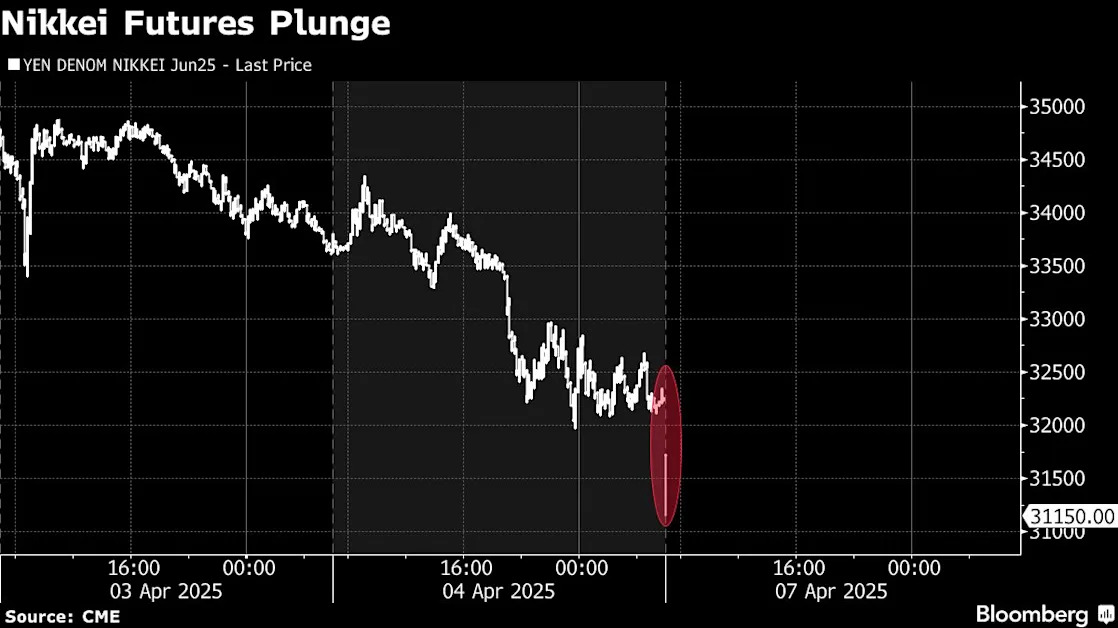

Ishiba to Talk With Trump as Japan’s Nikkei Enters Bear Market

(Bloomberg) -- Japan’s Nikkei 225 Stock Average slid into a bear market over fears of a widening trade war, while Japanese Prime Minister Shigeru Ishiba was reportedly set to have a call with US President Donald Trump on Monday night.

Most Read from Bloomberg

Ishiba is expected to make the last plea for exemptions or reduction from a 24% across-the-board tariff slated to hit the nation on Wednesday. The blue-chip index closed 7.8% lower on Monday, taking the loss from its December peak to 23%. The broader Topix index also sank, with electronics makers and banks weighing on the benchmark as Japan’s economic outlook darkened.

It’s the first time the Nikkei has entered a bear market since August, when an unexpected rate hike by the Bank of Japan triggered a widespread market rout.

Shortly after the market close, a local media report said Ishiba may hold a call with Trump by the end of Monday. Another report said the premier, whose popularity remains low ahead of a summer national election, is expected to order an extra budget this month to deal with the impact of the tariffs and persistent inflation.

Ishiba fielded a barrage of questions in parliament over Japan’s response on Monday after Trump signaled that he wasn’t planning to claw back the tariffs that had roiled financial markets worldwide.

“We must make it clear that our country is not doing anything unfair,” Ishiba said.

The Nikkei has fallen more than all other major Asian indexes this month as the yen’s strength threatened to erode the profits of exporters. From a broader perspective, Beijing’s decision to impose commensurate levies on American goods stoked fears of an escalating trade war.

“Stocks had already dropped to an extreme level, but now the market seems to be factoring in China’s retaliatory tariffs, and the fact that Trump is not backing down,” said Yusuke Sakai, senior trader at T&D Asset Management. “The situation has developed beyond a Trump ‘shock.’ We’re now looking at the possibility of a global economic recession.”

Rising uncertainties over the global trade war have also given traders more incentive to pare bets on the Bank of Japan’s interest rate hikes. That will put an onus on Ishiba to do more to address the persistent inflation that’s been weighing on consumption and growth.

Ishiba may order an extra budget by the end of April to stimulate domestic demand in the wake of the US auto tariffs that took effect last week, and boost support for inflation-hit households, Kyodo news reported.

At a meeting with officials from his ruling Liberal Democratic Party on Monday to discuss the tariffs, the premier stuck to his previous approach of touting Japan’s contributions to the US economy, and refrained from suggesting retaliatory actions.

“There are things that Japan can do to help create jobs in the U.S., and in order to do this, we would like to strongly call for the elimination or reduction of tariffs,” Ishiba said.

During a summit with Trump in February, Ishiba promised to buy more LNG from the US and raise Japan’s investments into the US to $1 trillion. He and other top officials have repeatedly touted Japan’s standing as the biggest investor in the US, including factories built by Japanese automakers that have created jobs for Americans.

Meanwhile, Finance Minister Katsunobu Kato told reporters on Monday that he’s watching market movements with a heightened sense of urgency, and called on traders to make calm and rational investment decisions.

Sliding Stocks

Japanese stocks are being hit particularly hard as a stronger yen against the dollar pressures exporters, said T&D’s Sakai. Diminishing expectations of more rate hikes by the BOJ, due to economic worries, are also weighing on bank stocks, he added.

Goldman Sachs Lowers Topix Targets on Trade Uncertainty, Economy

The yen earlier rallied more than 1% against the dollar on Monday, outperforming its major peers this month as the escalating trade tensions fueled demand for the safest assets.

Meanwhile, Japan’s benchmark 10-year bond yield fell nine basis points to 1.11%. Overnight-indexed swaps signaled a less than 25% chance of the BOJ raising interest rates this year, even after data showed nominal wages rose more than expected in February.

Concerns over a potential recession are fueling the risk-off mood, and are driving fears the profits of Japanese companies that do business in the US will suffer, said Shoji Hirakawa, chief global strategist at Tokai Tokyo Intelligence Lab.

“The moves in the market are not dissimilar to the rout in August, but that was short-lived,” said Sakai. “This time, Trump is the issue, and that can’t be so easily solved. It won’t be easy to rebound from this.”

--With assistance from Masaki Kondo, Toshiro Hasegawa, Erica Yokoyama, Aya Wagatsuma, Toru Fujioka and Sakura Murakami.

(Updates with Ishiba’s call with Trump)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.