3 Reasons PNTG is Risky and 1 Stock to Buy Instead

The Pennant Group has gotten torched over the last six months - since October 2024, its stock price has dropped 28.3% to $24.33 per share. This might have investors contemplating their next move.

Is now the time to buy The Pennant Group, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Even though the stock has become cheaper, we don't have much confidence in The Pennant Group. Here are three reasons why there are better opportunities than PNTG and a stock we'd rather own.

Why Is The Pennant Group Not Exciting?

Spun off from The Ensign Group in 2019 to focus on non-skilled nursing healthcare services, Pennant Group (NASDAQ:PNTG) operates home health, hospice, and senior living facilities across 13 western and midwestern states, serving patients of all ages including seniors.

1. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $695.2 million in revenue over the past 12 months, The Pennant Group is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

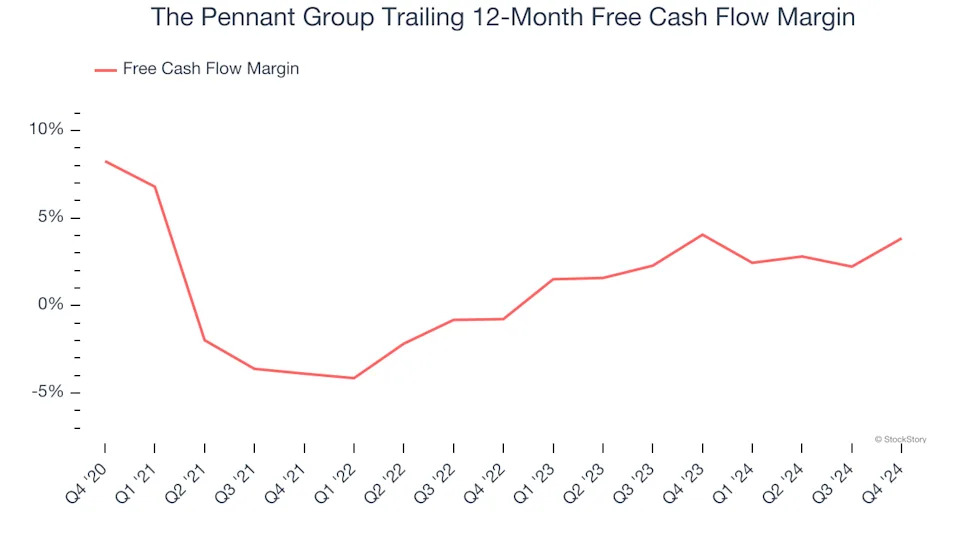

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, The Pennant Group’s margin dropped by 4.4 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. The Pennant Group’s free cash flow margin for the trailing 12 months was 3.8%.

3. Previous Growth Initiatives Haven’t Impressed

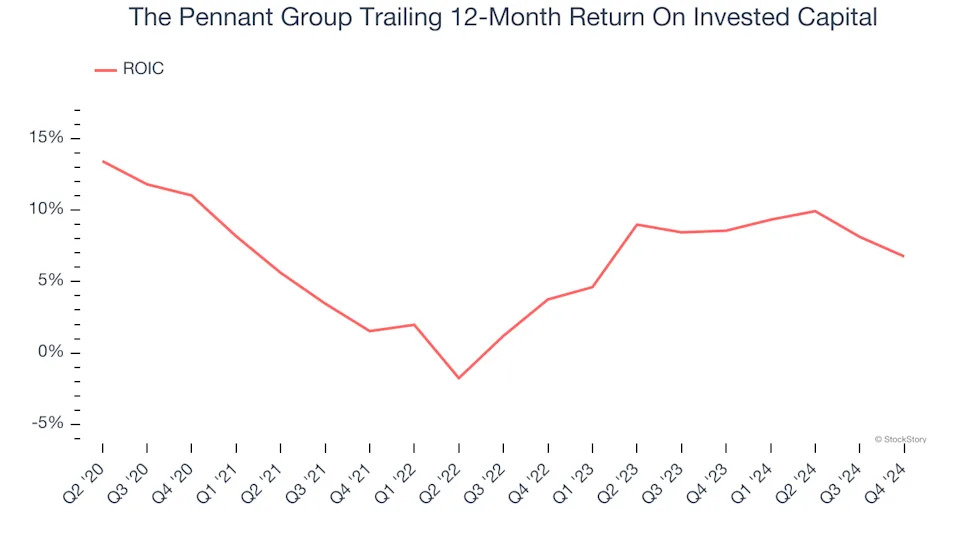

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

The Pennant Group historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.3%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.