3 Reasons PARA is Risky and 1 Stock to Buy Instead

Since October 2024, Paramount has been in a holding pattern, posting a small return of 2.8% while floating around $10.81. However, the stock is beating the S&P 500’s 14.2% decline during that period.

Is now the time to buy Paramount, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free .

Even with the strong relative performance, we don't have much confidence in Paramount. Here are three reasons why PARA doesn't excite us and a stock we'd rather own.

Why Do We Think Paramount Will Underperform?

Owner of Spongebob Squarepants and formerly known as ViacomCBS, Paramount Global (NASDAQ:PARA) is a major media conglomerate offering television, film production, and digital content across various global platforms.

1. Long-Term Revenue Growth Disappoints

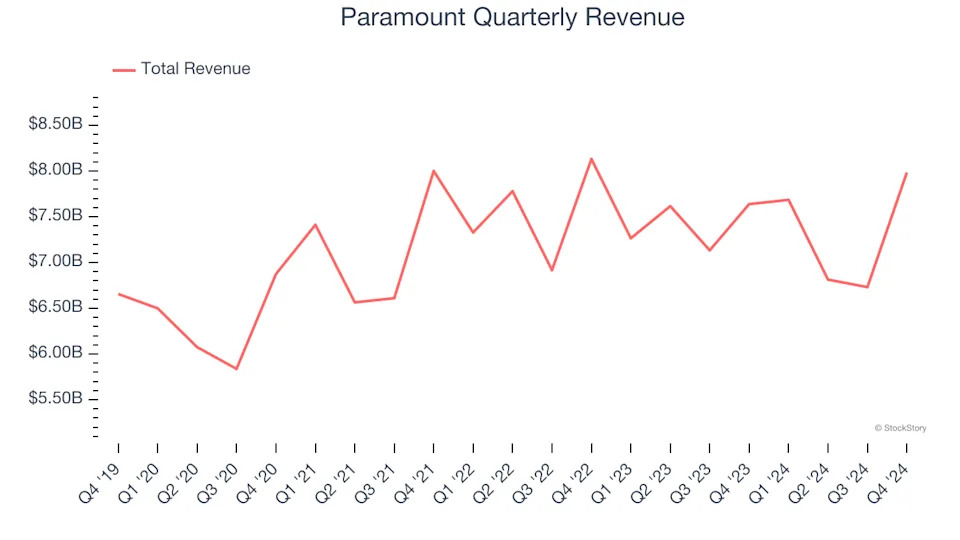

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Paramount’s 1.6% annualized revenue growth over the last five years was weak. This fell short of our benchmarks.

2. EPS Trending Down

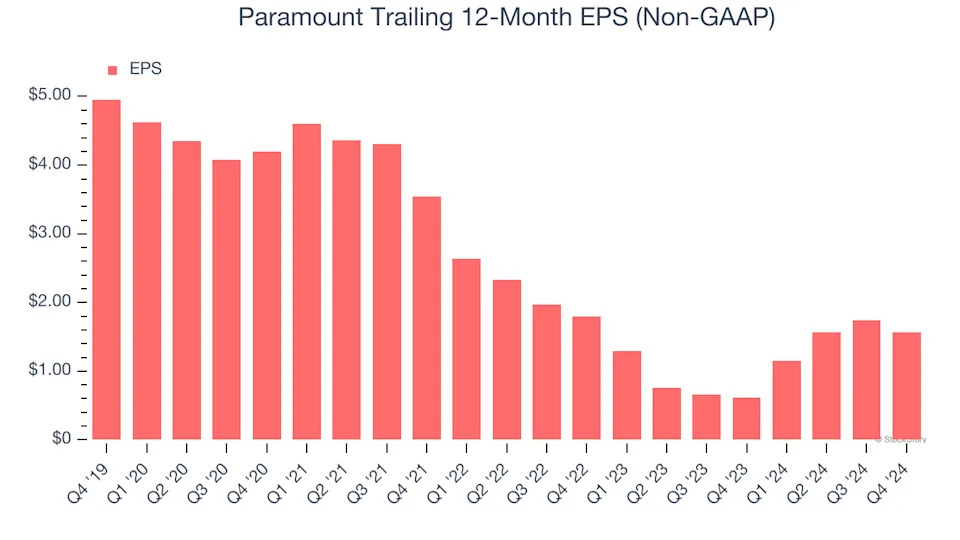

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Paramount, its EPS declined by 20.5% annually over the last five years while its revenue grew by 1.6%. This tells us the company became less profitable on a per-share basis as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

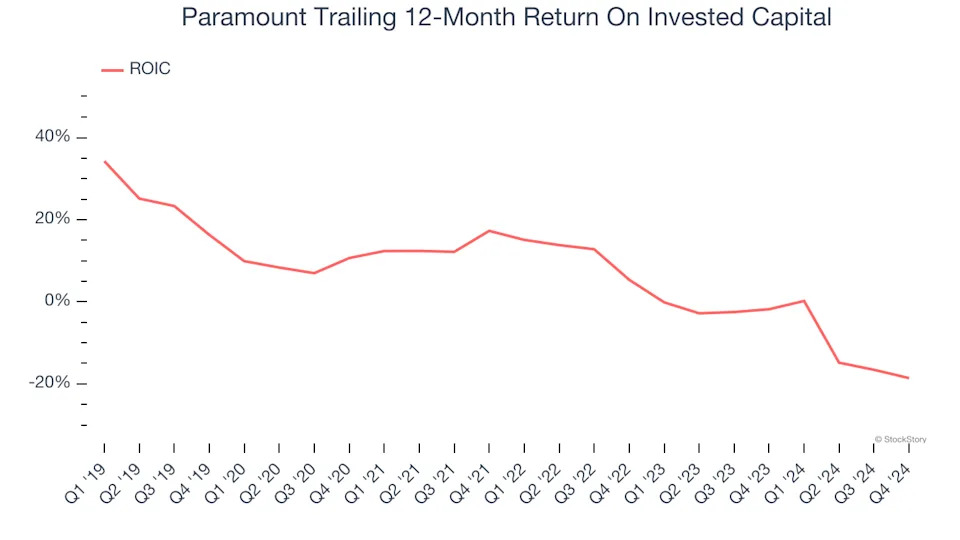

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Paramount’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We see the value of companies helping consumers, but in the case of Paramount, we’re out. Following its recent outperformance in a weaker market environment, the stock trades at 7.5× forward price-to-earnings (or $10.81 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d recommend looking at the most dominant software business in the world .