Norinchukin Dodges Trump’s Market Chaos After Selling Treasuries

(Bloomberg) -- Norinchukin Bank’s disastrous last fiscal year has had one silver lining for Japan’s $300 billion investing giant — it helped shield it from the turmoil unleashed by Donald Trump’s tariffs this month.

Most Read from Bloomberg

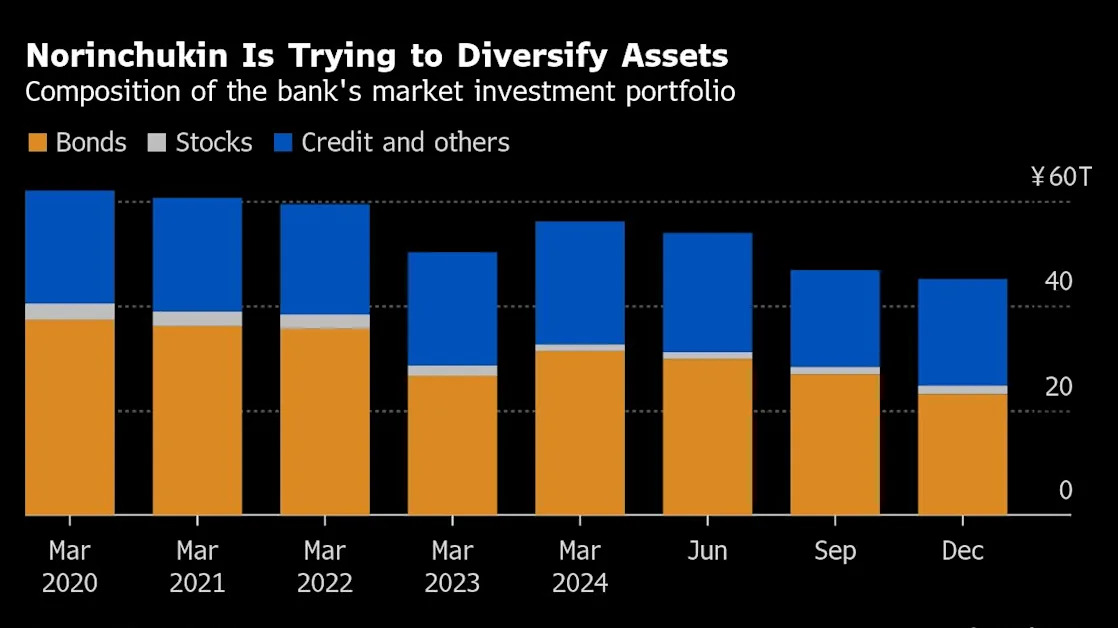

New Chief Executive Taro Kitabayashi said the bank finished selling off its unprofitable US Treasury holdings by the end of March, thus avoiding the volatility last week as Trump’s trade policies whipsawed markets. Through the end of December, the bank had unloaded ¥12.8 trillion of its holdings in US and European government bonds. The bank is not currently doing any large-scale buying or selling of sovereign debt, he said.

The bank expects to meet its target of between ¥30 billion and ¥70 billion ($210 million — $490 million) in profit for the year that started April 1 and will take its time on committing capital to fresh investments until there is more clarity, Kitabayashi said in an interview. Norinchukin has a mid-term plan of revamping its ¥45.2 trillion portfolio after a surge in US interest rates drove down the value of its foreign bond holdings last year.

“The one certain thing is that uncertainty will increase,” he said. “We are not in a situation where we need to rush into investment to make profit.”

The former chief financial officer took the top job at the bank at the beginning of this month after ex-CEO Kazuto Oku resigned to take responsibility for last year’s losses — which it expects to have reached roughly ¥1.9 trillion — stemming from its failed investment strategy. Kitabayashi has worked at the bank since 1994.

Kitabayashi’s priority is to shift the bank’s holdings away from a heavy reliance on Treasuries and other sovereign bonds. He listed a wide range of other investment assets, including corporate bonds, equity indexes and securitized products, as well as infrastructure finance to fund renewable projects and data centers. A more diverse portfolio will help mitigate the kind of adverse conditions currently roiling markets. The bank still held about 23.1 trillion yen in bonds as of the end of December.

Norinchukin holds about ¥8.2 trillion worth of collateralized loan obligations, an area where the firm’s prominence as one of the world’s biggest buyers of the securities had earned it the moniker of the CLO whale. Kitabayashi said while they remain one of the bank’s most important investment assets, it does not plan to aggressively increase them.