 Index to erase some $5 trillion in equity value, corporate insiders returned to buy the dip. A gauge of insider sentiment from the Washington Service shows that with two more weeks to go in March, the ratio of buyers to sellers rose to 0.46, up from 0.31 in January. That puts the measure on pace for the highest monthly reading since June and back near its historical average.

Moderna Inc. Chief Executive Officer Stephane Bancel was one of the buyers, scooping up $5 million of his company’s stock in March. Directors at American Express Co. and Marathon Petroleum Corp. also snapped up shares during the selloff.

The current distribution of sentiment among corporate leaders could be due to various reasons outside of markets performance. Still, increased buying from the executives who know a company best can be interpreted as a vote of confidence for investors wondering if the the rebound over the past two sessions is a sign that a bottom is in, at least for now.

“If we see corporate insiders begin to use the opportunity in their stock prices to purchase shares, that shows that they have confidence in the underlying economy and in their underlying businesses,” said Dave Mazza, chief executive officer of Roundhill Investments. “That differs from just the headlines, because the headlines are scary.”

The last time that ratio went this high, in mid-2024, the S&P 500 was setting record after record amid blowout earnings, a booming economy and building anticipation of the Federal Reserve’s looming interest-rate cuts.

“By the time we hit June, the idea that there was going be a hard landing or a deep recession went to the wayside and essentially investors began to get all in on the markets,” Mazza said.

Buybacks Bonanza

Insider buying is just one of many signals investors look at to gauge which way stocks are heading. Corporate buybacks are another one. Year-to-date, there have been $298 billion of announced buybacks, the third highest level on record, according to Birinyi Associates.