3 Reasons to Avoid WW and 1 Stock to Buy Instead

The past six months haven’t been great for WeightWatchers. It just made a new 52-week low of $0.16, and shareholders have lost 88.9% of their capital. This may have investors wondering how to approach the situation.

Is there a buying opportunity in WeightWatchers, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Despite the more favorable entry price, we don't have much confidence in WeightWatchers. Here are three reasons why you should be careful with WW and a stock we'd rather own.

Why Do We Think WeightWatchers Will Underperform?

Known by many for its old cable television commercials, WeightWatchers (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

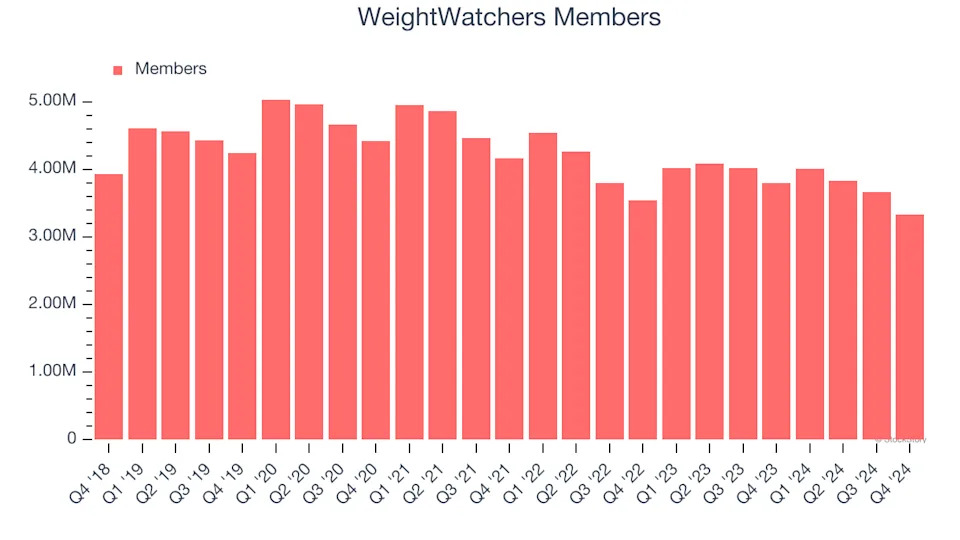

1. Decline in Members Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like WeightWatchers, our preferred volume metric is members). While both are important, the latter is the most critical to analyze because prices have a ceiling.

WeightWatchers’s members came in at 3.34 million in the latest quarter, and over the last two years, averaged 3.8% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests WeightWatchers might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

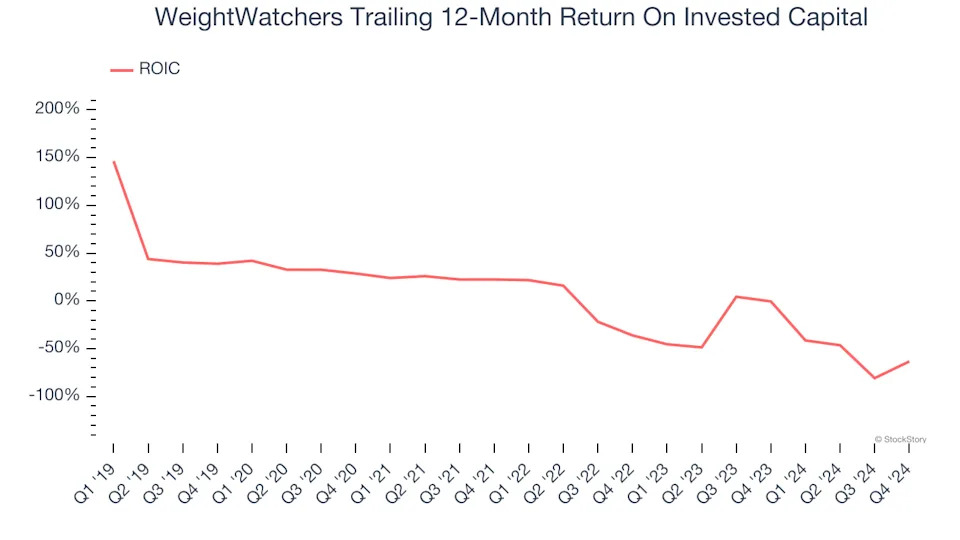

2. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, WeightWatchers’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

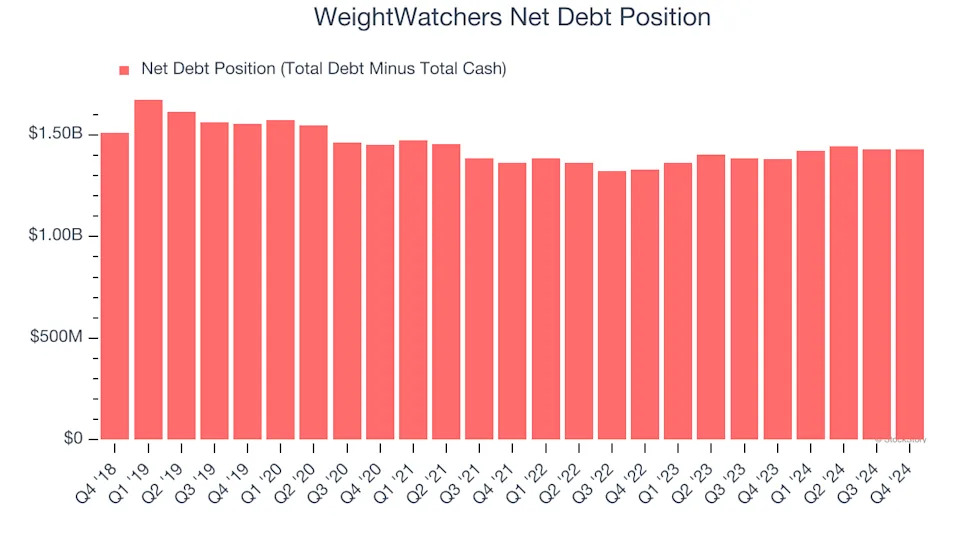

WeightWatchers burned through $17.56 million of cash over the last year, and its $1.48 billion of debt exceeds the $53.02 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.