3 Reasons RHI is Risky and 1 Stock to Buy Instead

Shareholders of Robert Half would probably like to forget the past six months even happened. The stock dropped 28.1% and now trades at $48.67. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Robert Half, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the more favorable entry price, we're cautious about Robert Half. Here are three reasons why we avoid RHI and a stock we'd rather own.

Why Do We Think Robert Half Will Underperform?

With roots dating back to 1948 as the first specialized recruiting firm for accounting and finance professionals, Robert Half (NYSE:RHI) provides specialized talent solutions and business consulting services, connecting skilled professionals with companies across various fields.

1. Long-Term Revenue Growth Flatter Than a Pancake

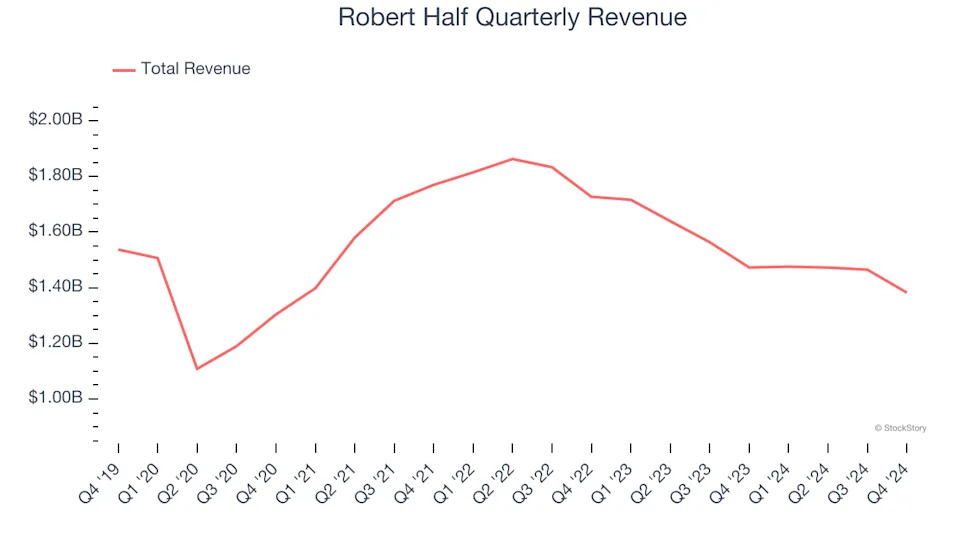

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Robert Half struggled to consistently increase demand as its $5.80 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

2. EPS Trending Down

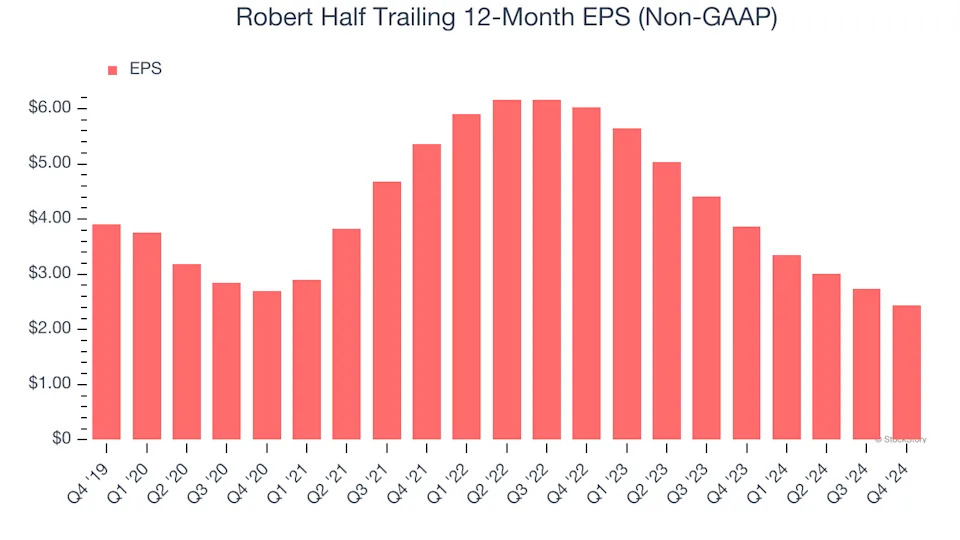

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Robert Half, its EPS declined by 9% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

3. New Investments Fail to Bear Fruit as ROIC Declines

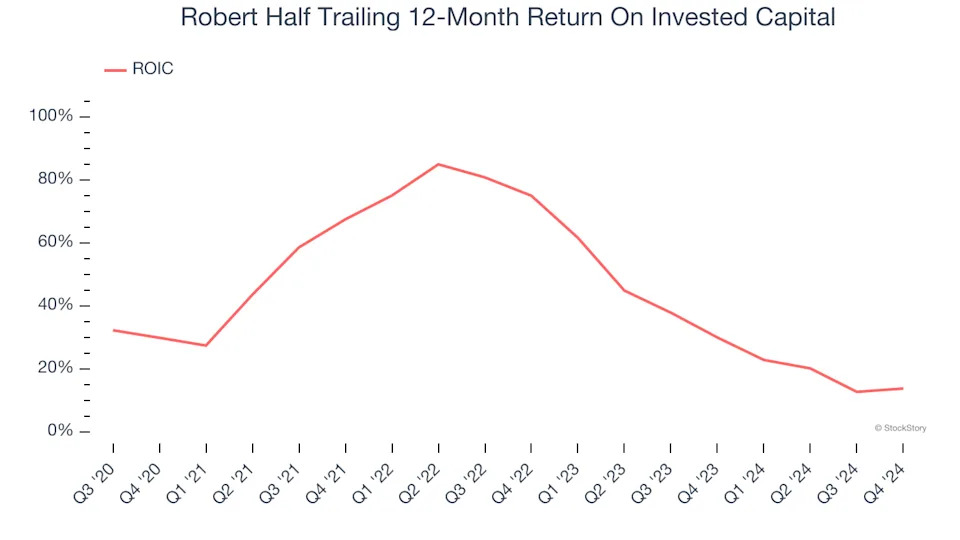

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Robert Half’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We see the value of companies helping consumers, but in the case of Robert Half, we’re out. After the recent drawdown, the stock trades at 16.4× forward price-to-earnings (or $48.67 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better investment opportunities out there. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce .