3 Reasons SGRY is Risky and 1 Stock to Buy Instead

What a brutal six months it’s been for Surgery Partners. The stock has dropped 29.9% and now trades at $21.10, rattling many shareholders. This might have investors contemplating their next move.

Is now the time to buy Surgery Partners, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even with the cheaper entry price, we're swiping left on Surgery Partners for now. Here are three reasons why you should be careful with SGRY and a stock we'd rather own.

Why Is Surgery Partners Not Exciting?

With more than 180 locations across 33 states serving as alternatives to traditional hospital settings, Surgery Partners (NASDAQ:SGRY) operates a national network of outpatient surgical facilities including ambulatory surgery centers and short-stay surgical hospitals.

1. Weak Sales Volumes Indicate Waning Demand

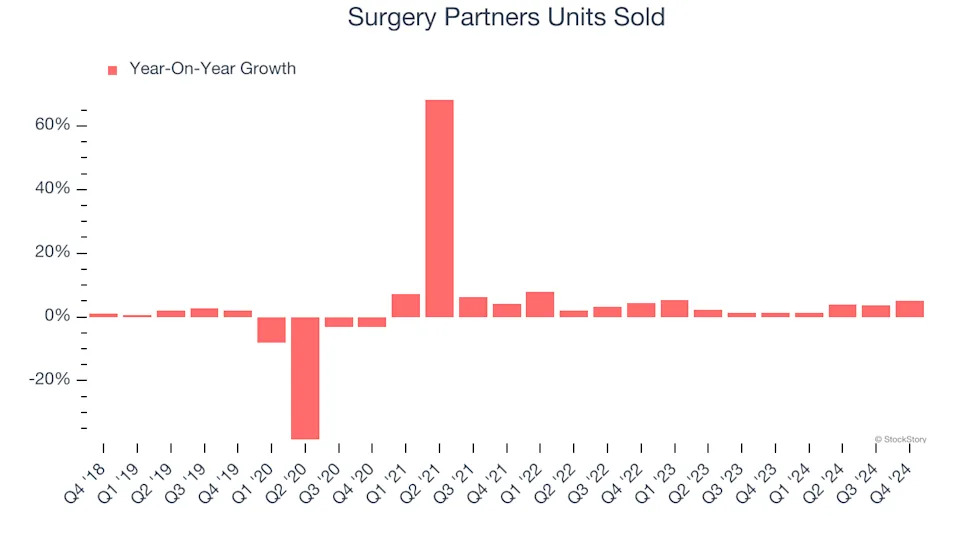

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Outpatient & Specialty Care company because there’s a ceiling to what customers will pay.

Over the last two years, Surgery Partners’s units sold averaged 3% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Free Cash Flow Margin Dropping

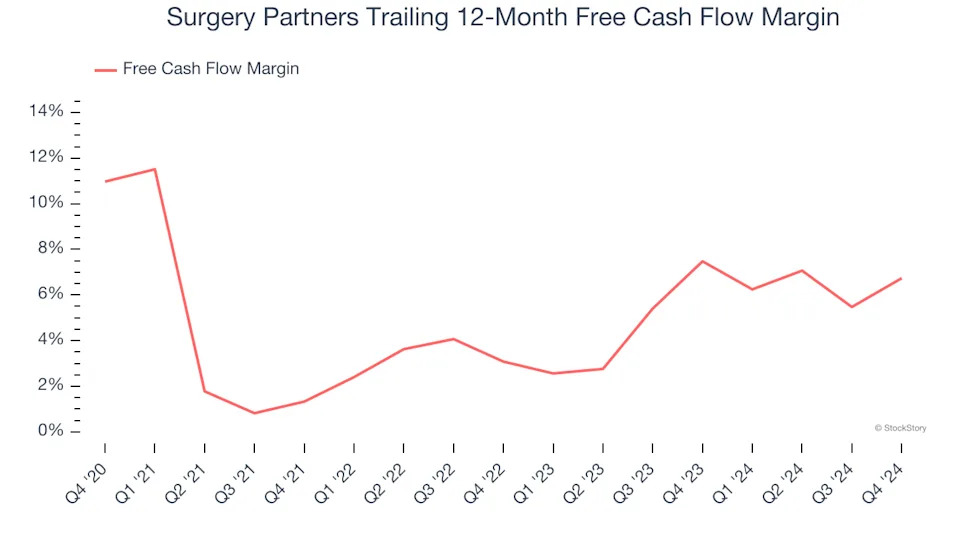

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Surgery Partners’s margin dropped by 4.2 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Surgery Partners’s free cash flow margin for the trailing 12 months was 6.7%.

3. High Debt Levels Increase Risk

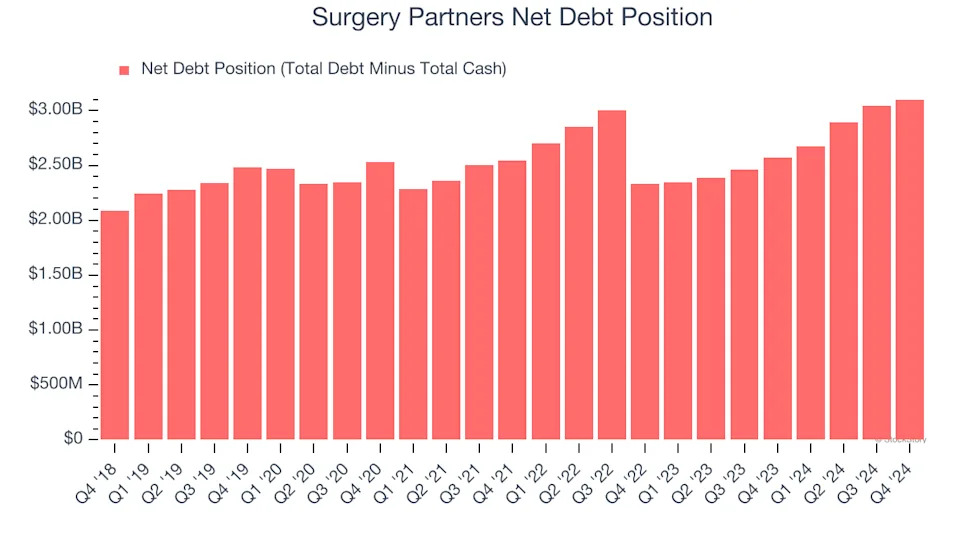

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Surgery Partners’s $3.37 billion of debt exceeds the $269.5 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $508.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Surgery Partners could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.