Tesla stock drops after a report says its low-cost vehicle will be delayed to 2026

The move: Tesla stock dropped 6% on Monday to $227.50, extending its year-to-date decline to 44%. The stock was down as much as 8% to $222.79 at its intraday low.

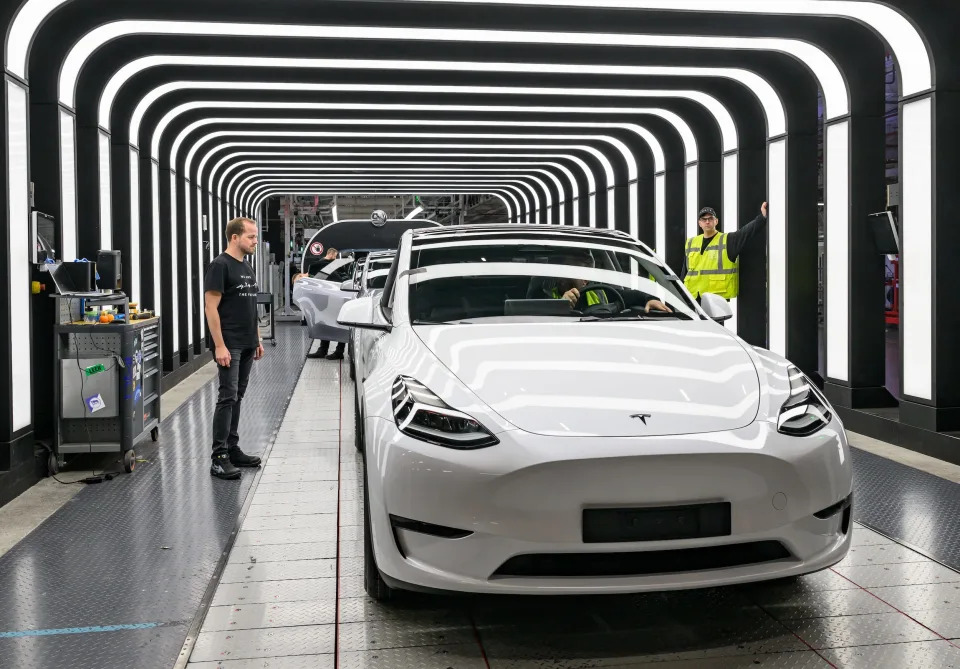

Why: Monday's sell-off came after Reuters reported on Friday that Tesla was delaying its long-anticipated lower-cost vehicle until 2026.

Previous guidance from Tesla suggested it would begin producing the vehicle in the first half of this year. It's expected to cost about $30,000.

The report said Tesla was aiming to produce 250,000 lower-cost vehicles in 2026.

Also weighing on Tesla shares was Barclays' price target cut ahead of the carmaker's Tuesday earnings report. The bank cut its target to $275 from $325, citing lower vehicle deliveries and falling profit margins.

What it means: The prospect of a delay is likely dismaying for investors as they prepare to digest the carmaker's first-quarter earnings report this week.

Shareholders will be keenly attuned to any mention of the timeline for the lower-cost model and updates on initiatives like its robotaxi and Full Self-Driving.

This wouldn't be the first time Tesla has failed to meet its production timelines. In 2017, Tesla introduced an electric semitruck, with a target of production beginning in 2019. Production didn't occur until October 2022 and has since been paused.

Tesla's second-generation Roadster was revealed in 2017 but has yet to go into production.

But investors and Wall Street analysts eagerly await the lower-cost vehicle because it could significantly boost Tesla's sales volume, which has been dropping recently.

President Donald Trump's tariffs also aren't helping Tesla.

In a note on Sunday, Wedbush analyst Dan Ives said: "25% auto tariffs have been enacted delaying future lower cost models for Tesla even though Musk is vocally against the tariffs for obvious reasons."

Read the original article on Business Insider