Bond Market Turbulence Lifts 30-Year Yield Most Since March 2020

(Bloomberg) -- US government bonds tumbled Monday, erasing a portion of their biggest weekly advance since August, amid signs investors were momentarily regaining their appetite for risk.

Most Read from Bloomberg

The historic selloff lifted yields across all maturities by at least 20 basis points during the session, with those on 30-year bonds higher by nearly 23 basis points in late trading — set for the biggest one-day increase since March 2020.

“We are in this environment where a little bit of good news has a disproportional environment on asset prices,” said Ian Pollick, head of fixed income, commodities and currency strategy at CIBC. “We saw some potential rebalancing of the markets today, with the equity market starting to improve, and it had the first impact on displacing bonds.”

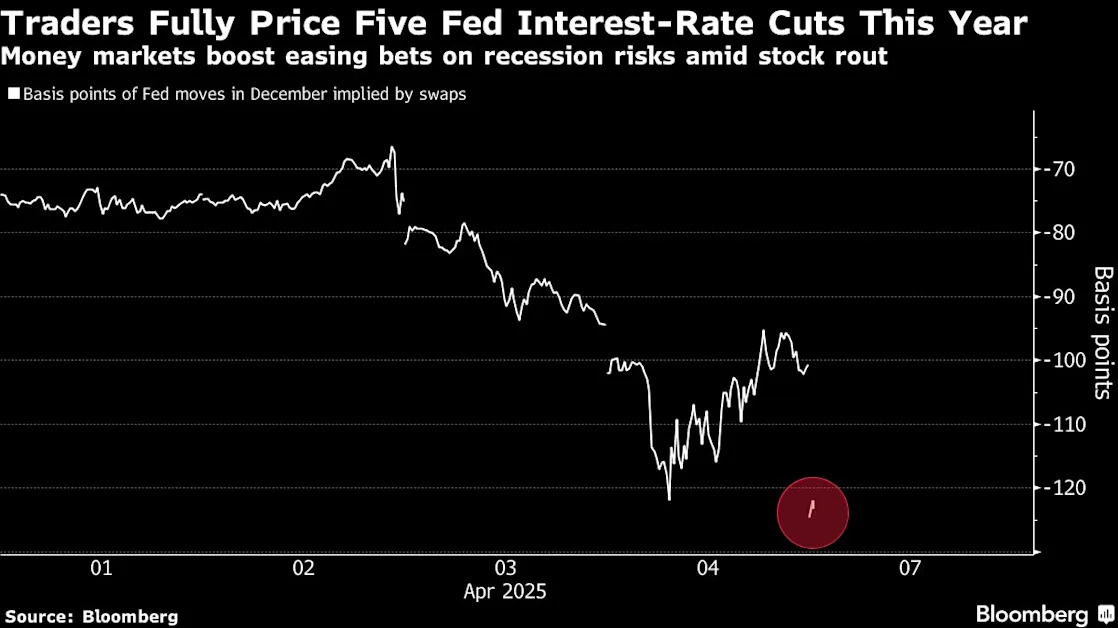

Traders’ bets on how much the Federal Reserve will lower interest rates this year fluctuated between three and five quarter-point cuts. Four reductions are now reflected in overnight interest-rate swaps this year, with the first fully priced in for June. A May reduction is seen as a coin toss.

Fear of a global recession triggered by the US administration’s tariffs agenda announced last week — and uncertainty around whether some of the most severe levies are being negotiated — led to sharp swings in the bond market as the week kicked off. While US President Donald Trump touted talks with Japanese officials, the White House denied to CNBC any plans to pause tariffs for 90 days.

Some of the whipsawing in Treasuries is tied to to the volatility in stocks, said Subadra Rajappa, head of US rates strategy at Societe Generale. The S&P 500 was only slightly lower after diving as much as 4.7% and then climbing 3.4%. Likewise, yields on 30-year bonds fell as low as 4.32%, then shot up to 4.62%. They were around 4.58% in late trading.

“It’s perhaps a combination of factors,” Rajappa said. “First, unlike prior crises it is not clear the Fed put is viable this time. Second, it is the concern that Treasuries might not act as a haven asset.”

Volatility in rates also surged, and interest-rate swaps dramatically outperformed Treasuries, indicating a preference for off-balance-sheet alternatives.

There’s also potential for auctions later this week to reveal cracks in demand for US bonds, especially from foreign buyers. The Treasury will sell three- and 10-year notes and 30-year bonds, starting on Tuesday.

“The market’s notably skittish,” Brij Khurana, portfolio manager at Wellington Management Co., said. “If you want to solve trade, unfortunately that does mean that you’re going to have less demand for US assets going forward from foreigners.”

Wobbly Fed Bets

For traders wagering on the Fed’s reaction to the uncertainty, it’s a question of how severely a trade war will impact inflation and the economy. Bill Dudley, a Bloomberg Opinion columnist and former New York Fed president, said on Monday that stagflation has become the US’s best-case scenario.

Traders earlier in the session had priced in five rate cuts in 2025 — and even started to bet on the chance that policymakers would lower rates before their next planned policy meeting in May.

Those wagers have since crumbled. Emergency interest-rate cuts are highly unusual and last employed by the Fed as the coronavirus outbreak roiled markets in early 2020. Traders briefly anticipated an inter-meeting cut in August when stocks fell sharply amid an unwind of the yen carry-trade, but policymakers held firm.

Late last week, open interest in the April fed funds futures soared, with volumes Thursday ending at a record high. At least one large block trade stands to benefit from a potential Fed policy move before the next scheduled meeting, based on the expiry date of the contract.

Recession Incoming

In recent days, JPMorgan Chase & Co. said it expects the US economy to fall into a recession this year. Chief Economist Michael Feroli sees the Fed cutting in June, with moves at each subsequent meeting through January. The bank’s chief executive officer Jamie Dimon weighed in early Monday, urging a quick resolution to the uncertainties sparked by tariffs.

Economists at Goldman Sachs Group Inc. also changed their forecasts last week, with three reductions now the base case for both the Federal Reserve and the European Central Bank.

What Bloomberg strategists say...

“The Federal Reserve may soon not have a choice but to cut rates. Tariffs raise the ugly scepter of inflation, true, but if growth turns pear-shaped, the Fed will have no choice but to prioritize the economy.”

— Ven Ram, macro strategist, Dubai.

Governments around the world are rushing to negotiate with US officials to reduce the tariffs imposed on their exports, leaving markets in freefall as traders price in the uncertainty of whether deals can be struck.

Traders have also slashed rate-cut bets for the ECB and Bank of England on expectations policymakers will have to act to shield their economies.

Fed Chair Jerome Powell made clear on Friday that he would not rush to ease rates even as turmoil erupts across markets. In a speech, he stressed that still-elevated inflation means policymakers will need to act with caution given the temporary price boost from tariffs.

Still, “there’s a mentality that Treasuries were overpriced, and people who felt comfortable enough that the tariff situation was showing some signs of improvement were willing to sell,” said Tony Farren, managing director in rates sales and trading at Mischler Financial Group. “I’m not saying they’ll be right tomorrow, but they were definitely right today.”

--With assistance from Michael Mackenzie, Alice Atkins and Ye Xie.

(Adds comments, updates yield levels.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.