A 'bear killer': The stock market's fear gauge is flashing signs of major stock gains ahead

A collapse in volatility suggests that the painful stock market sell-off is over and that a fresh rally could be brewing.

That's according to Jason Goepfert, senior research analyst at SentimenTrader, who told BI on Wednesday that the sharp decline in the Cboe Volatility Index, or VIX, flashed a "bear killer" signal.

The bullish signal flashes when the VIX surges above 50 and then closes below 30.

"The signal has triggered, so we would consider it as a compelling input in the current environment," Goepfert said.

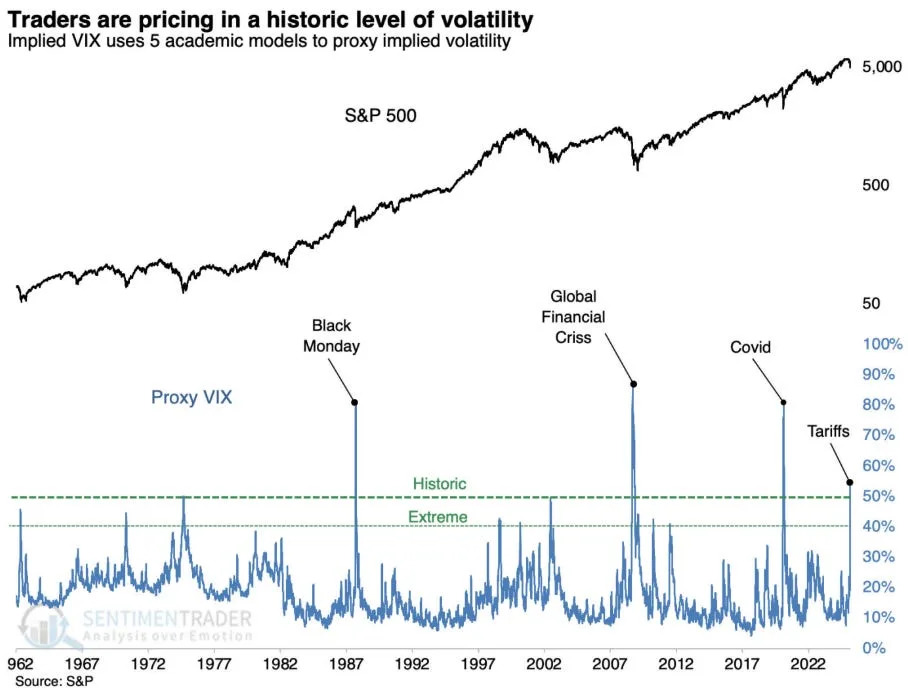

Since President Donald Trump's "Liberation Day" tariff announcement in early April, stock market volatility has soared to historic levels. That tariff announcement sparked a 10.5% two-day decline in the S&P 500, the worst two-day loss for the benchmark index since March 2020.

The VIX closed above 50 on April 8 and collapsed to about 33 on April 9, when the Trump administration announced a 90-day pause in most reciprocal tariffs.

The VIX has since closed at 29.65 on April 17, officially flashing the "bear killer" signal. On Wednesday, it traded at around 28.56.

VIX drop signals gains ahead

According to Goepfert, the forward returns for the stock market are strong once the signal flashes.

The median 3-month, 6-month, and 12-month forward returns are 2.8%, 11.0%, and 17.9%, respectively, with a percent positive rate of 100% 12 months after the signal flashes.

"While sample sizes are small, we have generally seen throughout history that when the stock market volatility peaks above a high level, it has only occurred during bottoming phases after a decline," Goepfert said.

Historic stock market volatility

The only three other times this particular volatility signal flashed were shortly after the onset of the COVID-19 pandemic in 2020, in 2009 during the Great Financial Crisis, and the Black Monday crash in 1987.

Read the original article on Business Insider