3 Reasons SATS is Risky and 1 Stock to Buy Instead

Over the last six months, EchoStar shares have sunk to $22.63, producing a disappointing 12.3% loss - worse than the S&P 500’s 6.9% drop. This might have investors contemplating their next move.

Is now the time to buy EchoStar, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why SATS doesn't excite us and a stock we'd rather own.

Why Is EchoStar Not Exciting?

Following its 2023 acquisition of DISH Network, EchoStar (NASDAQ:SATS) provides satellite communications, pay-TV services, wireless networks, and broadband solutions across consumer and enterprise markets.

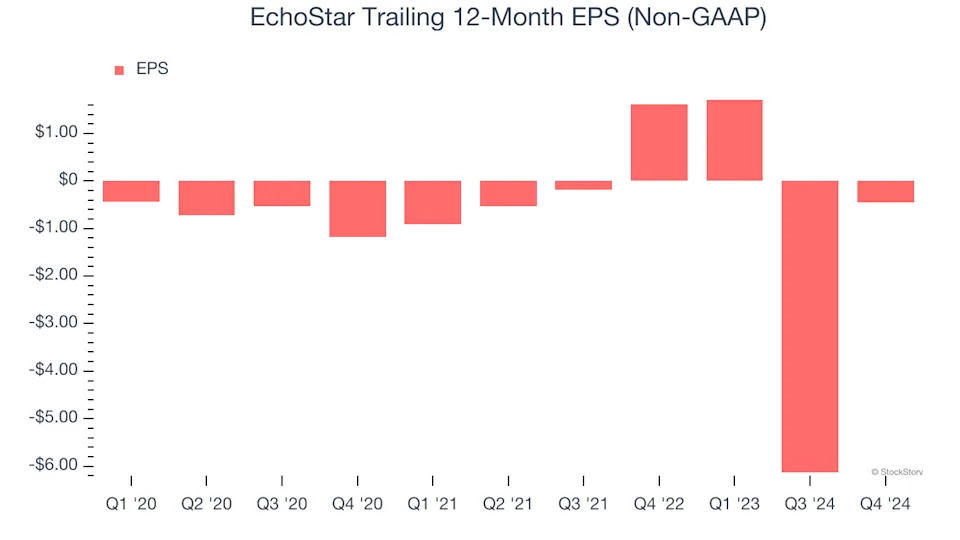

1. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for EchoStar, its EPS declined by 50.9% annually over the last two years while its revenue grew by 62%. This tells us the company became less profitable on a per-share basis as it expanded.

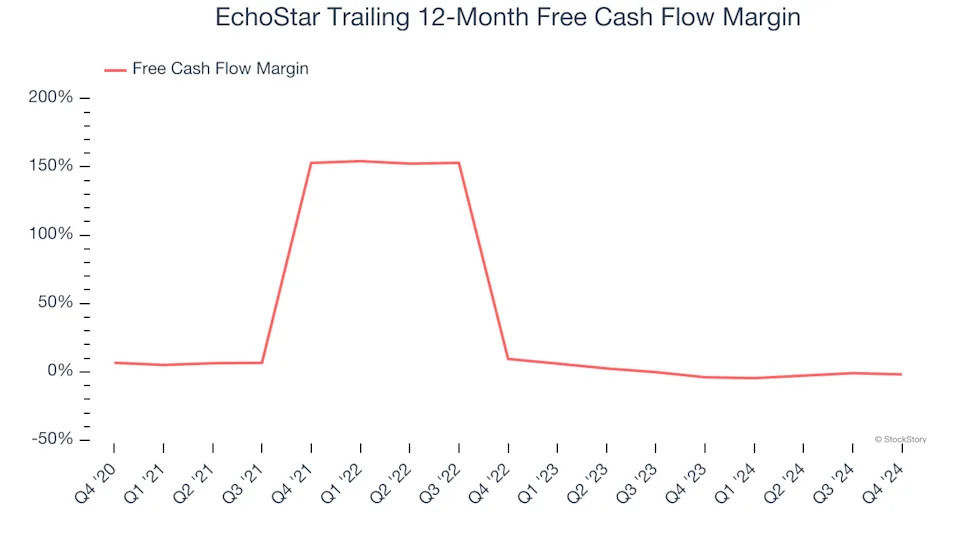

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, EchoStar’s margin dropped by 8.5 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it is in the middle of an investment cycle. EchoStar’s free cash flow margin for the trailing 12 months was negative 1.8%.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

EchoStar burned through $292.2 million of cash over the last year, and its $29.81 billion of debt exceeds the $5.70 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the EchoStar’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.