3 Reasons to Avoid DBX and 1 Stock to Buy Instead

Since October 2024, Dropbox has been in a holding pattern, posting a small loss of 4.5% while floating around $24.15. However, the stock is beating the S&P 500’s 14.2% decline during that period.

Is now the time to buy Dropbox, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the relative momentum, we're cautious about Dropbox. Here are three reasons why you should be careful with DBX and a stock we'd rather own.

Why Is Dropbox Not Exciting?

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

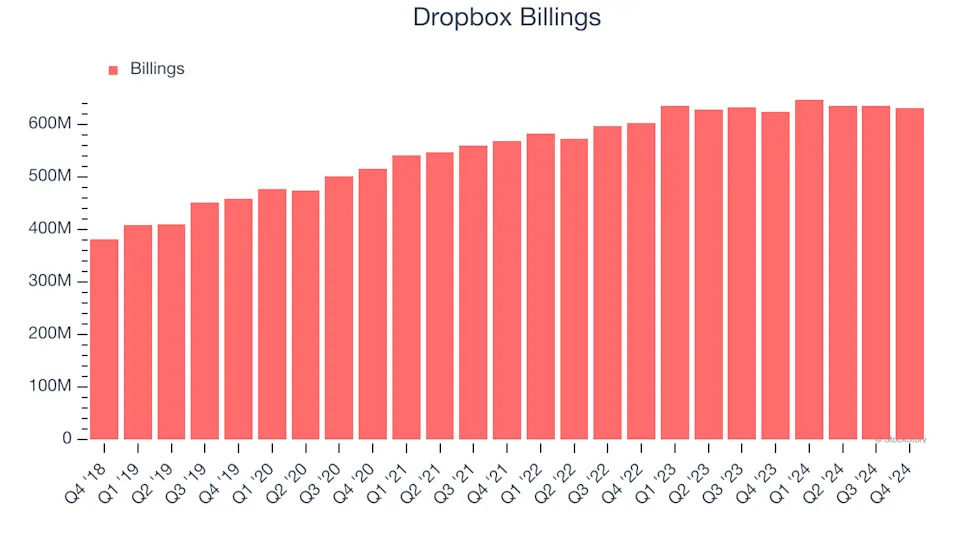

1. Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Dropbox’s billings came in at $631.5 million in Q4, and over the last four quarters, its year-on-year growth averaged 1.1%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Dropbox’s revenue to drop by 2.8%, a decrease from its 5.7% annualized growth for the past three years. This projection is underwhelming and suggests its products and services will face some demand challenges.

3. Shrinking Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, Dropbox’s operating margin decreased by 2.5 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 19.1%.