Industrial Distributors Stocks Q4 Teardown: Beacon Roofing Supply (NASDAQ:BECN) Vs The Rest

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the industrial distributors industry, including Beacon Roofing Supply (NASDAQ:BECN) and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Distributors that boast a reliable selection of products–everything from hardhats and fasteners for jet engines to ceiling systems–and quickly deliver goods to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to better interact with customers. Additionally, distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 28 industrial distributors stocks we track reported a mixed Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18% since the latest earnings results.

Beacon Roofing Supply (NASDAQ:BECN)

Established in 1928, Beacon Roofing Supply (NASDAQ:BECN) distributes residential and commercial roofing materials and complementary building products.

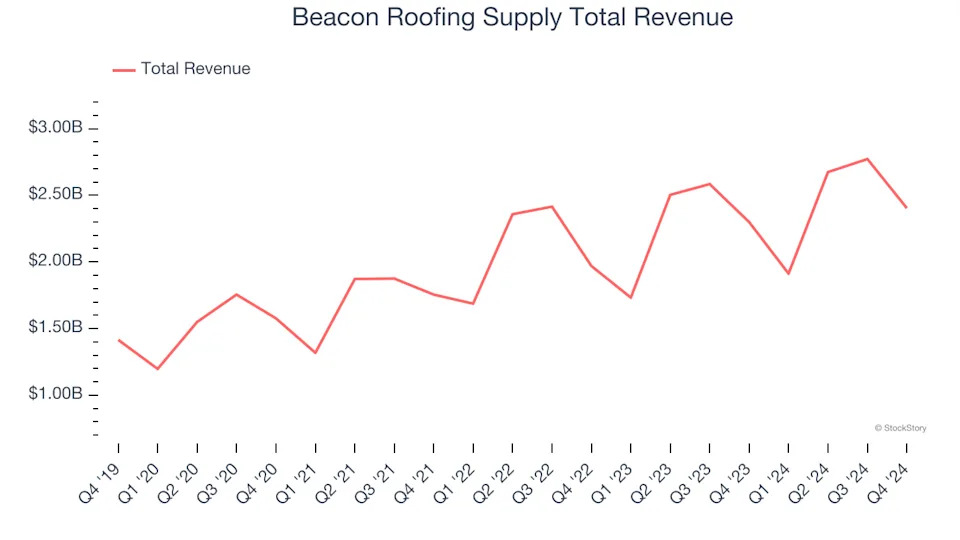

Beacon Roofing Supply reported revenues of $2.40 billion, up 4.5% year on year. This print fell short of analysts’ expectations by 1.1%. Overall, it was a slower quarter for the company with a significant miss of analysts’ adjusted operating income estimates and a miss of analysts’ EBITDA estimates.

“Despite the challenging economic environment in 2024, we delivered record fourth quarter and full year sales and our highest fourth quarter Adjusted EBITDA in history,” said Julian Francis, Beacon’s President & CEO.

The stock is up 5.6% since reporting and currently trades at $122.54.

Read our full report on Beacon Roofing Supply here, it’s free .

Best Q4: DistributionNOW (NYSE:DNOW)

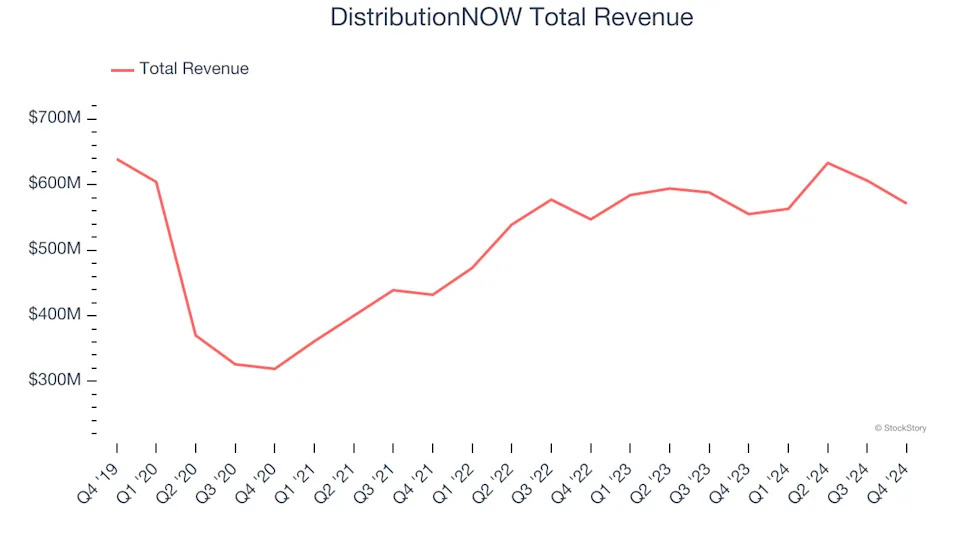

Spun off from National Oilwell Varco, DistributionNOW (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

DistributionNOW reported revenues of $571 million, up 2.9% year on year, outperforming analysts’ expectations by 3.4%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 2.6% since reporting. It currently trades at $13.77.