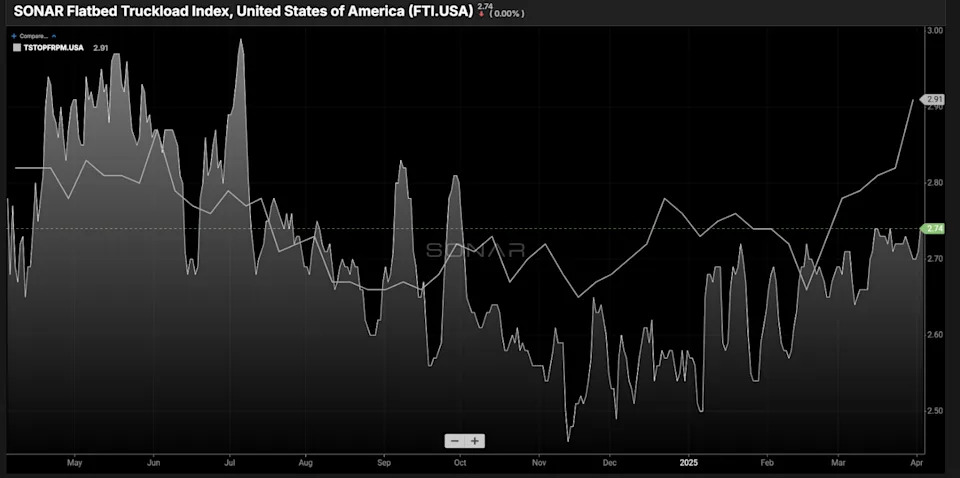

Flatbed market benefits from tariff uncertainty

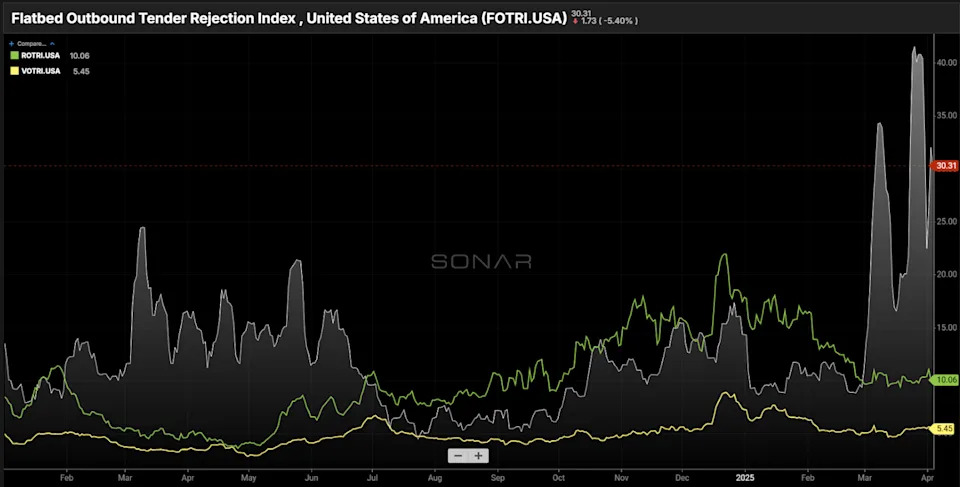

Chart of the Week: Flatbed Outbound Tender Reject Index – USA SONAR : FOTRI.USA, VOTRI.USA, ROTRI.USA

Tender rejection rates for flatbed loads (FOTRI) spiked to 40% in March, its highest level since early 2022. Van (VOTRI) and refrigerated (ROTRI) rejections also saw increases. While some of this can be attributed to seasonal patterns, the timing suggests that tariff-related uncertainty and concerns about rising costs are playing a key role in supporting this surge in demand.

It’s important to note that flatbed freight represents only a small percentage of total tender volume. This makes it more responsive to market fluctuations – and thus one of the quickest indicators of disruption. Another reason for its heightened sensitivity is that it largely consists of contracted freight, which is typically priced lower than spot market freight.

Three primary factors are driving the current state of the flatbed market and its potential sustainability:

Seasonal trends

The flatbed market tends to awaken in the spring as construction activity picks up with warmer weather. The initial spike in demand usually impacts the spot market first, pulling capacity away from more stable contract freight. This shift leads to increased tender rejections as carriers reallocate resources.

Following the brief implementation of tariffs on Canada and Mexico by President Donald Trump – before they were paused in early March – flatbed rejections surged from around 10% to nearly 35%. While this may seem like a clear cause-and-effect relationship, it’s worth noting that FOTRI also rose from 11% to 24% in March of last year. Even in 2021, during the pandemic, there was a noticeable seasonal bump from March through July.

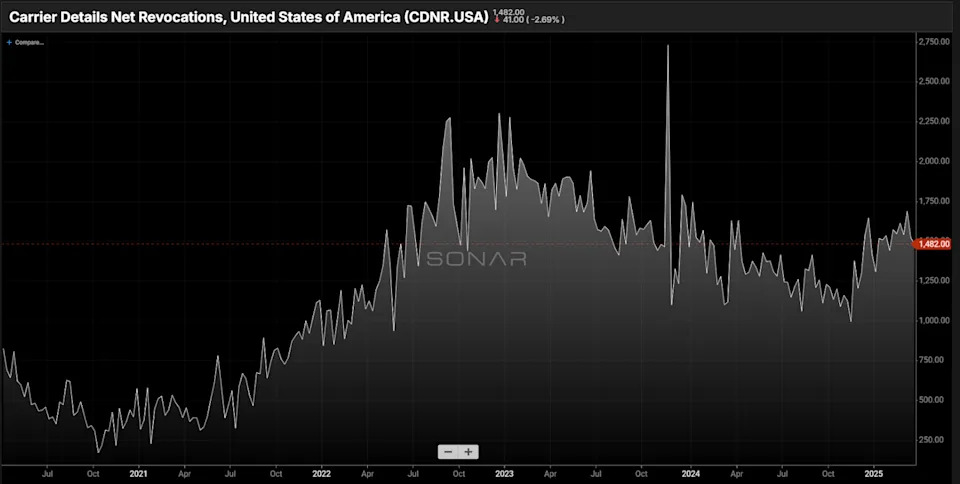

Market capacity shift

Truckload capacity has been declining at a notable rate over the past year. Net revocations of operating authorities have increased during the winter months. Flatbed carriers, in particular, are more vulnerable during the winter season due to decreased demand, which likely led to a disproportionate number of exits compared to van or reefer operators.

As capacity continues to contract, the market becomes increasingly sensitive to shifts in demand. While current capacity may still be sufficient for the predictable flow of freight, sudden spikes or changes in volume are more likely to cause disruptions in carrier networks – something already seen in the van and reefer segments.

Tariff-driven activity

As previously mentioned, tariff threats – particularly the early, aggressive stance on duties involving Canada and Mexico in February – have had an outsize impact on the flatbed market. With high exposure to industries like automotive and lumber, companies are clearly accelerating shipments to avoid potential cost increases.