3 Reasons to Sell EBAY and 1 Stock to Buy Instead

While eBay has slipped 9.2% to $60.64 per share over the past six months, it’s still beating the S&P 500 by 5 percentage points.

Is now the time to buy eBay, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Despite the more favorable entry price, we're cautious about eBay. Here are three reasons why you should be careful with EBAY and a stock we'd rather own.

Why Is eBay Not Exciting?

Originally known as the first online auction site, eBay (NASDAQ:EBAY) is one of the world’s largest online marketplaces.

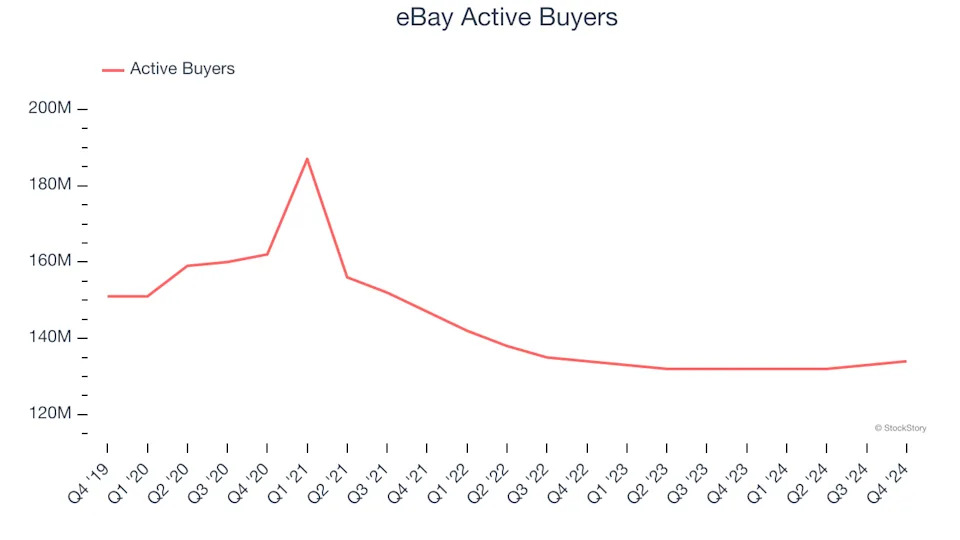

1. Declining Active Buyers Reflect Product Weakness

As an online marketplace, eBay generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

eBay struggled with new customer acquisition over the last two years as its active buyers have declined by 1.6% annually to 134 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If eBay wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect eBay’s revenue to rise by 2.1%. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

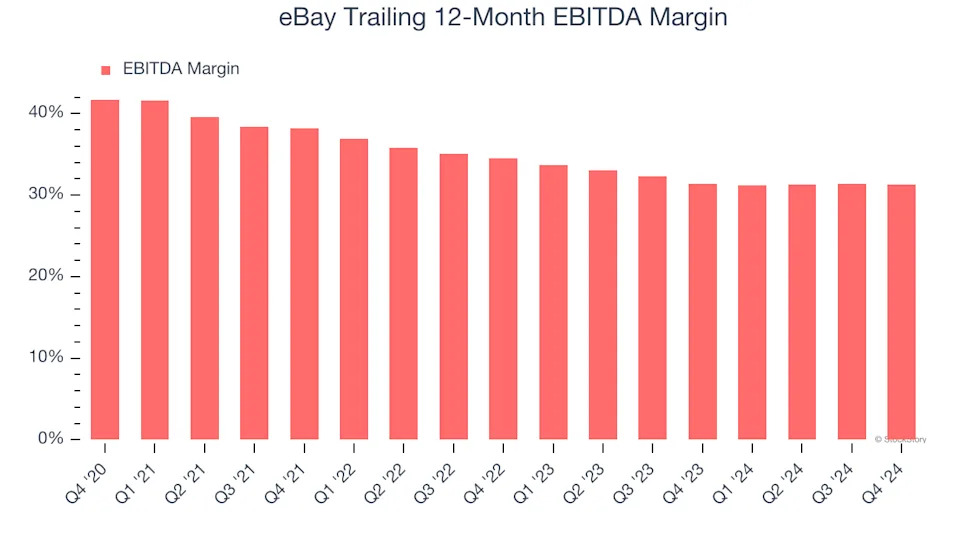

3. Shrinking EBITDA Margin

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Looking at the trend in its profitability, eBay’s EBITDA margin decreased by 6.9 percentage points over the last few years. Even though its historical margin was healthy, shareholders will want to see eBay become more profitable in the future. Its EBITDA margin for the trailing 12 months was 31.3%.

Final Judgment

eBay isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 9× forward EV-to-EBITDA (or $60.64 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle .