Spotting Winners: Roku (NASDAQ:ROKU) And Consumer Subscription Stocks In Q4

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Roku (NASDAQ:ROKU) and the rest of the consumer subscription stocks fared in Q4.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 34.2% since the latest earnings results.

Roku (NASDAQ:ROKU)

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

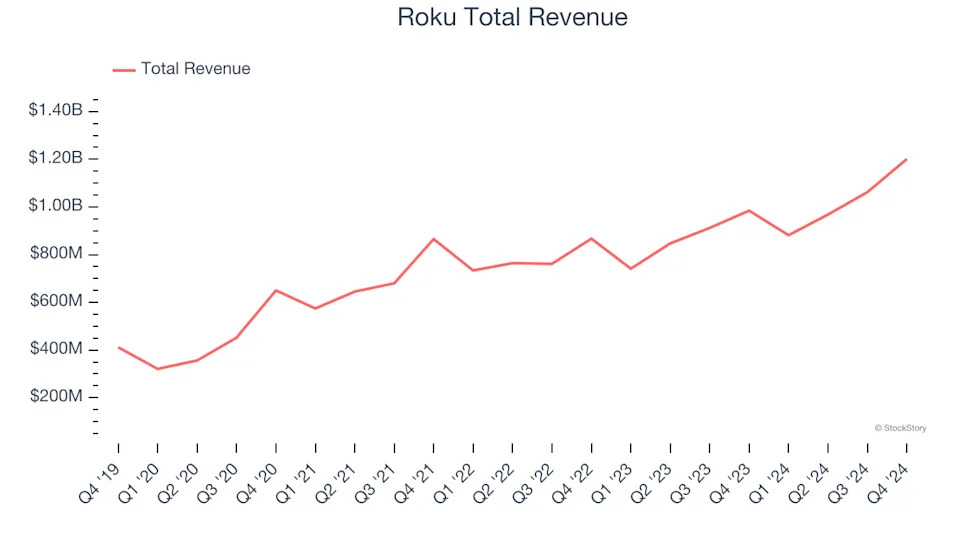

Roku reported revenues of $1.20 billion, up 22% year on year. This print exceeded analysts’ expectations by 4.4%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

Roku achieved the biggest analyst estimates beat of the whole group. The company reported 89.8 million monthly active users, up 12.3% year on year. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 36.6% since reporting and currently trades at $55.12.

Is now the time to buy Roku? Access our full analysis of the earnings results here, it’s free .

Best Q4: Udemy (NASDAQ:UDMY)

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ:UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

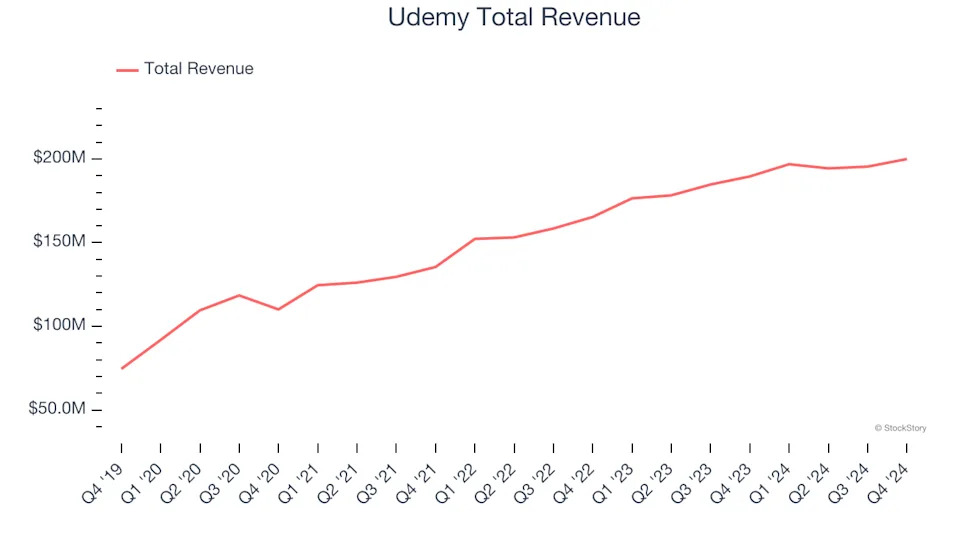

Udemy reported revenues of $199.9 million, up 5.5% year on year, outperforming analysts’ expectations by 2.7%. The business had a strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

The stock is down 26.3% since reporting. It currently trades at $5.76.

Is now the time to buy Udemy? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Match Group (NASDAQ:MTCH)

Originally started as a dial-up service before widespread internet adoption, Match (NASDAQ:MTCH) was an early innovator in online dating and today has a portfolio of apps including Tinder, Hinge, Archer, and OkCupid.