3 Reasons KEYS is Risky and 1 Stock to Buy Instead

Although the S&P 500 is down 9.9% over the past six months, Keysight’s stock price has fallen further to $131.95, losing shareholders 17% of their capital. This might have investors contemplating their next move.

Is now the time to buy Keysight, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free .

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than KEYS and a stock we'd rather own.

Why Do We Think Keysight Will Underperform?

Spun off from Hewlett-Packard in 2014, Keysight (NYSE:KEYS) offers electronic measurement products for use in various sectors.

1. Backlog Declines as Orders Drop

In addition to reported revenue, backlog is a useful data point for analyzing Inspection Instruments companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Keysight’s future revenue streams.

Keysight’s backlog came in at $2.34 billion in the latest quarter, and it averaged 3.9% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

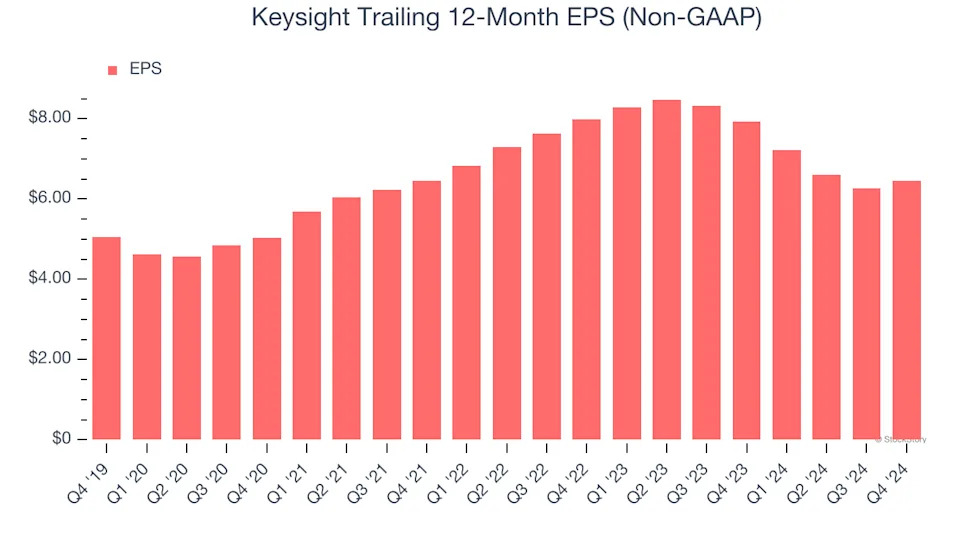

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Keysight’s EPS grew at an unimpressive 5% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.7% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

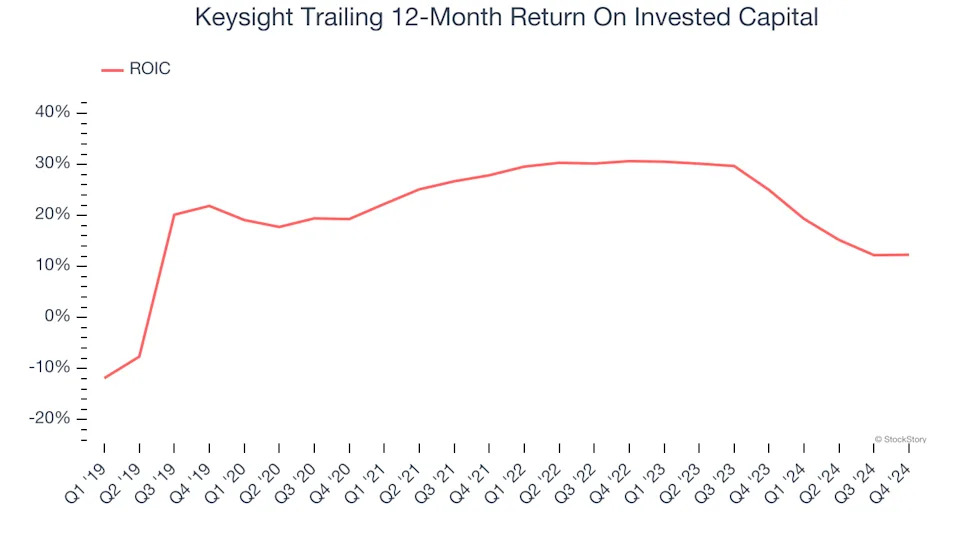

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Keysight’s ROIC decreased by 4.9 percentage points annually over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We see the value of companies helping their customers, but in the case of Keysight, we’re out. Following the recent decline, the stock trades at 18.6× forward price-to-earnings (or $131.95 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. We’d recommend looking at our favorite semiconductor picks and shovels play .