3 Reasons FDP is Risky and 1 Stock to Buy Instead

Fresh Del Monte Produce has been treading water for the past six months, recording a small return of 0.8% while holding steady at $29.11. However, the stock is beating the S&P 500’s 13.6% decline during that period.

Is there a buying opportunity in Fresh Del Monte Produce, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Despite the relative momentum, we're cautious about Fresh Del Monte Produce. Here are three reasons why you should be careful with FDP and a stock we'd rather own.

Why Do We Think Fresh Del Monte Produce Will Underperform?

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE:FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

1. Long-Term Revenue Growth Flatter Than a Pancake

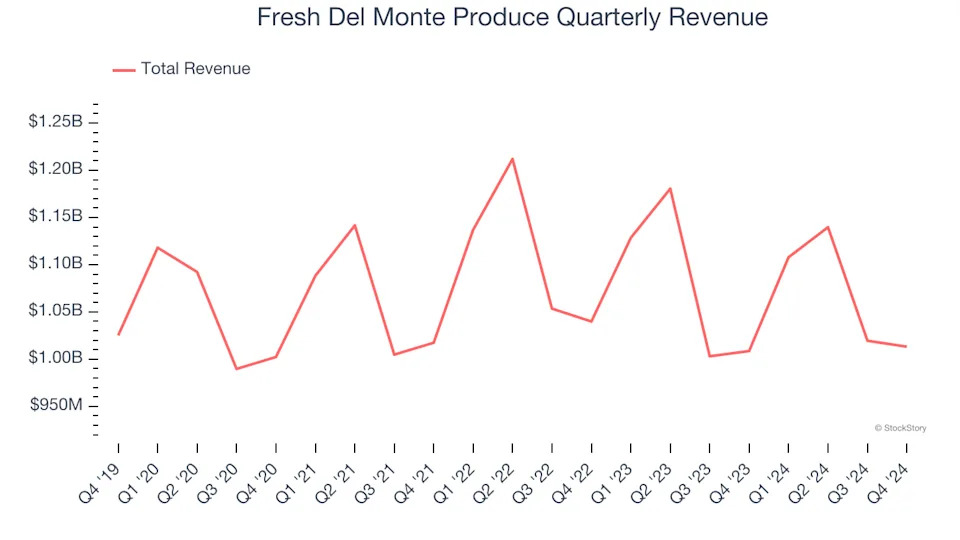

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Fresh Del Monte Produce struggled to consistently increase demand as its $4.28 billion of sales for the trailing 12 months was close to its revenue three years ago. This was below our standards and signals it’s a low quality business.

2. Low Gross Margin Reveals Weak Structural Profitability

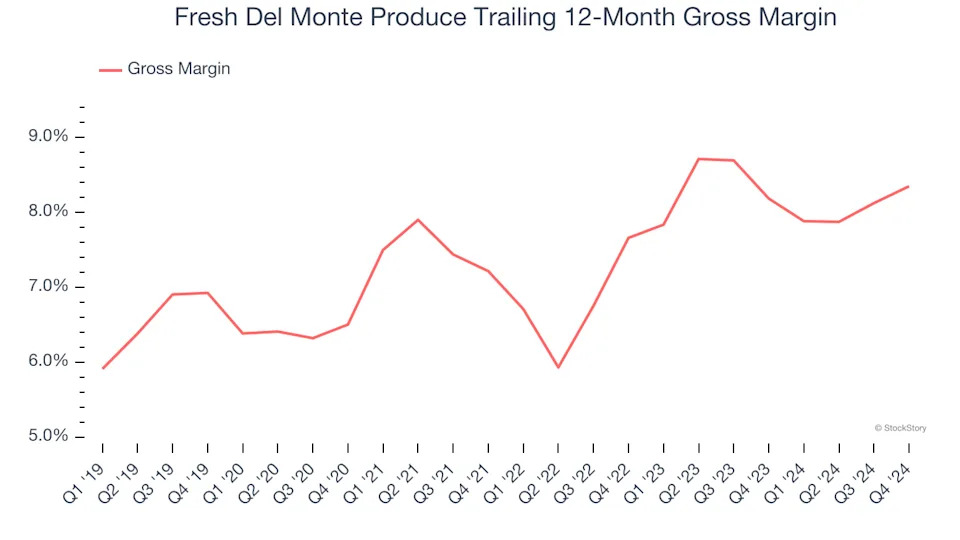

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Fresh Del Monte Produce has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 8.3% gross margin over the last two years. That means Fresh Del Monte Produce paid its suppliers a lot of money ($91.73 for every $100 in revenue) to run its business.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Fresh Del Monte Produce historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.1%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

Final Judgment

Fresh Del Monte Produce doesn’t pass our quality test. Following its recent outperformance amid a softer market environment, the stock trades at 10.4× forward price-to-earnings (or $29.11 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle .