3 Reasons to Sell SKLZ and 1 Stock to Buy Instead

What a brutal six months it’s been for Skillz. The stock has dropped 27.4% and now trades at $3.95, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Skillz, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the more favorable entry price, we're cautious about Skillz. Here are three reasons why there are better opportunities than SKLZ and a stock we'd rather own.

Why Do We Think Skillz Will Underperform?

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

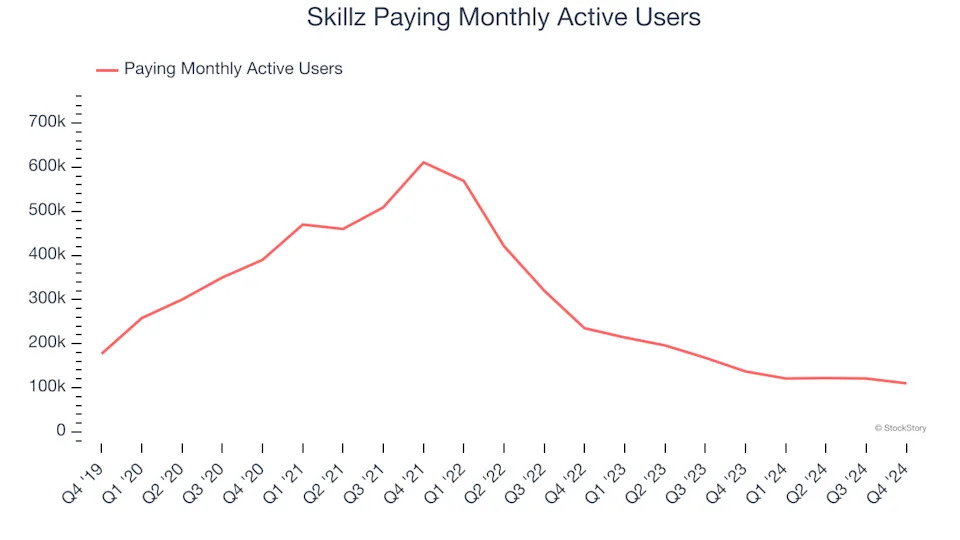

1. Declining Paying Monthly Active Users Reflect Product Weakness

As a video gaming company, Skillz generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Skillz struggled with new customer acquisition over the last two years as its paying monthly active users have declined by 41.7% annually to 110,000 in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Skillz wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

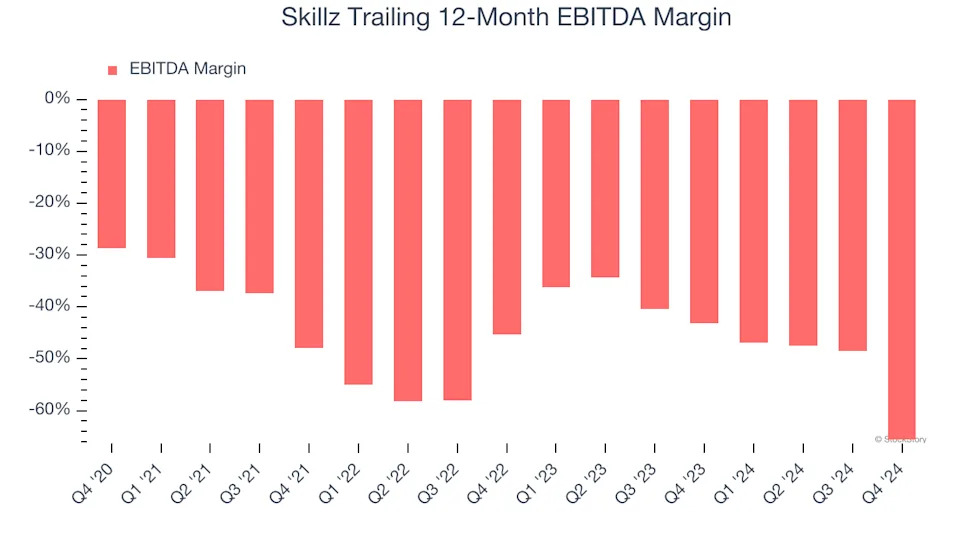

2. Shrinking EBITDA Margin

EBITDA is a good way of judging operating profitability for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

Analyzing the trend in its profitability, Skillz’s EBITDA margin decreased by 17.7 percentage points over the last few years. Skillz’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its EBITDA margin for the trailing 12 months was negative 65.6%.

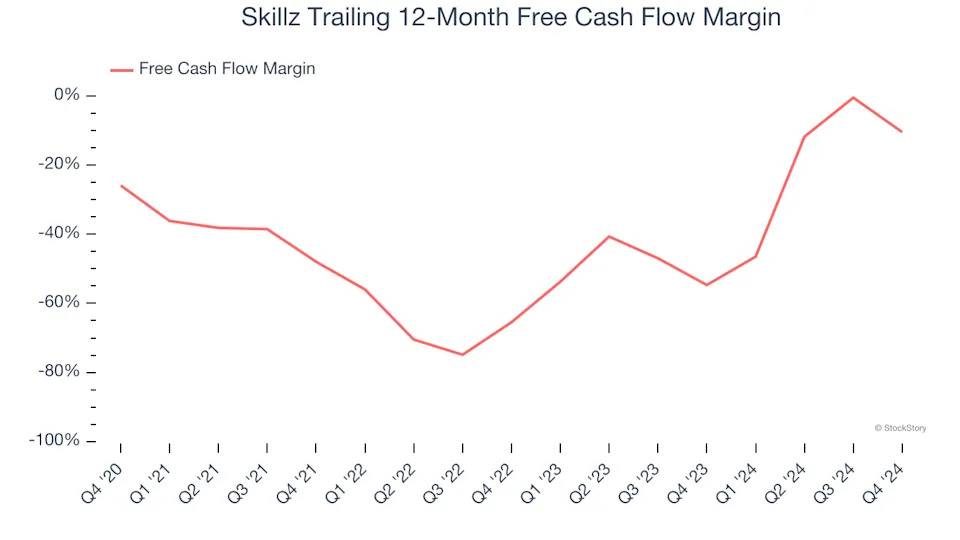

3. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Skillz’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 37.6%, meaning it lit $37.62 of cash on fire for every $100 in revenue.