3 Reasons to Avoid NWSA and 1 Stock to Buy Instead

Although News Corp has dropped 6.3% to $24.35 per share over the past six months, it has beaten the S&P 500 by 7.7 percentage points.

Is now the time to buy News Corp, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even with the cheaper entry price, we're cautious about News Corp. Here are three reasons why you should be careful with NWSA and a stock we'd rather own.

Why Do We Think News Corp Will Underperform?

Established in 2013 after a restructuring, News Corp (NASDAQ:NWSA) is a multinational conglomerate known for its news publishing, broadcasting, digital media, and book publishing.

1. Long-Term Revenue Growth Flatter Than a Pancake

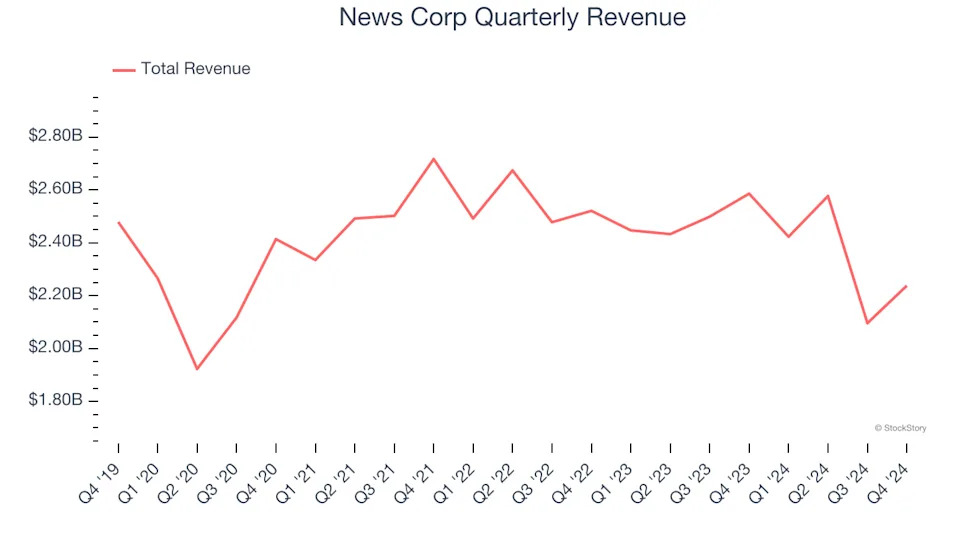

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, News Corp struggled to consistently increase demand as its $9.33 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect News Corp’s revenue to drop by 8.8%, a decrease from its 4.2% annualized declines for the past two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

News Corp historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.1%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

We see the value of companies helping consumers, but in the case of News Corp, we’re out. Following the recent decline, the stock trades at 27.1× forward price-to-earnings (or $24.35 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d recommend looking at the most dominant software business in the world .