3 Reasons to Avoid PCTY and 1 Stock to Buy Instead

While the broader market has struggled with the S&P 500 down 6.9% since October 2024, Paylocity has surged ahead as its stock price has climbed by 6.8% to $181.76 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Paylocity, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free .

We’re happy investors have made money, but we're cautious about Paylocity. Here are three reasons why you should be careful with PCTY and a stock we'd rather own.

Why Is Paylocity Not Exciting?

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

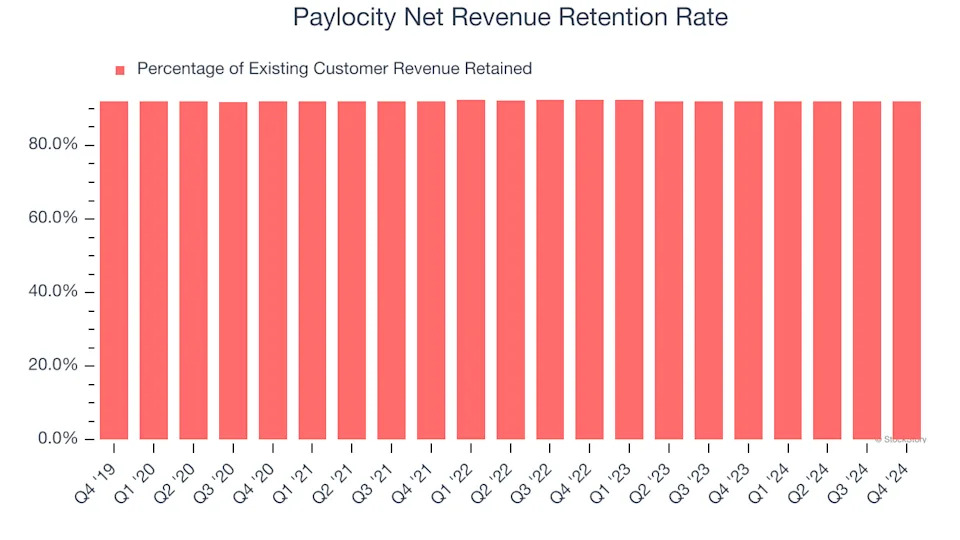

1. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Paylocity’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 92% in Q4. This means Paylocity’s revenue would’ve decreased by 8% over the last 12 months if it didn’t win any new customers.

Paylocity has a poor net retention rate, warning us that its customers are churning and that its products might not live up to expectations.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Paylocity’s revenue to rise by 8.8%, a deceleration versus its 27% annualized growth for the past three years. This projection is underwhelming and suggests its products and services will face some demand challenges.

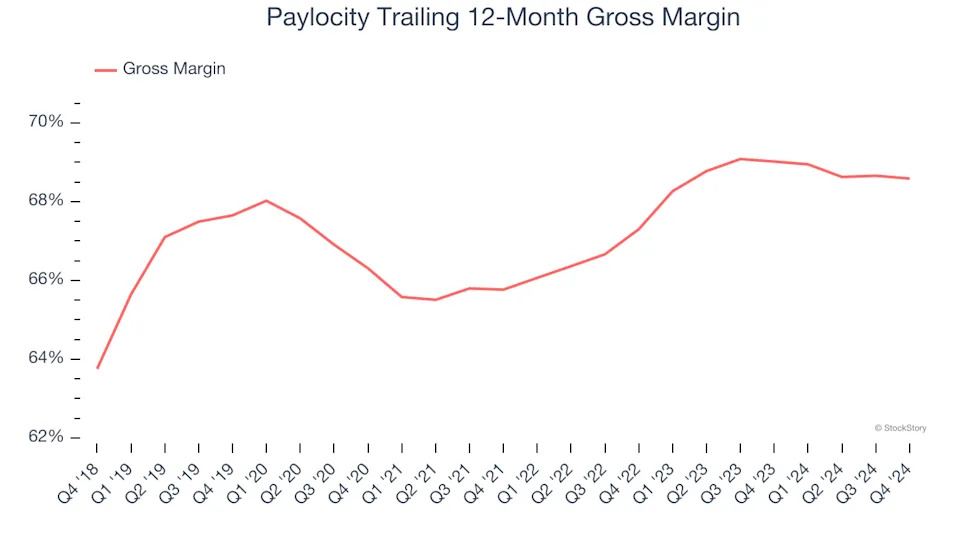

3. Low Gross Margin Hinders Flexibility

For software companies like Paylocity, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Paylocity’s gross margin is slightly below the average software company, giving it less room than its competitors to invest in areas such as product and sales. As you can see below, it averaged a 68.6% gross margin over the last year. That means Paylocity paid its providers a lot of money ($31.41 for every $100 in revenue) to run its business.