3 Reasons to Avoid MAN and 1 Stock to Buy Instead

Shareholders of ManpowerGroup would probably like to forget the past six months even happened. The stock dropped 28.2% and now trades at $50.37. This may have investors wondering how to approach the situation.

Is now the time to buy ManpowerGroup, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the more favorable entry price, we're swiping left on ManpowerGroup for now. Here are three reasons why we avoid MAN and a stock we'd rather own.

Why Do We Think ManpowerGroup Will Underperform?

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup (NYSE:MAN) connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

1. Core Business Falling Behind as Demand Declines

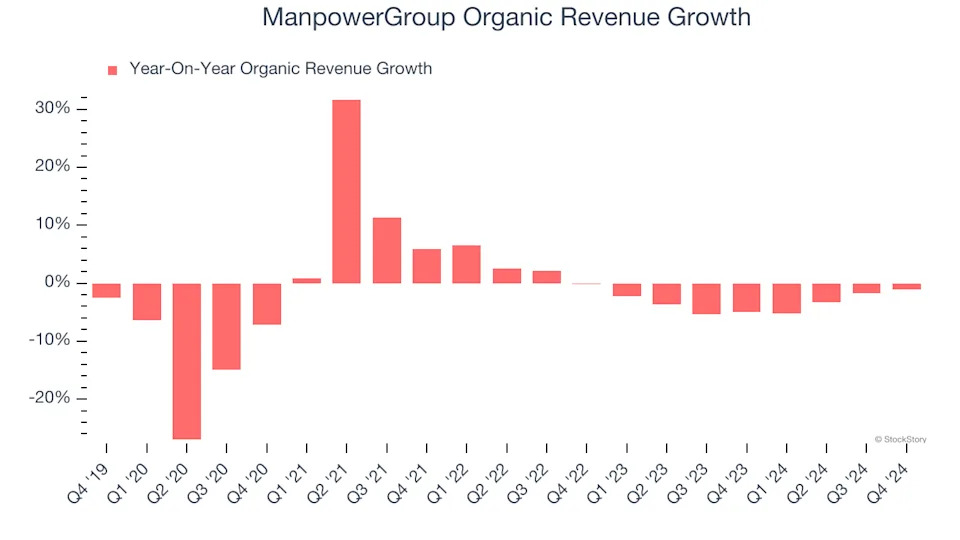

Investors interested in Professional Staffing & HR Solutions companies should track organic revenue in addition to reported revenue. This metric gives visibility into ManpowerGroup’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, ManpowerGroup’s organic revenue averaged 3.5% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests ManpowerGroup might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect ManpowerGroup’s revenue to drop by 5.2%, close to its 5.1% annualized declines for the past two years. This projection is underwhelming and suggests its newer products and services will not lead to better top-line performance yet.

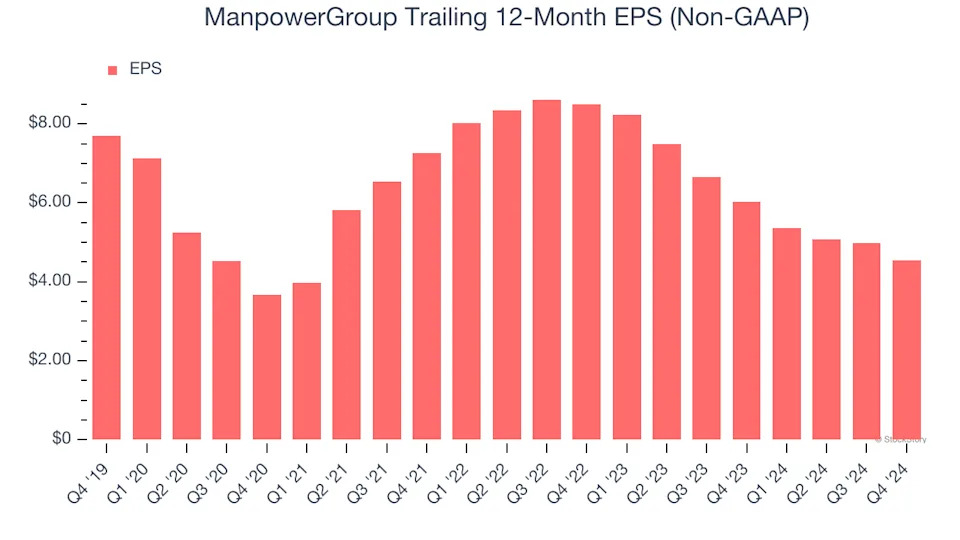

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for ManpowerGroup, its EPS declined by 10% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.