3 Reasons RDW is Risky and 1 Stock to Buy Instead

In a sliding market, Redwire has defied the odds, trading up to $7.93 per share. Its 5% gain since October 2024 has outpaced the S&P 500’s 13.8% drop. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Redwire, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

We’re glad investors have benefited from the price increase, but we're cautious about Redwire. Here are three reasons why you should be careful with RDW and a stock we'd rather own.

Why Is Redwire Not Exciting?

Based in Jacksonville, Florida, Redwire (NYSE:RDW) is a provider of systems and components used in space infrastructure.

1. EPS Trending Down

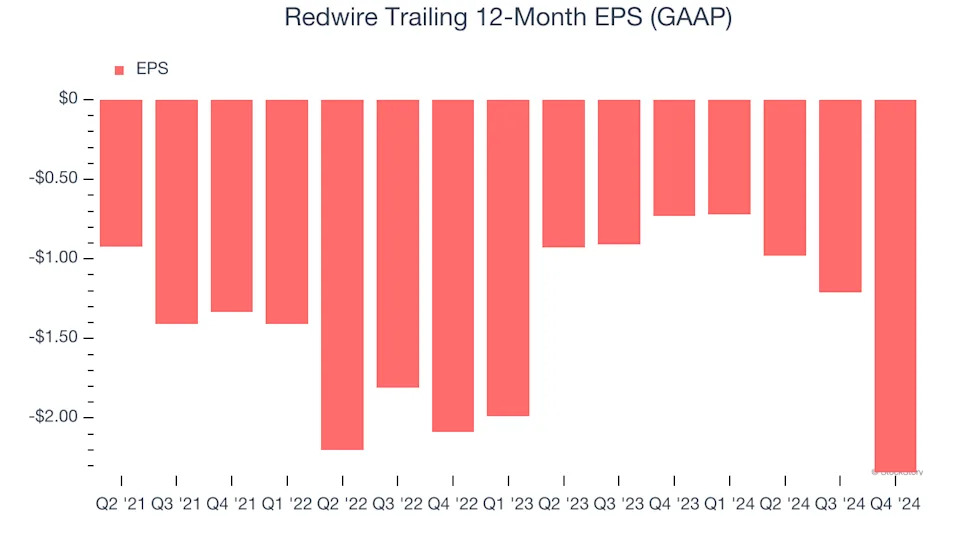

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Redwire’s earnings losses deepened over the last four years as its EPS dropped 57% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Redwire’s low margin of safety could leave its stock price susceptible to large downswings.

2. Cash Burn Ignites Concerns

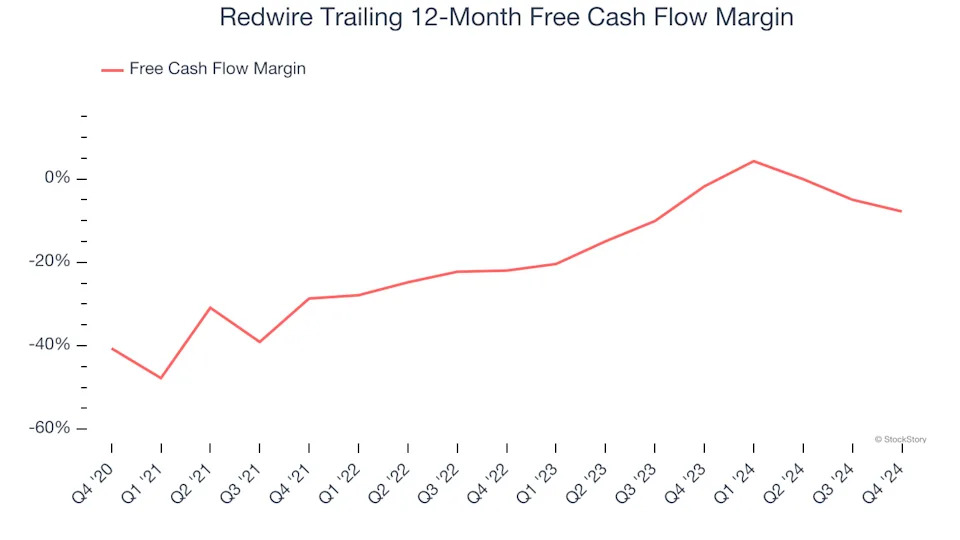

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Redwire posted positive free cash flow this quarter, the broader story hasn’t been so clean. Redwire’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 13.6%, meaning it lit $13.58 of cash on fire for every $100 in revenue.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

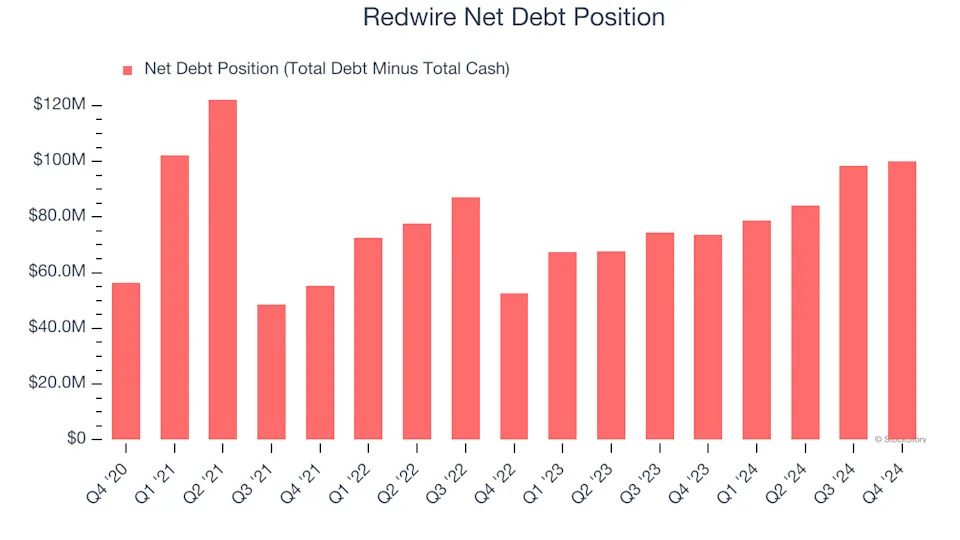

Redwire burned through $23.75 million of cash over the last year, and its $149 million of debt exceeds the $49.07 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.