US stocks fall after Trump confirms 104pc tariffs on China

- April 8, 2025

The US stock market lurched lower on Tuesday night after Donald Trump forged ahead with 104pc tariffs on China.

A rally proved short-lived as the S&P 500 swung from gains of more than 4pc to finish down 1.6pc after investor hopes of a last minute reprieve on the crippling tariffs faded.

The Nasdaq 100 of tech-focused stocks also ended down 2pc and oil prices fell below $60 a barrel for the first time. WTI oil fell to $58.20 per barrel amid fears of a crippling drop in demand because of the trade war.

Global markets had surged earlier in the day after Mr Trump signalled a deal between the US and China “will happen” in the wake of his sweeping tariffs. But US stocks reversed course on Tuesday evening after the White House confirmed it would impose a 104pc levy on Asia’s largest economy at midnight.

Earlier on Tuesday, Britain’s blue-chip FTSE 100 index surged by 2.7pc after the US president said he was waiting for a call from China because its leaders “badly” wanted to agree a deal.

The UK move had reversed historic losses, which battered markets over the past few days. An estimated $10 trillion (£8trillion) was wiped off global stock markets because of Mr Trump’s tariffs.

On Wall Street, stocks had also initially rocketed higher amid hopes for a resolution to the turmoil caused by Mr Trump’s “liberation day” levies.

The president wrote on his Truth Social website: “China also wants to make a deal, badly, but they don’t know how to get it started. We are waiting for their call. It will happen!”

Mr Trump’s upbeat tone comes despite China pledging to “fight to the end” in an escalating global trade war.

Beijing said it would not bow to “blackmail” if the US president followed through on his threat to impose 50pc additional tariffs on the country from Wednesday.

Mr Trump urged China to reverse course on its plan to enforce a 34pc retaliatory tariff against all US imports from Friday. The move is in response to an additional 34pc US tariff on Chinese goods announced on “liberation day” last week.

A spokesman for China’s commerce ministry said: “The US side’s threat to escalate tariffs against China is a mistake on top of a mistake, once again exposing the American side’s blackmailing nature.

“If the US insists on going its own way, China will fight to the end.”

The war of words prompted an intervention from Ursula von der Leyen, the president of the European Commission, who pleaded for a “negotiated resolution” amid a deepening threat of a decoupling between the world’s two largest economies.

Ms Von der Leyen held a call with Li Qiang, the Chinese premier, in which she “called for a negotiated resolution to the current situation, emphasising the need to avoid further escalation”.

She “stressed the responsibility of Europe and China, as two of the world’s largest markets, to support a strong reformed trading system, free, fair and founded on a level playing field”.

Both leaders discussed setting up a mechanism to track possible trade diversion caused by the tariffs as the EU fears China will redirect cheap exports from the US to Europe.

Global stocks were also earlier buoyed by indications that the US was closing in on trade deals with other nations. Mr Trump said there was the “probability of a great deal” with South Korea over tariffs after a call with the country’s acting president.

Scott Bessent, the US Treasury secretary, said “some very large countries with large trade deficits” would “come forward very quickly”.

Mr Bessent, a former hedge fund tycoon, said he had seen the “substantial” call list at the White House.

“If they come to the table with solid proposals, I think we can end up with some good deals,” he told CNBC.

Rachel Reeves told the House of Commons she would meet Mr Bessent “shortly” as Britain seeks to secure a closer trading relationship with the US.

The Chancellor also held talks with the Governor of the Bank of England.

She told MPs that Andrew Bailey had reassured her that markets “are functioning effectively and that our banking system is resilient”.

10:43 PM BST

Signing off...

Thanks for joining us today.

That’s all for today but you can read all our latest news and commentary on the economy here .

10:09 PM BST

Wall Street surges ‘built on a house of cards’

Wall Street’s turbulence was unusual today, with the stock market jumping up as much as 4.1pc, but falling as much as 3pc.

The technology-heavy Nasdaq rose as much as 4.6pc, but also lost as much as 3.5pc.

Meanwhile, the Dow Jones Industrial Average of 30 leading American companies rose by as much as 3.85pc and lost as much as 2.3pc.

Que Nguyen, at investment adviser Research Affiliates, told Bloomberg: “The volatility reflects the new situation in which no one knows what the rules of road are, or even what the desired destination is.

“Until investors reset expectations or those rules and goals are better understood, markets will continue these wild swings between hope and fear.”

Stephen Innes, of SPI Asset Management, said: “The S&P 500 was up over 4pc intraday - its biggest one-day jump since 2022 - only to fade hard into the close. This is the kind of market where extremes get faded fast. Volatility is now the main show, and if you bought the Monday flush and sold near today’s highs, congrats ...

“But let’s not pretend this is a stable foundation. These rallies are still built on a house of cards.”

09:52 PM BST

Trump making ‘tailored deals’ on tariffs

Donald Trump has said his government was making “tailored deals” with trading partners, after Washington imposed punishing tariffs with countries around the world.

“We’re doing very well and making I call them tailored deals, not off the rack, these are tailored, highly tailored deals,” Mr Trump said. “Right now Japan is flying here to make a deal. South Korea is flying here to make a deal. And others are flying here.”

09:45 PM BST

Trump says US taking in $2bn a day from tariffs

Donald Trump has said that the United States is taking in $2bn (£1.6bn) a day from tariffs.

He made the comment without providing details during an event at the White House.

Mr Trump has imposed an array of tariffs on other countries since taking office in January.

09:42 PM BST

Trump: it will take time to see countries wanting trade deals

Donald Trump has cautioned that it will take time to see all the countries wanting trade deals with the US , writes Connor Stringer .

“Sometimes you have to mix it up a little bit,” President Trump said, defending his tariff plan on Tuesday.

He said countries are rushing to negotiate “tailored deals” as the midnight deadline looms.

“We’ve had talks with many, many countries, over 70 they all want to come in,” he said, during an executive order signing to help a dying US coal industry.

“Our problem is, we can’t see that many that fast, but we don’t have to, because, as you know, the tariffs are on, and the money is pouring in at a level that we’ve never seen before, and it’s going to be great for us.”

09:40 PM BST

Trump: unrealistic to make workers move to high-tech jobs

Donald Trump has doubled down in his opposition to green policies and globalisation, saying that it is unrealistic to expect coal miners to switch jobs.

The US president attacked the Biden administration for opposing coal mining on environmental grounds, claiming that China had been opening two coal plants every week.

He also criticised his former presidential rival, Hillary Clinton, saying that she “was talking about how bad coal was and how they were going to teach coal miners how to make widgets and gadgets and technology, which they didn’t want to do.”

He added: “One thing I learned about the coal miners ... you could give them a penthouse of Fifth Avenue and a different kind of a job and they’d be unhappy. They want to mine coal. That’s what they love to do.

“And she was going to put them in a high-tech industry where you make little cellphones and things.”

09:01 PM BST

Wall Street closes down after afternoon of gains

Wall Street plunged this evening after the Trump administration said it would go ahead with 104pc tariffs on China from tomorrow.

The S&P 500 had risen as much as 4.1pc this afternoon before gains were wiped out. All three main Wall Street indexes finished lower. The S&P 500 closed down by 1.6pc.

Meanwhile, the Nasdaq lost 2.2pc and the Dow Jones fell by 0.8pc.

“Obviously investors are clamouring for clarity and there still isn’t any,” said Jack Ablin of Cresset Capital, who estimated that the market now sees a greater than 50pc chance of a US recession.

08:31 PM BST

Wall Street losses increase

Wall Street has fallen further into negative territory this evening after strong gains this afternoon.

The S&P 500 is down by 1.5pc, the Nasdaq is down by 2pc and the Dow Jones has lost 0.8pc.

Steve Sosnick, chief strategist at Interactive Brokers, said: “This is what happens in highly volatile markets - they overshoot in both directions.

“The selling gets overdone, but so does the knee-jerk reaction to buy and chase.”

08:23 PM BST

Canadian tariffs on US car imports come into force tomorrow

Canada has said it will begin imposing a 25pc tariff on certain US auto imports from tomorrow, activating a retaliatory measure in response to Donald Trump’s levies on foreign-made cars and trucks.

“Canada continues to respond forcefully to all unwarranted and unreasonable tariffs,” Canadian finance minister Francois-Philippe Champagne said.

08:17 PM BST

US can take its time to cut rates, says central banker

Donald Trump has been publicly lobbying for an interest rate cut, but monetary policy is already “in a good place”, a US central banker has said.

Mary Daly, head of the Federal Reserve Bank of San Francisco, said: “We cut the interest rate by 100 basis points [1 percentage point] last year.

“That puts policy in a good place to stay modestly restrictive - keep inflation coming down - but not so restrictive that the economy is vulnerable.

“So, with growth good and policy in a good place, we’ve built the time and the ability to just tread slowly and tread carefully.”

08:12 PM BST

Oil hits four-year low on trade war fears

Oil prices fell today by as much as 3pc as traders bet that Donald Trump’s trade war would depress global demand.

The US benchmark price, West Texas Intermediate, dropped below the symbolic level of $60 a barrel, reaching as low as $58.90.

It was last this low in March 2021, during the Covid pandemic.

Brent Crude, the global benchmark price for oil, fell as much as 3.2pc to $62.17 a barrel, which was also the lowest for four years.

08:01 PM BST

Wall Street fluctuates as traders mill direction of trade war

Wall Street’s main indexes flitted between red and green this evening after rallying sharply in the afternoon as investors’ hopes ebbed for signs of movement on tariffs.

Market participants “were optimistic [earlier] that we would get some sort of sign that we’re moving closer to a deal or a compromise with some of these bigger countries or that there would be a delay coming given that so many people wanted to negotiate,” said Lindsey Bell, chief market strategist at Clearnomics in New York.

“That doesn’t seem to necessarily be the case as we are quickly approaching the midnight deadline and investors are losing confidence.”

The White House said on Tuesday evening that it expects more tariffs on China to go into effect tomorrow.

07:57 PM BST

Stephen Kinnock says closeness to EU key to coping with trade war

A UK minister has said the global economic headwinds are “very turbulent” and rebuilding relations with the European Union will be key to protecting Britain’s national interest.

Health minister Stephen Kinnock told Sky News: “It is very turbulent. Nobody benefits from a trade war. We live in an incredibly deeply integrated global economy with very integrated supply chains and hugely interdependent commercial relationships, so nobody benefits from a trade war.

“We are seeing a Prime Minister who is really showing leadership, he is engaging with Donald Trump and seeking to negotiate the best possible deal that we can in terms of economic prosperity.

“He’s also rebuilding the bridges that were burned by previous Conservative governments in terms of our relationship with the European Union.

“And we’re also developing an industrial strategy to help Britain stand firmly on its own two feet, investing in our own industries, boosting domestic demand, investing in skills in infrastructure rebuilding our manufacturing sector.

“So I think the combination of those three things is going to help us to weather the storm.”

07:35 PM BST

Trump will cause millions to be unemployed, says Clinton’s treasury secretary

Donald Trump will cause an extra two million people to lose their jobs, a former US treasury secretary has claimed.

Larry Summers, who served under Bill Clinton, told Bloomberg Television: “It’s more likely than not that we’re going to have a recession - and in the context of a recession, we’ll see an extra 2m people be unemployed.”

He said that he expected to “see losses in household income” of $5,000 per family or more.

He added that it would be wise for Mr Trump to be “backing off” from his tariff plans.

07:32 PM BST

Everyone knows Trump is right, claims White House

Donald Trump’s press secretary Karoline Leavitt has told reporters that everyone in Washington DC supports the trade war.

She said: “Everybody in Washington, whether they want to admit it not not, knows that this President is right when it comes to tariffs and when it comes to trade.

“In fact, Democrats have long said that the United States of America been ripped off by the countries around the world. They just don’t want to admit it now because it’s President Trump who is saying that.”

However, centrist Democrats have long been strong supporters of free trade and the introduction of the North American Free Trade Agreement, signed in 1992, was a flagship policy of the Clinton presidency.

The Progressive Policy Institute, a Washington think tank popular popular with the Democrats, has said that White House’s trade policies consist of “paranoid nonsense [that] shows Trump has no idea of how trade works”.

07:08 PM BST

Italy’s Meloni says to visit US next week

Italy’s Giorgia Meloni has said she will visit Washington next week to talk to Donald Trump about tariffs, as the European Union seeks to avert an all-out trade war.

In comments to Italian businesses, the prime minister backed EU moves to find a negotiated solution to the crisis, but said the situation required all hands on deck.

“This is the negotiation that must see us all engaged and at all levels,” she said. “And that involves me, who will be in Washington on April 17 and obviously I intend to address this issue with the US president.”

Ms Meloni, the leader of the hard-Right Brothers of Italy party, was the only EU leader invited to Mr Trump’s inauguration in January. She has sought to maintain ties with the Republican despite the disruption caused by his policies.

She has criticised the tariffs as “wrong”, and repeated today that “a trade war between Europe and the United States does not suit anyone”.

07:03 PM BST

Israel ‘should serve as a model’ for countries wanting trade deals

Israel’s proactive approach should lead as an example to the rest of the world on tariffs, Donald Trump’s press secretary Karoline Leavitt has suggested.

“Bring us your best offers and he will listen,” Ms Leavitt said of countries potentially wanting to negotiate lower tariff rates.

She said Israeli prime minister Benjamin Netanyahu coming to Washington to talk trade “should serve as a model”.

06:59 PM BST

White House: we will let Musk-Navarro spat continue

The White House has played down a spat between Elon Musk and Donald Trump’s trade adviser Peter Navarro.

Mr Musk said that Mr Navarro was “dumber than a sack of bricks” and “a moron”, after Mr Navarro criticised Tesla for using imported parts.

This evening, Karoline Leavitt, the White House press secretary, told reporters: “These are obviously two individuals who have very different views on trade and on tariffs.

“Boys will be boys and we will let their public sparring continue.

“And you guys should all be very grateful that we have the most transparent administration in history and I think it also speaks to the President’s willingness to hear from all sides.”

06:54 PM BST

Trump ‘absolutely’ believes iPhones can be made in US

Donald Trump “absolutely” believes iPhone manufacturing could be moved to the US, the White House press secretary has said.

Karoline Leavitt said: “We have the labour, we have the workforce, we have the resources to do it.”

06:49 PM BST

China has to make a deal with the US, White House says

Donald Trump believes that China has to make a deal with the United States on tariffs, White House press secretary Karoline Leavitt has told a press briefing.

“The Chinese want to make a deal. They just don’t know how to do it,” she said.

“He believes China has to make a deal with the United States.”

If China reaches out, she added, Mr Trump would be “incredibly gracious, but he’s going to do what’s best for the American people.”

06:48 PM BST

‘Phones ringing off the hook’ says White Hosue

Donald Trump has “a lot of leverage” in his trade war, the White House has claimed.

Karoline Leavitt, the White House press secretary, said: “The phones have been ringing off the hook, [with countries] wanting to talk to this administration, this president and his his trade team to try to strike a deal…

“The President has a lot of leverage on his side because he has best economy and the best country in the world that he leads and he knows that.

“And it’s about dang time that we finally have a president who uses that economic leverage to benefit American workers.”

06:30 PM BST

Three in four Americans expect price surge under Trump tariffs

Most Americans are bracing for higher prices following Donald Trump’s move to impose sweeping new tariffs, a new Reuters/Ipsos poll has found.

The three-day poll, which concluded on Sunday, found that 73pc of respondents said they thought prices in the next six months would increase for the items they buy every day after the new taxes on almost all imports took effect.

Just 4pc of respondents thought prices would fall and the rest expected no change or did not answer the question.

Mr Trump’s announcement last week of the biggest US tariff increases in decades shook Wall Street as many economists predicted they would push prices higher and could trigger a recession in the US and the rest of the world.

Some 57pc of poll respondents - including one quarter of respondents from Trump’s Republican Party - said they opposed the new tariffs, which include levies of at least 10pc on imports from almost every country.

Some 39pc of respondents supported the new tariffs, and 52pc said they agreed with the Trump administration’s argument that other countries have been taking advantage of the US when it comes to international trade.

Mr Trump frequently cites that view as a reason to enact new trade barriers, saying they will lead to a boom in US manufacturing. Forty-four percent of respondents said they disagreed with that view.

Americans have mostly split along partisan lines on whether higher tariffs are a good idea. Half of respondents - including almost all Republicans - said they agreed with a statement that “any short-term economic pain is worth it to make the US stronger in the long term.” The other half - including almost all Democrats - disagreed.

06:27 PM BST

Tariffs ‘will generate trillions’, says White House

Donald Trump’s tariffs will will be a cash cow, the White House has suggested, despite hopes that the US President is becoming more open to negotiate free trade deals.

Asked about the likely revenue from tariffs, Karoline Leavitt, the White House press secretary, said: “That has yet to be seen but as the President said, the reciprocal tariffs which will continue to go into effect ... will generate trillions of dollars in revenue.”

06:24 PM BST

Wall Street gives up gains as uncertainty about tariffs continues

US stock indexes have given up an after rally, and briefly went negative.

The S&P 500 erased nearly all of a 4.1pc gain by this evening and is roughly flat.

Stocks globally had rallied earlier in the day on hopes that Donald Trump may ease up on his trade war following negotiations with other countries.

The Dow Jones is up 0.4pc, while the Nasdaq is down by 0.3pc.

06:21 PM BST

Trump already delivering ‘economic golden age’, despite market chaos

Donald Trump is already improving the US economy, the White House has claimed.

Karoline Leavitt, the White House press secretary, said: “By focusing on supercharging the onshoring of American manufacturing, the President is already delivering on his promise to usher in an economic golden age for our country.”

It comes after a month where Wall Street’s main S&P 500 index fell nearly 14pc.

06:17 PM BST

China ‘making a mistake’, says White House

President Trump will not break in his determination to restructure global trade, the White House press secretary has said.

Karoline Leavitt told reporters: “Countries like China who have chosen to retaliate and try to double down on their mistreatment of American workers are making a mistake.

“President Trump has a spine of steel that he will not break and America will not break under his leadership.”

06:15 PM BST

‘Era of American economic surrender is over’, says White House

The White House has declared that the “era of American economic surrender is over” as it hit out at “fear mongering by the media” the in coverage of Donald Trump’s trade war.

Karoline Leavitt, the White House press secretary, told reporters that the “liberation day” announcement had been a success. She claimed that over 70 nations have said they want to negotiate trade deals.

“Deals will only be made if they benefit American workers and address our nation’s crippling trade deficit.”

“America does need need other countries as much as other countries need us, and other countries know this,” she said.

06:09 PM BST

Too early to say if UK will cut rates in response to trade war, says rate setter

Clare Lombardelli, deputy Governor at the Bank of England, has said Donald Trump’s tariffs are going to hit the UK economy, but warned it is too soon to say whether the Monetary Policy Committee will slash interest rates in return.

“What we’re seeing is a change in US trade policy, potentially a change in other countries’ trade policies, in response to that we’re seeing an increase in uncertainty, we’re seeing some changes in asset prices. We will bring all of that together and think about all of that for the next policy round, and think about the impact on UK activity and on UK prices,” she told a Resolution Foundation event.

“We know that tariffs are likely to depress activity overall, the uncertainty, the combination of those things - the direction of that is relatively clear.

“On inflation it depends a lot more on the circumstances, of how other countries respond, how that feeds through to the UK, and we will put all of that together for our next decision - I am not going to take a position now on what that means for the precise level.”

06:05 PM BST

White House confirms 104pc tariffs on China tomorrow

A White House official has confirmed that the US will go ahead with 104pc tariffs on China tomorrow.

The tit-for-tat tariff hike is being made in response to China’s decision to retaliate against Donald Trump’s “reciprocal” tariffs, which the US President announced last week.

China’s commerce ministry has called the move “a mistake on top of a mistake”.

Yesterday, Mr Trump demanded that China removes its retaliatory tariffs. He wrote on his social media platform if China did not withdraw its additional 34pc tariff on the US, the US would add a further tariff of 50pc. Collectively, US tariffs are set to become 104pc on China.

05:47 PM BST

British stocks notch strongest session since 2022

British stocks ended higher this afternoon amid hopes that the US might soften its stance on some of its aggressive import tariffs.

The blue-chip FTSE 100 rose 2.7pc, its biggest daily jump since March 2022, recovering from its lowest close in more than a year yesterday.

The domestically focused mid-cap FTSE 250 index gained 3.3pc, bouncing back after three consecutive trading days of losses.

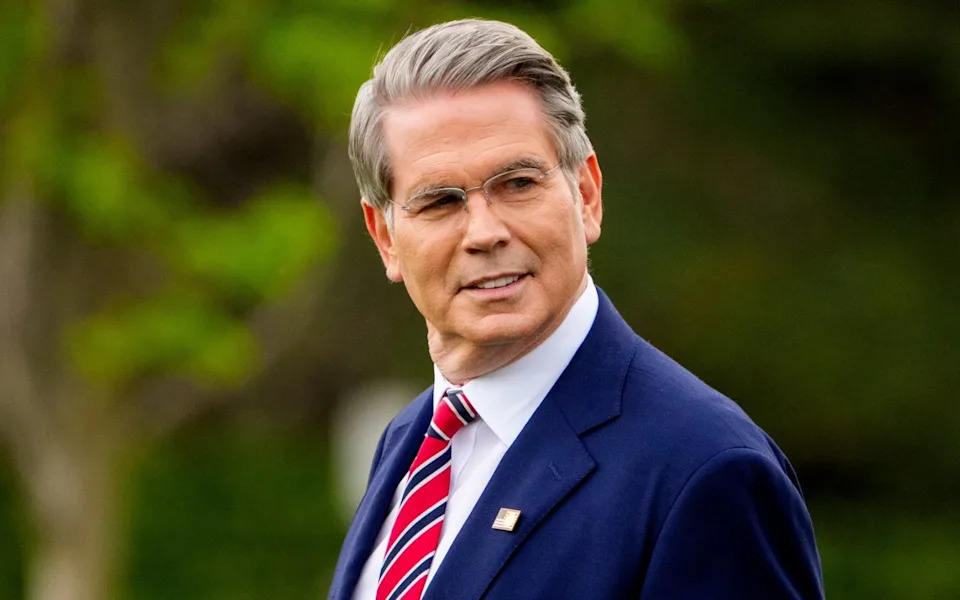

Comments from US treasury secretary Scott Bessent that he believes they could strike “some good deals” helped to ease recent market concerns.

Nevertheless, major markets are still heavily down after a dramatic slump when Mr Trump announced plans to hit countries with tariffs last Wednesday.

Axel Rudolph, senior technical analyst at IG, said: “Following three days of intense selling, global stock indices bounced back as investors took advantage of lower valuations and grew more optimistic about US tariff negotiations.

“Nonetheless, tensions between the US and China remain elevated after Beijing vowed to ‘fight to the end’ in response to Mr Trump’s threat of imposing new 50pc tariffs unless China rapidly removed its retaliatory measures.”

05:44 PM BST

UN chief warns over ‘devastating’ impact of trade war on poor

United Nations secretary-general Antonio Guterres has said that he is particularly worried about the most vulnerable developing countries amid a trade war

He told reporters that the impact on poor countries would be “more devastating”.

“Trade wars are extremely negative. Nobody wins with a trade war, everybody tends to lose,” he said.

05:41 PM BST

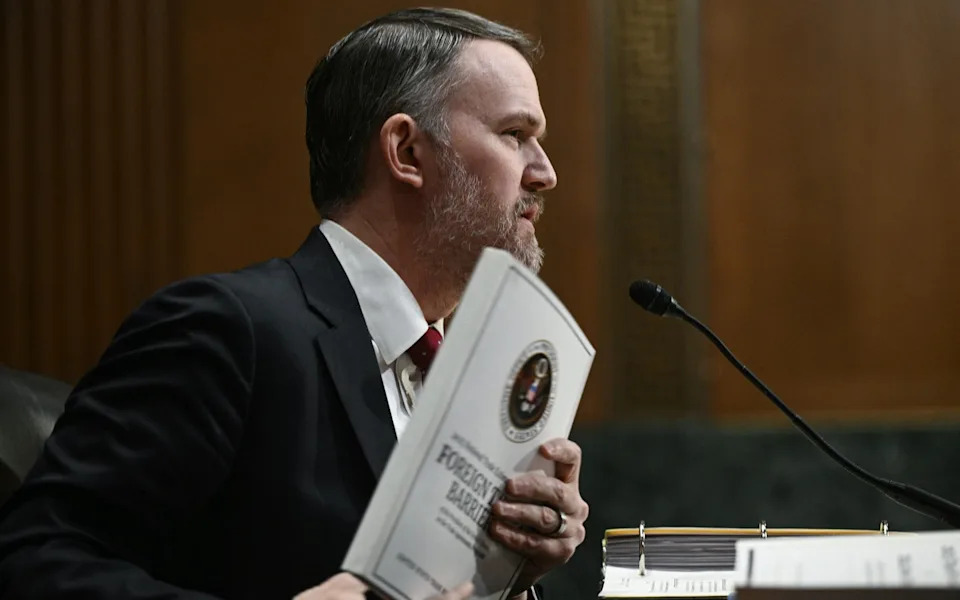

US companies may feel pain, says Trump’s trade negotiator

US Trade Representative Jamieson Greer has told senators that American companies could feel pain from reworking supply chains after Donald Trump hiked tariffs.

Mr Greer, who oversees the implementation of tariffs, told the Senate finance committee that US companies should prepare to rework their supply chains for the future and source materials domestically, if needed.

He said: “We can’t keep doing the same thing we always did ... We can’t do nothing for four years.”

05:34 PM BST

‘We can’t allow Wall Street to run the economy’

Donald Trump’s trade negotiator has said he is more concerned about Main Street than Wall Street, dismissing pressure from the financial markets.

Jamieson Greer, the US Trade Representative, told the Senate finance committee: “I know everyone is concerned about Wall Street, I’m just concerned about Main Street and getting these jobs back.

“We are not going to be in a situation where we keep allowing Wall Street to run the economy”.

05:32 PM BST

Chinese currency hits historic low on US-China trade tensions

China’s yuan fell to an all-time low against the US dollar today as trade tensions between the United States and China continued after days of turmoil over tariffs.

The offshore yuan, which is circulated outside mainland China and is more freely traded than currency in the domestic market, hit the lowest level since it started trading in 2010.

A single dollar could buy up to 7.3981 yuan, after the US currency strengthened by as much as 0.7pc against its Chinese rival.

05:16 PM BST

Macron says he hopes Trump reconsiders tariffs decision

Emmanuel Macron, the French president, has called on Donald Trump to reconsider the sweeping tariffs that have raised the spectre of a world recession.

“The aim is to reach a situation where President Trump reconsiders his decision,” Mr Macron said during a visit to Egypt.

“If that means we have to go though a stage where we explain that we are ready to respond, so be it ... France and Europe never wanted chaos.”

05:11 PM BST

Coventry ‘most exposed’ to Trump tariffs

Coventry is more exposed to Donald Trump’s trade war than any other city in Britain, economists have warned, with Derby and Telford also vulnerable.

The Midlands industrial hubs are major exporters to the US and so have the most to lose from the US President’s tariffs of 10pc on all British goods and 25pc on cars, according to the Centre for Cities.

Such high taxes on vehicles are expected to be particularly painful for the region traditionally at the heart of Britain’s automotive industries.

More than one-fifth of Coventry’s exports go to the US, according to analysis by Yunze Wang at the think tank, along with 19.9pc of those from Derby and 17.3pc of those from Telford.

The south-east of England is much less vulnerable as tariffs focus on goods sold into the US, not the services in which London and the surrounding region largely specialise.

05:03 PM BST

Trump’s America is an ‘economy in a hospice’, says US senator

A leading Democratic senator has berated Donald Trump’s trade negotiator for introducing tariffs against allies.

Senator Mark Warner told Jamieson Greer: “I loved your fancy Greek formula which was basically bad math on steroids.

“With the trade surplus, with the strong relationship, Australia got hit with a 10pc tariff as well?”

Mr Greer noted that “Australia has the lowest rate available”, to which the Senator asked why the country had been “whacked in the first place” considering the country is “an incredibly important national security partner”.

The US Trade Representative claimed that Australia bans US beef and pork, adding that there had been “global tariffs on everyone” - though neglecting to note that the US has not imposed levies on Russia or North Korea.

Interrupting Mr Greer, the senator said: “Sir, you are a much smarter person than that answer - the idea that we are going to whack friend and foe alike - and particularly friends - with this level is both insulting to Australians, undermines our national security and frankly makes us not a good partner going forward.

“The lack of trust from friends and allies based upon this ridiculous policy that goes into full effect at midnight tonight is extraordinary.

“I go back to what the market believes today is happening - a good day in hospice. I am afraid if we keep these tariffs in effect we are looking like an economy in a hospice.”

Credit: C-Span

04:40 PM BST

FTSE 100 closes up 2.7pc

The FTSE 100 has closed up by more 2.7pc as the mood in stock markets globally turned positive.

London’s top index is still down 4.2pc since the start of the year, after investors were spooked by Donald Trump’s trade war.

David Morrison, an analyst at Trade Nation, cautioned that “it feels far too soon to sound the ‘all clear’ and expect a larger and more protracted rally. That could be the case, but traders must remain cautious as there’s a strong possibility of aftershocks”.

Dan Coatsworth, investment analyst at AJ Bell, said: “It feels like a lifetime since stock markets were moving higher, but finally we’ve had the magic bounce-back day.

“The majority of the stocks in the FTSE 100 were in positive territory as investors regained confidence and celebrated the end of the market bloodbath.

“The big unknown is for how long the rebound party lasts. It’s not uncommon to see another leg down after a moment of calm and whether that happens or not, investors should continue to focus their investing strategy on the long term rather than just recent events.

“For the time being, risk appetite appears to be returning and that was reflected by the type of stocks leading the UK market higher. Yesterday’s losers were today’s winners, including various defence names, technology investment vehicles and banks.”

04:33 PM BST

‘Relief has flooded through financial markets’, says analyst

Stock markets have risen globally as investors felt became more hopeful that the US will sign tariff deals with key trading partners.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “With hints of negotiations in the air, relief has flooded through financial markets, with the FTSE 100 rebounding from a chunk of yesterday’s losses.

“Investors have taken the chance to buy into beaten up stocks, with an eye on a longer-term recovery.

“They’ve also been buoyed by measured stances from leaders across European Union, the UK, Japan and South Korea, who have shown a willingness to talk first and hold off from retaliatory action for now.

“But sentiment is still skittish towards the end of the trading day, given how clouded the trade outlook is for the global economy. The China US stand-off is likely to keep markets volatile, with investors waiting with bated breath to see if Xi Jinping or Trump will blink first.

“The risk is that neither will be willing to lose face, and the situation could escalate further.”

04:29 PM BST

Citibank fears global investors will turn their backs on the dollar

Donald Trump risks pushing global investors away from US assets, undermining the country’s status at the heart of the financial system, and its ability to raise funds worldwide, Citi’s chief economist has warned.

Such a switch away from the dollar would represent a major shift in the world economy, and the privileged status which America has enjoyed since the Second World War.

“I can tell you what I am the most worried about - and it is really a dog that has not barked for decades and decades and decades - but it is, is there a threat, is there a risk, where foreign investors become less willing to continue to purchase US assets?” said Nathan Sheets.

He said a sell-off in US Government bonds, known as Treasuries, would raise risks to Mr Trump’s ability to finance the national debt, while businesses and banks would also risk “a period of financial stress” if foreign investors turn their back on US assets.

“The good news is that, over the last few days, the dollar has been well supported,” he said.

“But I have to tell you, yesterday’s sell off in the Treasury’s market … it is just not clear what was driving that. If we see that continue, it would highlight that there are some deeper risks that we need to watch.”

Mr Sheets said it depends how foreign governments and international investors respond to Mr Trump’s aggressive trade policies.

“In this environment where the US is playing its cards so vigorously, how does the rest of the world respond to that, and does it influence the attractiveness of our assets?” he said.

“I am worried about increases in bond yields that we don’t really understand. We have to see how persistent is it.”

04:24 PM BST

Australian PM ‘should have strength to stand up to bullies’

Anthony Albanese, the Australian prime minister, has been urged to “stand up against bullies” after the Trump administration imposed 10pc tariffs on the nation.

Peter Dutton, the Liberal Party leader, told a televised town hall debate in Sydney that the prime minister “should have the ability and the strength of character to be able to stand up against bullies, against those who would seek to do us harm”.

He added that a better deal was negotiated during the first Trump administration, when the country secured exemption for Australian steel and aluminium imports.

The Australian prime minister said that the tariffs would pose challenges but noted that “Australia got the best deal of any country on the planet”.

He said that he would not allow the trade dispute to derail the country’s procurement of a fleet of submarines powered by US nuclear technology.

04:13 PM BST

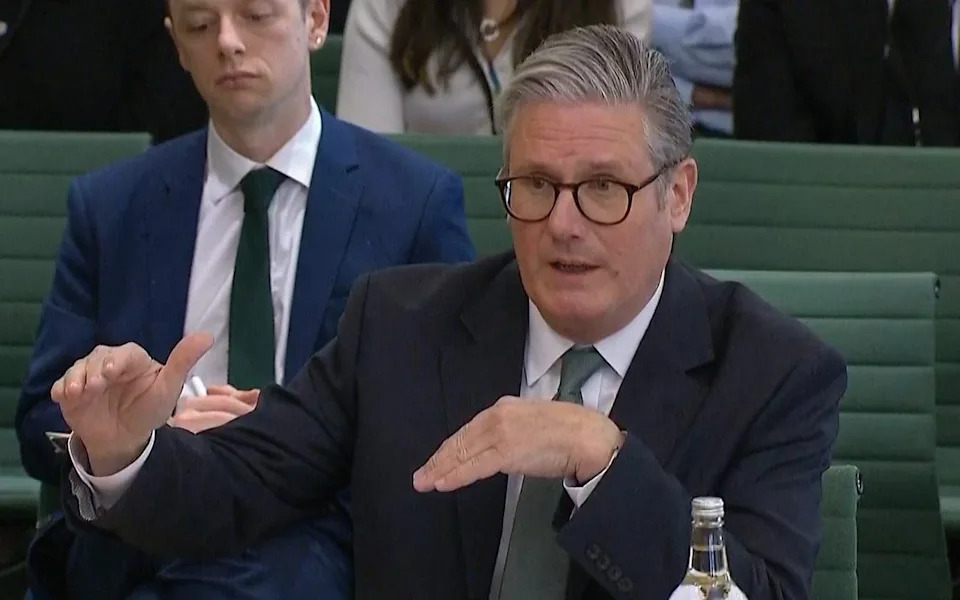

Starmer says UK needs digital tax despite pressure from Trump

Sir Keir Starmer has signalled he wants the UK to maintain a digital services tax, as reports suggest abolishing the levy are part of trade deal talks with the US.

The Prime Minister also suggested the Online Safety Act was important for “dealing with paedophiles” in light of criticism from the US about its impact on free speech.

Sir Keir told the Commons liaison committee that AI and other technology companies were “very powerful”.

He added: “In relation to trade talks, obviously there are questions about the appropriate way to tax digital services, etc. There are questions about how technology impacts with free speech.

“I’ve been very clear in my view that we need to have arrangements for a digital tax of some sort, and equally we need to be pioneers of free speech, which we have been for very many years in this country.

“But at the same time, we rightly protect under the Online Safety Act - further provisions of which are coming into force pretty quickly - and when it comes to dealing with paedophiles and protecting children, I take a pretty strong line that we take the necessary measures in order to do so.”

04:04 PM BST

Investment banks slash forecasts for economic growth

Investment banks and wealth managers are slashing forecasts for economic growth around the world as Donald Trump doubles down on his trade war plans.

Morgan Stanley’s analysts have cut their projections for US growth almost in half, predicting GDP in the world’s largest economy will grow by just 0.8pc this year and 0.7pc next, down from previous forecasts of 1.5pc and 1.2pc.

Lombard Odier says there is a 50pc chance of recession in the US.

Citi’s economists say this will be combined with higher price rises: “We see a distinct risk that inflation could rise as high as 4pc. In tandem, we see plausible scenarios in which growth falls well below 1pc and perhaps to zero.”

The rest of the world will not be spared.

UBS expects the eurozone to fall into recession in the second half of the year, growing by 0.5pc across the year as a whole - down from the 0.9pc previously anticipated. GDP should rise by 0.8pc next year, down from an earlier forecast of 1.1pc. Eventually a recovery will come through in 2027, when GDP would rise 1.7pc, fuelled by German defence spending.

Economists at Julius Baer cut their projections for the US and eurozone, while Investec said US households are poorly placed to handle a tariff-induced rise in prices as savings are already “historically low” and those with investments in the stock market have seen their wealth hammered in the past week.

03:59 PM BST

Trump ‘disappointed’ in China

Donald Trump’s trade negotiator has said the Trump administration is ‘disappointed’ in China’s decision to retaliate.

Jamieson Greer, testifying before the Senate Finance Committee, said: “We are disappointed. The Chinese obviously have agency in this.

“It is not just a matter of US policy. We of course welcome and we hope that foreign countries will change their practices to make sure they are fair.”

Mr Greer said the administration was favouring negotiating with countries open to compromise.

He said: “We are trying to remedy a situation which has persisted for many years. It would be wonderful if the Chinese agreed with that and wanted to work with us on that but that is not where they are, the President has recognised this and he wants to focus on other partners.”

03:55 PM BST

Starmer says US tariffs ‘very challenging’

Sir Keir Starmer’s second appearance in front of the Liaison Committee is now underway.

Dame Meg Hillier, the Labour chair of the committee, asked Sir Keir if he could revisit the Government’s economic plans in the wake of Donald Trump’s trade war.

The Prime Minister said it was an “obviously very challenging” situation and he was “very disappointed to see tariffs in place”.

“I don’t think they are good for our economy or economies around the world,” he said.

Read our live blog of Sir Keir’s appearance here.

03:53 PM BST

China hasn’t shown it wants a level playing field, Trump negotiator says

Jamieson Greer, Donald Trump’s trade negotiator, has said that China has given no indication that it wants to work towards a level playing field on trade.

Mr Greer told lawmakers on the Senate finance committee: “Unfortunately, China for many years seems to be choosing its own path on market access.

“They elected to announce retaliation, other countries did not. Other countries have signalled that they’d like to find a path toward reciprocity. China has not said that and we will see where that goes.”

03:49 PM BST

Hong Kong leader condemns tariff ‘bullying’

John Lee, the chief executive of Hong Kong, has described Donald Trump’s tariffs as “bullying”, warning such “ruthless behaviour” would damage global trade.

Bloomberg reported that Mr Lee pledged to approach China for opportunities, sign more free trade agreements with other economies and continue to push for Hong Kong’s accession to an Asia-Pacific free trade agreement.

He also vowed to attract inward investment and help Hong Kong companies cope with the effects of tariffs.

03:44 PM BST

Trump’s trade representative says tariffs ‘bearing fruit’

The top US trade official has defended Donald Trump’s sweeping tariffs on nearly every other nation

Jamieson Greer’s appearance in Congress came with Republicans ringing alarm bells over Trump’s escalating trade war and Wall Street clamouring for clarity on the president’s plans.

The US trade representative argued that the strategy was “already bearing fruit.”

“Nearly 50 countries have approached me personally to discuss the president’s new policy and explore how to achieve reciprocity,” he told the Senate finance committee.

Several countries - including Argentina, Vietnam and Israel - had offered to reduce their tariffs, Mr Greer said, while auto manufacturers were cancelling redundancies and companies had announced $4 trillion (£3.1 trillion) in new investment in the United States.

Mr Greer told senators the country had shed five million manufacturing jobs and 90,000 factories in the last 30 years, since a trilateral free trade agreement with Mexico and Canada was enacted.

America’s “large and persistent trade deficit” will not be resolved overnight, he cautioned.

“But all of this is in the right direction,” he told senators.

“We must move away from an economy based solely on the financial sector and government spending, and we must become an economy based on producing real goods and services,” Mr Greer added.

Senior Republican lawmakers have pledged to allow Trump time to see how his tariff gambit plays out, but are desperate to see progress on trade negotiations they believe will calm markets.

03:40 PM BST

Hungary hopes Trump the dealmaker will end tariff war

Hungary hopes that the US and China will end their tariff war with a free trade agreement.

Péter Szijjártó, Hungary’s foreign minister, said the US and China were his country’s two most important investing communities outside of the EU.

“I’m still hopeful, because we know President Trump as a dealmaker,” he said at the Royal United Services Institute think tank in London.

“If we remind ourselves of his first term, he was almost successful in making a big trade deal with China, and I do hope that this time, the word almost will disappear.”

He said that would be a “good deal” for Hungary and for the world economy.

03:35 PM BST

India should stand with China to combat America’s ‘abuse of tariffs’, says Chinese spokesman

India and China should stand together to overcome America’s “abuse of tariffs”, the spokesman of the Chinese Embassy in India has said.

“China-India economic and trade relationship is based on complimentarity and mutual benefit. Facing the US abuse of tariffs... the two largest developing countries should stand together to overcome the difficulties,” Yu Jing said in a post on X.

03:28 PM BST

Musk slams senior Trump trade adviser as a ‘moron’

Elon Musk has described Peter Navarro, a senior White House trade adviser, as “truly a moron” and “dumber than a sack of bricks” in a growing rift over Donald Trump’s tariff policy.

Mr Musk, a key aide to the president, has signalled opposition to the tariffs. The Tesla chief hit out after Navarro described him as “not a car manufacturer” but “a car assembler.”

03:16 PM BST

Wall Street fear gauge retreats after hitting highest level in years

Wall Street’s “fear gauge” - the Vix - has retreated 19.9pc today, a day after hitting a recent high.

The level yesterday has only been beaten in the past 20 years by the financial crisis in 2008 and Covid in 2020.

Lukman Otunuga, senior market analyst at FXTM, said: “While today’s market bounce offers some relief, trade tensions remain the elephant in the room.

“With Trump threatening a further 50pc tariff on China and Beijing refusing to back down, sentiment could turn quickly.”

03:08 PM BST

US prioritising allies, not China, in trade talks, says Trump adviser

US trade negotiators are prioritising allies as they move forward on trade, White House economic adviser Kevin Hassett has said.

“The president will decide when and if to talk with China, but right now, we’ve received the instruction to prioritise our allies and our trading partners like Japan and Korea and others,” Mr Hassett said in an interview with Fox News.

03:05 PM BST

Stocks rise as ‘bargain hunters step in’

Stocks are rising this afternoon as buyers looking to snap up cheap stocks make trades.

Colin Cieszynski, at SIA Wealth Management, told Bloomberg: “The initial shock phase following President Trump’s tariff announcement appears to have run its course.

“First reaction on Thursday, panic on Friday, stabilisation yesterday and today the bargain hunters appear to be stepping in and short sellers covering. This is a relatively common pattern following external shocks to the system.”

The FTSE 100 is up 3.6pc. On Wall Street, the S&P 50 has surged 3.7pc and the Nasdaq by 4.2pc. Meanwhile, the Dow Jones Industrial Average of 30 leading US companies has risen 3.6pc.

02:54 PM BST

Farage ‘wouldn’t eat chlorinated chicken’ under UK-US trade deal

Nigel Farage has signalled he would not eat chicken washed with chlorine if it was imported from the US into Britain as a result of a future trade deal.

Asked during a visit to County Durham, if he would eat chlorinated chicken, the Reform UK leader told reporters: “I have got a confession to make: I eat chlorinated salad - I bought a bag last week from a major leading supermarket.

“Every single bag of salad you buy in Britain is chlorine-treated.

“Do I like the sound of chlorinated chicken? No, not very much, but do you know what the most important thing with all of this is?

“If we want to free the whole thing up, provided food is labelled properly, consumers can make their own decisions.

“Frankly, we wouldn’t be buying much chlorinated chicken because the cost of it being produced in America and being shipped here means it wouldn’t be competitive anyway.”

02:48 PM BST

Magnificent Seven stocks all rise

The so-called Magnificent Seven group of companies that have powered gains on Wall Street in recent years were all up at the start of trading.

02:36 PM BST

US stocks surge as Trump says China deal ‘will happen’

Wall Street stock markets surged higher after Donald Trump said a deal between the US and China “will happen” over tariffs.

The Dow Jones Industrial Average jumped 3.2pc to 39,167.01 while the benchmark S&P 500 rose 3.2pc to 5,225.40 a day after it looked on course to enter a bear market.

The tech-heavy Nasdaq Composite rocketed 3.6pc to 16,161.15.

02:31 PM BST

Trump ‘waiting for China to call’ on tariff negotiations

Donald Trump said he was waiting for a call from China as its leaders “badly” want to agree a deal with the US on tariffs.

The US president said a deal with Beijing “will happen” despite the two countries trading tariff threats in recent days.

Mr Trump wrote on his Truth Social platform: “China also wants to make a deal, badly, but they don’t know how to get it started. We are waiting for their call. It will happen!”

02:28 PM BST

Trump close to ‘great deal’ with South Korea on tariffs

Donald Trump said there was the “probability of a great deal” with South Korea over tariffs after a call with the country’s acting president.

The US president said the two leaders spoke about the Asian country’s “tremendous and unsustainable surplus” as well as tariffs, shipbuilding, US natural gas purchase and military protection.

Mr Trump wrote on his Truth Social platform: Their top team is on a plane heading to the US, and things are looking good.

“We are likewise dealing with many other countries, all of whom want to make a deal with the United States.”

02:23 PM BST

European stocks rebound after worst drop since pandemic

European stocks rebounded as Scott Bessent signalled that negotiations would soon commence on easing Donald Trump’s “liberation day” tariffs.

The pan-European Stoxx 600 index was up more than 3.5pc, while the Cac 40 in Paris rose 2.9pc.

The Dax in Frankfurt gained 2.6pc.

02:14 PM BST

Trump is listening to Starmer, insists No 10

Sir Keir Starmer has the ear of Donald Trump, Downing Street has insisted.

Asked if he believed Mr Trump was “listening to” Sir Keir, the Prime Minister’s official spokesman replied: “Of course, and we’ve had really good dialogue with the US ever since President Trump came to office.

“And the Prime Minister visited the White House where they kicked off the discussions on an economic deal and as we said last week those discussions are at an advanced stage.

“But we’re also working with the US on a wide range of issues, not just on trade and investment, but security, defense, Russia-Ukraine, where we’ve had very good engagement and continue to do so.”

Downing Street went on to confirm Sir Keir and Mr Trump have not spoken since tariffs were introduced.

02:04 PM BST

China stocks jump as Xi urges spending spree

China’s stock market bounced back from a historic sell-off on Monday as Xi Jinping urged its people to ramp up spending.

The Hang Seng in Hong Kong closed 1.5pc higher after beginning the week with its worst day since 1997.

The onshore CSI 300 index, which had dropped more than 7pc on Monday, ended 1.7pc higher.

Chinese president Xi called on the nation to “fully unleash” consumption in a bid to offset the damage of tariffs, state-run broadcaster China Central Television reported on Monday.

In response, companies announced a flurry of share buybacks totalling at least $4.1bn (£3.2bn) and a loyal ensemble of eight exchange-traded funds recorded $14.3bn of turnover today.

China also vowed to “fight to the end” after Donald Trump threatened the world’s second largest economy with a further 50pc of tariffs.

Peter Kim of KB Securities Co said: “As far as US and China goes, we are well and truly into the game of chicken.

“Trump has made his move and China has retaliated rather than choosing the path of compromise and it’s now up to which country is going to blink first. That’s very dangerous.”

Regulators also pledged to lift the limit for insurance companies’ equity investments, allowing them to buy more shares, while the central bank eased its grip on the currency.

Charlie Robertson of FIM Partners said: “The biggest next round of risk comes from Chinese currency devaluation.”

Mr Robertson noted that China could resort to a currency devaluation which would make its exports more competitive in the global market but bring about a wider weakness in emerging markets.

01:49 PM BST

Stocks surge as Trump official hints at tariff deals

Stock markets surged higher after Donald Trump’s top official suggested countries were getting in touch with the White House seeking deals on tariffs.

The FTSE 100 and share indexes across Europe were up more than 2pc after US treasury secretary Scott Bessent said “some very large countries with large trade deficits” would “come forward very quickly”.

Wall Street was also on track to surge higher as Mr Bessent, a former hedge fund tycoon, said he had seen the “substantial” call list at the White House.

He told CNBC: “We were having a discussion last night about which countries to prioritise and I think you are going to see some very large countries with large trade deficits come forward very quickly.

“If they come to the table with solid proposals, I think we can end up with some good deals.”

01:28 PM BST

Consumer confidence dropped even before tariff blow

Consumer confidence was already falling in Britain before Donald Trump’s “liberation day” tariffs, according to YouGov and the Centre for Economics and Business Research.

The outlook for household finances fell in March at the steepest pace since July 2023, according to the monthly survey, indicating a deepening sense of gloom for the future.

It shows the economy was already in a vulnerable position amid Rachel Reeves’s record-breaking tax rises, with sentiment likely to have been hammered further by the US President’s war on trade.

“March’s fall in confidence highlights that consumers are still in a precarious position, particularly when it comes to household finances,” said Sam Miley at CEBR.

“Looking ahead, even more negativity is expected on these metrics, with April bringing a number of increases to household bills that will push up inflation sharply. The business activity metrics may also face some pressure in the coming months. The UK’s current economic growth is weak as it is and the recent announcement of tariffs from the Trump administration presents a further downside risk.”

It comes after the economy shrank 0.1pc in January, according to the Office for National Statistics, with economists chopping back their forecasts for this year’s growth amid the chaos of the trade war.

01:14 PM BST

Ministers to ‘look carefully’ at impact of EU retaliation on Northern Ireland

The Government is preparing for the European Union’s response to Donald Trump’s tariffs as it examines how the trade war could impact Northern Ireland, Hilary Benn has said.

The Northern Ireland Secretary said he would look at the impact of new retaliatory tariffs by Brussels if they arrived, and how new levies would effect businesses importing goods from the US.

Under the Windsor Framework agreed by Rishi Sunak, EU tariffs would apply in this situation.

Mr Benn said: “Because of the Windsor Framework, businesses can reclaim any such tariff through the existing duty reimbursement scheme in cases where US imports into Northern Ireland do not then enter the European Union.”

Northern Ireland has not been “not uniquely disadvantaged” by Mr Trump’s trade war, Mr Benn told the Commons.

The Northern Ireland Secretary said the nation’s exporters faced the same general 10pc tariff on exports to US and 25 tariffs on steel and aluminium as other regions of the UK.

Later Downing Street said the Government would “look carefully” at the impact any retaliatory tariffs the EU launches against the United States.

Asked about their impact on Northern Ireland, the Prime Minister’s official spokesman told reporters: “As things stand, Northern Ireland exporters will be impacted in the same way as any other exporters in the UK, but we will need to look carefully, as you say, at the details of any retaliatory tariffs announced by the EU, any impact these might have on businesses.”

Asked if Sir Keir Starmer believed US President Donald Trump was listening to his calls for open trade between the UK and America, the spokesman said: “Of course, and we’ve had very good dialogue with the US ever since President Trump came to office.”

01:03 PM BST

Trump tariffs have left Reeves ‘out of room’ on public finances, say Tories

The Chancellor is “out of room” on fiscal targets as a result of tariffs, the Tory shadow treasury minister has said.

Richard Fuller told MPs: “Two weeks ago, the Spring Statement rushed through changes to disability benefits, or ‘pocket money’ to the chief secretary (Darren Jones), to help plug the £14bn gap in public finances created by the first Labour budget.

“Now we are already in the OBR (Office for Budget Responsibility) scenario two on tariffs, and the Chancellor is once again forecast to be out of room on her fiscal targets.

“Therefore, how does she plan to ask the chief secretary to update departmental budgets in his multi-year spending review to avoid punishing businesses and people once again with further taxes?”

Rachel Reeves replied: “I think (Mr Fuller) is somewhat jumping the gun. We delivered the Spring Statement just two weeks ago and we were able to restore the fiscal headroom in that after the change in global bond yields.

“We will set out the Budget in the autumn, moving to one fiscal event a year – very, very different from the multiple budgets we had from the previous government – but we have set the spending totals for the spending review, and we’ll be setting out the departmental allocations on June 11.”

01:00 PM BST

Collaborate with other nations hit by Trump tariffs, says Badenoch

Kemi Badenoch has urged the Prime Minister to collaborate with other countries that are “feeling the brunt” of US tariffs.

“What the Prime Minister needs to do that is tough, is work with other countries where we have trade agreements, collaborating with them - whether it’s the EU, the Trans-Pacific Partnership which has got Japan and Mexico, all these countries are feeling the brunt of tariffs,” the Tory leader said.

“We should work with them to lower tariffs but the most important thing that he should do is get on with a UK-US trade deal.”

She added: “What I’m asking the Prime Minister to do is pick up where we left off and make sure that we get meaningful gains for both our economies, not just get us to where we were last week before the tariffs came in.”

12:52 PM BST

FTSE 100 bounces back from Trump tariff sell-off

The FTSE 100 has surged higher as traders spied potential to “buy the dip” ahead of US markets opening.

The UK’s flagship stock index rallied as much as 2.2pc with defence stocks leading the charge on the back of the index’s biggest three-session drop since March 2020.

Rolls-Royce, BAE Systems and Babcock International rose as much as 6.5pc, 6.1pc and 5.9pc respectively, as investors sought respite from the tariff-induced sell-off.

Banks with the most exposure to Asia dipped further after Donald Trump threatened China with a further 50pc levy.

HSBC slumped as far as 1.8pc, taking its five day losses past 17pc, while Standard Chartered added another 2.2pc drop.

Investors may have precious little time to bask in the recovery as the simmering trade war between China and the US appeared once again on the verge of further escalation.

Arthur Kroeber of Hong Kong-based Gavekal said: “China cannot inflict as much pain on the US as it receives, since it runs the big trade surplus and, rare earths aside, still has more to lose from export controls.

“But that is now beside the point. The signal from Beijing’s move is that it will push back on US efforts at domination, and that it is perfectly happy to settle into a war of economic attrition.”

12:41 PM BST

China escalation was ‘big mistake’ says top Trump official

The US treasury secretary said China had made a “big mistake” by threatening to “escalate” Donald Trump’s trade war.

Scott Bessent said Beijing had a “losing hand” as it exports more to the US than vice versa.

China said it would “fight to the end” against Mr Trump’s tariffs, after the President said he would hit the country with an additional 50pc of levies after Beijing said it would impose 34pc retaliatory tariffs on US goods.

Mr Bessent insisted the move was “bad for China”. He said that tariff negotiations had led to multiple calls from other countries.

“Everything is on the table”, Mr Bessent said in an interview with CNBC.

He added that President Donald Trump will be personally involved in negotiations.

12:22 PM BST

Reeves to meet Bessent ‘shortly’ amid tariff crisis

Chancellor Rachel Reeves said she would be meeting US treasury secretary Scott Bessent “shortly” as Donald Trump’s tariffs upend the global economic order.

She told MPs in the Commons: “Discussions are ongoing across a range of Government departments, including the Treasury, with the United States, and I will be meeting US treasury secretary Scott Bessent shortly.

“Beyond tariffs, of course we are discussing a range of different areas but the focus is on reducing tariff and non-tariff barriers to trade, with a particular focus on those sectors that are subject to the higher tariffs, because although the 10pc tariffs are lower than many other countries around the world - and we welcome that - the additional tariffs on cars, on steel, and potentially on life sciences pose a real challenge to our country because those are some of our biggest export markets.”

The Chancellor said that in those sectors, the Government “will continue to take the action that is necessary, working in partnership with business and also with trade unions to make sure that we are addressing those issues”.

She added: “In my time as shadow chancellor, those moments when we can work constructively in the national interest, whether that was in the response to Covid or indeed in supporting Ukraine against the aggression of Russia, it is when this House is at its best when we work together in the national interest.”

Conservative shadow chancellor Mel Stride had earlier asked what sectors beyond cars and life sciences are being considered for potential Government support, and called for “further details of the US negotiations”.

12:11 PM BST

Pound rises as Chancellor insists fiscal rules ‘non-negotiable’

The value of the pound edged higher after Rachel Reeves insisted the turmoil caused by Donald Trump’s trade war would not encourage her to amend her fiscal rules.

Sterling was up 0.3pc against the dollar to $1.276 and remained 0.1pc higher vesus the euro, which is worth 85.7p.

12:04 PM BST

Reeves rejects plea for ‘Buy British’ campaign

The Chancellor rejected a request from the Lib Dems to back a “Buy British” campaign in response to Mr Trump’s “America First” rhetoric.

“In terms of buying British, I think everyone will make their own decisions,” Ms Reeves said.

“What we don’t want to see is a trade war with Britain becoming inward-looking, because if every country in the world decided they only wanted to buy things produced in their country, that is not a good way forward.

“Our country has benefitted hugely from access to global markets and we want to continue to be able to do that because that is in our national interest, for working people and businesses in our country.”

12:01 PM BST

Reeves ‘won’t make mistake’ of losing control of public finances during tariff crisis

The Chancellor insisted stability was “sacrosanct” for the Government as she said Donald Trump’s trade war would not lead to her relaxing her fiscal rules.

Rachel Reeves was asked by Treasury select committee chairman Dame Meg Hillier if the she would consider changing any of her rules in the way that the Government stepped in during the global financial crisis and the pandemic.

The Chancellor told MPs: “I think it is incredibly important to maintain cool heads at this moment. Tariffs have been imposed and we are working closely with our friends and counterparts from the United States to reduce the impact of those not just in the UK but around the world as well.

“At the same time, we are looking to secure better trading relationships with some of our biggest trading partners around the world.

“Of course, as we did yesterday, we are looking at some of the sectoral responses on life sciences, on automotives, on steel as well.

“But the fiscal rules are very important for giving our country the stability it needs.

“We saw what happened when a previous government lost control of the public finances. It resulted in interest rates going through the roof, meaning higher costs for businesses and for working families.

“We won’t make those mistakes. That’s why the fiscal rules are non-negotiable and stability for this government is sacrosanct.”

11:53 AM BST

Reeves: Labour’s fiscal rules are non-negotiable

Rachel Reeves has repeated Labour’s fiscal rules are “non-negotiable” despite growing global financial instability.

Economists have warned the Chancellor’s £10bn of economic room for manoeuvre could be wiped out by Donald Trump’s trade war.

But Ms Reeves made clear the rules - to have debt falling as a share of the economy and to have day-to-day spending covered by revenue within five years - will be retained.

She told the House of Commons: “This Government is clear-eyed that our response to global change cannot be to watch and wait but instead to act decisively, to take the right decisions that are in our national interest, protecting working people.

“All of the decisions that we make as a Government will be underpinned by the stability of our non-negotiable fiscal rules.

“A trade war is in nobody’s interest. It is why we must remain pragmatic, cool-headed and pursue the best deal with the United States that is in our national interest.

“This remains our priority and that was part of the discussion that I had with US treasury secretary Scott Bessent last week. We have been clear nothing is off the table.”

11:43 AM BST

Reeves holds talks with Bailey about state of markets

Rachel Reeves has held talks with Andrew Bailey about the state of the financial markets, with the Governor of the Bank of England telling the Chancellor that the banking system is “resilient”.

The Chancellor told MPs that Mr Bailey had also reassured her that “markets are functioning effectively”.

She spoke as the FTSE 100 climbed 1.6pc after a three-day drop of more than 10pc since the US announced its latest global tariffs.

Addressing the House of Commons, Ms Reeves said: “The United States’ decision to impose tariffs has had and will continue to have huge implications for the world economy.

“These implications have been reflected in the reaction that we have seen in global markets in recent days which the financial authorities have of course been monitoring closely.

“This morning I spoke to the Governor of the Bank of England who has confirmed that markets are functioning effectively and that our banking system is resilient.

“I know too that this is an anxious time for families who are worried about the cost of living. We have your backs. And British businesses who are worried about what a changing world will mean for them, we have your backs too.”

11:41 AM BST

Reeves tells families and businesses ‘we’ve got your backs’ in trade war

Rachel Reeves said Donald Trump’s trade war was “in nobody’s interest” and reassured families and businesses “we have your backs”.

The Chancellor said the US decision to impose tariffs “had and will continue to have huge implications for the world economy”.

Speaking in the Commons for Treasury questions, she said she had met with Bank of England governor Andrew Bailey who had confirmed markets were “functioning effectively and our banking system is resilient”.

She said the Government’s decisions would be underpinned by the “stability of our non negotiable fiscal rules”.

She added ministers next move “cannot be to watch and wait but instead to act decisively”.

11:35 AM BST

Telegraph readers: Trump wants zero imports to US

Donald Trump’s trade war will have “no winners” and the US will “never be viewed in the same light”, Telegraph readers have said.

Here is a selection of views on US tariffs from the comments section below, and you can join the debate here :

11:14 AM BST

Pound rises as economists say Britain ‘may become more attractive’ in trade war

The value of the pound edged higher as economists debated whether Britain could be a beneficiary from Donald Trump’s trade war.

Sterling gained 0.2pc against the dollar to $1.275 following a slide of about 1.4pc since the US president announced his “liberation day” tariff plans.

The pound rose 0.1pc versus the euro, which is worth 85.7p.

RSM UK chief economist Tom Pugh said: “As markets absorb the latest shock, UK financial assets may become more attractive to international investors.

“The UK government also looks far less likely to rush into significant retaliation and faces lower tariffs than other major economies.”

Analysts at Monex said their long-term view “remains that UK fundamentals are better than markets currently price, now helped by tariff differentials, while the government will ultimately choose not to scrap their fiscal rules with the memory of Liz Truss still fresh in the mind”.

10:53 AM BST

Italy and Spain urge calm in EU response to tariffs

Italy and Spain’s finance ministers urged Brussels not to “press the panic button” as the European Union considers its response to Donald Trump’s tariffs.

Carlos Cuerpo, who also serves as the Spanish trade chief, said any escalation of trade tensions would be a “lose-lose”.

Meanwhile, Italian minister Giancarlo Giorgetti told a conference near Lake Como: “We should not press the panic button.

“We must try to keep a cool head, evaluate the impact, and avoid a policy of retaliatory tariffs which would just be damaging for all, and especially for us.”

10:43 AM BST

Oil steadies despite US-China threats

Oil edged higher after a three-day slump as calm began to return to global markets after Donald Trump’s tariff announcements.

Brent crude, the international benchmark, inched 0.2pc higher but remained close to four-year lows at just over $64 a barrel.

It has plunged about 15pc since the US president announced his “liberation day” tariffs. US-produced West Texas Intermediate was up 0.3pc towards $61.

Traders were unfazed by threats the stand-off between the US and China over tariffs.

Analysts at Saxo Bank said: “Commodities are staging a small comeback as global markets calmed down following a three-day sell-off that saw the Bloomberg Commodity Index slump by 8.3pc to an early January low, led by those suffering the biggest setbacks, including crude oil, copper and silver.”

10:24 AM BST

Britain could gain from trade war, says economist

Britain is “relatively well placed to weather the tariff shock” and could even make gains as a result of Donald Trump’s trade war, according to a top economist.

Andrew Wishart, senior UK economist at Berenberg, said he expects most of the US president’s tariffs “to be negotiated away” in the next three months, although this could still cause a global recession.

However, Britain could make gains against competitors hit harder by Mr Trump’s levies.

He said: “Some UK producers may gain US market share from worse-hit competitors, and international companies could relocate operations to the UK to avoid higher charges.

“Admittedly, the spillover from slower growth in economies worse affected by US tariffs will ensure that, in absolute terms, UK growth is weaker than it otherwise would have been.”

He added that while the Brexit referendum and Liz Truss’s “mini budget” had hurt the UK’s reputation among global investors, Britain’s welfare savings and fiscal rules would make it “begin to look like a relatively safe investment”.

He said: “Alongside reform of the planning system and stable corporate tax rates with generous capital investment allowances, that would begin to improve the UK’s reputation as a place to invest.”

10:05 AM BST

Von der Leyen pleads with China to avoid escalating Trump trade war

Ursula von der Leyen asked China not to escalate its trade war with Donald Trump after Beijing accused the US president of “blackmail” over tariffs.

The President of the European Commission called for a “negotiated resolution” as the world’s two largest economies raised the stakes in their trade conflict.

China has vowed to “fight to the end” after Mr Trump told Beijing to cancel its planned 34pc tariffs on US goods or face an additional 50pc levy.

Ms von der Leyen held a call with China premier Li Qiang today in which she “called for a negotiated resolution to the current situation, emphasising the need to avoid further escalation”.

She “stressed the responsibility of Europe and China, as two of the world’s largest markets, to support a strong reformed trading system, free, fair and founded on a level playing field”.

Both leaders discussed setting up a mechanism to track possible trade diversion caused by the tariffs, Ms von der Leyen’s office said, as the EU fears China will redirect cheap exports from the US to Europe.

09:51 AM BST

Netanyahu pledges to eliminate trade deficit with US

Israeli prime minister Benjamin Netanyahu assured Donald Trump that his government would erase its $7.4bn trade deficit with the US during a meeting with the US president at the White House on Monday.

“We will eliminate the trade deficit with the United States,” Mr Netanyahu said. “We intend to do it very quickly.”

Mr Trump had noted that in addition to the trade deficit, the US provides Israel nearly $4 billion in assistance per year — much of it in military aid.

The US president could also push Israel to end its war in Gaza in return for easing its 17pc tariffs .

Asked if he might be willing to reduce Israel’s tariff rate, Mr Trump replied: “Maybe not, maybe not. Don’t forget we help Israel a lot.”

09:36 AM BST

NHS ‘not for sale’ during US trade talks, says Health Secretary

The Health Secretary said the NHS is not part of trade negotiations with the US and Donald Trump’s tariff regime will cause “real pain” for the British economy.

Wes Streeting was asked on ITV’s Good Morning Britain if access to the NHS for American pharmaceutical firms could be part of talks on a free trade deal.

He said: “Well, our NHS is not for sale. We’ve always been clear about that, and it won’t surprise you to know that a Labour Government feels that particularly strongly.

“What we do want to do is make sure that, despite being at the best end of president Trump’s tariff regime at the moment, we know that’s going to still come at real pain for British industry and cost the British economy.

“We want an economic partnership agreement, and we are working as fast as we can to see if we can secure that outcome for our country.”

Mr Streeting told BBC Breakfast that “the NHS is not for sale and our patients’ data is not for sale”.

09:20 AM BST

Musk urged Trump to reverse tariffs

Elon Musk urged Donald Trump over the weekend to reverse his tariffs as the US president’s trade war sent stock markets plummeting, it has been reported.

The Tesla chief executive made direct but unsuccessful appeals to the President after he imposed his “liberation day” levies, according to the Washington Post .

Mr Musk, who has been leading cuts to federal spending in his role as a Trump adviser, called for zero tariffs between the US and Europe during a virtual appearance at a meeting of Italy’s right-wing, co-ruling League Party in Florence over the weekend.

He had earlier said that Tesla would face a “significant” impact from Mr Trump’s tariffs.

Tesla’s suffered its biggest drop in sales for more than a decade at the start of this year as the electric carmaker reeled from a political backlash against Mr Musk over his close association to the US president.

08:57 AM BST

Government borrowing costs fall again despite concerns over US

The cost of government borrowing in Europe fell further despite a sharp spike in US debt costs on Monday over fears for the American economy.

The yield on 10-year UK gilts - a benchmark for the cost of new sovereign debt - has fallen five basis points today to 4.56pc after a jump on Monday.

It came as US Treasury yields surged on Monday, with the 30-year yield rising at the fastest pace since the first Covid lockdown. It pushed up government borrowing costs around the world.

Deutsche Bank analyst Jim Reid said: “That marked a big shift with recent sessions, when investors had moved into sovereign bonds amidst the risk-off move, and it spoke to broader concerns about the safety of US assets and their capacity to act as a haven in times of market stress.”

Kathleen Brooks, research director at XTB, added: “During periods of stress, we expect to see the bond market rally, this was not the case.

“The surge in 10-year yields was a reaction to the overall market stress, which triggered concerns about fiscal stability.

“Yields are stable so far on Tuesday, which suggests that the bond market vigilantes are not targeting markets right now.”

08:40 AM BST

Streeting: No one knows where Trump trade war will end up

No one knows where Donald Trump’s trade war could lead to, Wes Streeting has said.

But the Health Secretary insisted the Government was not “in a council of despair” and remained committed to reversing the UK’s decline.

Asked where he believed the tariff row would end up, he told the BBC Radio 4 Today programme: “Well, I think the blunt truth of it at the moment is it is uncertain and that is why this Government under the Prime Minister’s leadership has been doing everything we can to make sure we protect British industry, British jobs, British interests against an extremely turbulent backdrop.”