3 Reasons to Sell PLCE and 1 Stock to Buy Instead

Children's Place’s stock price has taken a beating over the past six months, shedding 46.9% of its value and falling to $7.97 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Children's Place, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even though the stock has become cheaper, we're cautious about Children's Place. Here are three reasons why there are better opportunities than PLCE and a stock we'd rather own.

Why Do We Think Children's Place Will Underperform?

Offering sizes up to young teens, The Children’s Place (NASDAQ:PLCE) is a specialty retailer that sells its own brands of kid’s apparel and accessories.

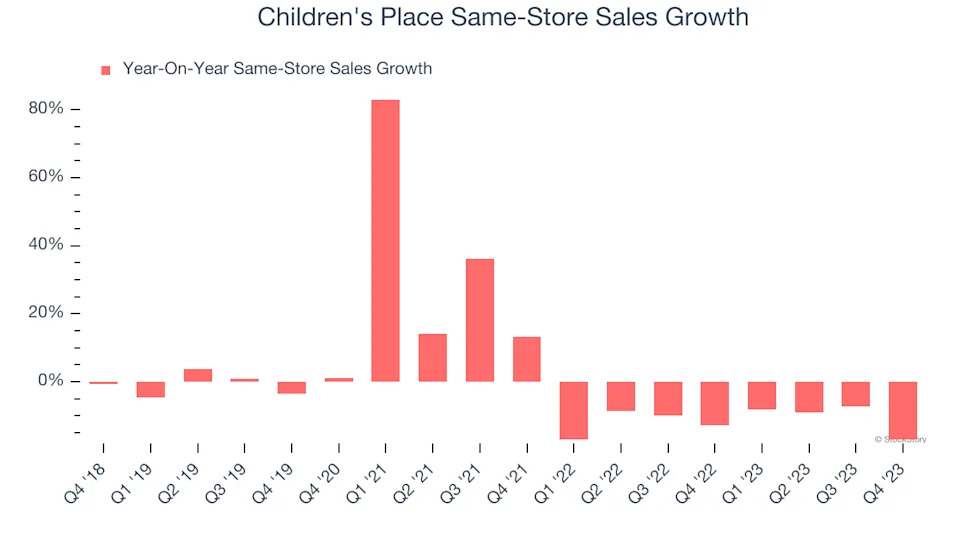

1. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Children's Place’s demand has been shrinking over the last two years as its same-store sales have averaged 11.3% annual declines.

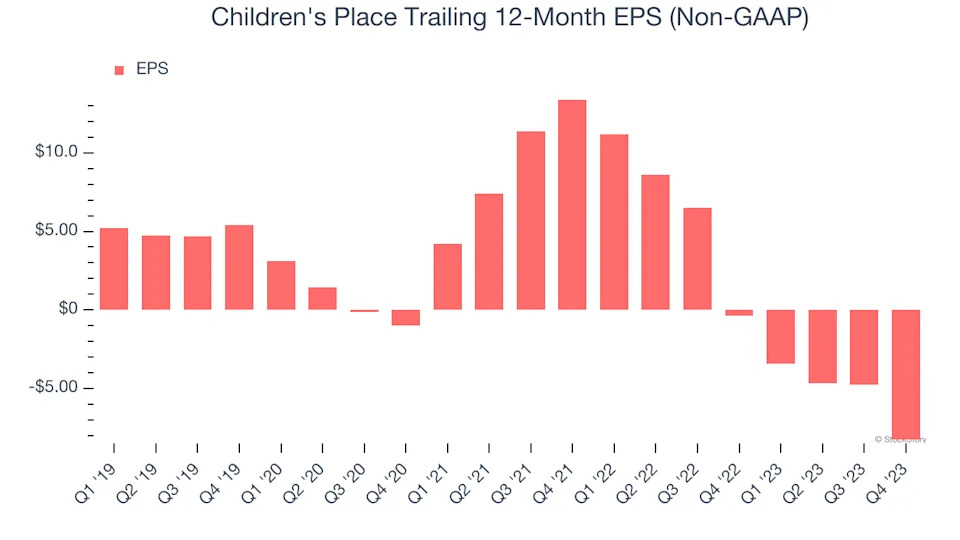

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Children's Place, its EPS declined by 37% annually over the last four years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

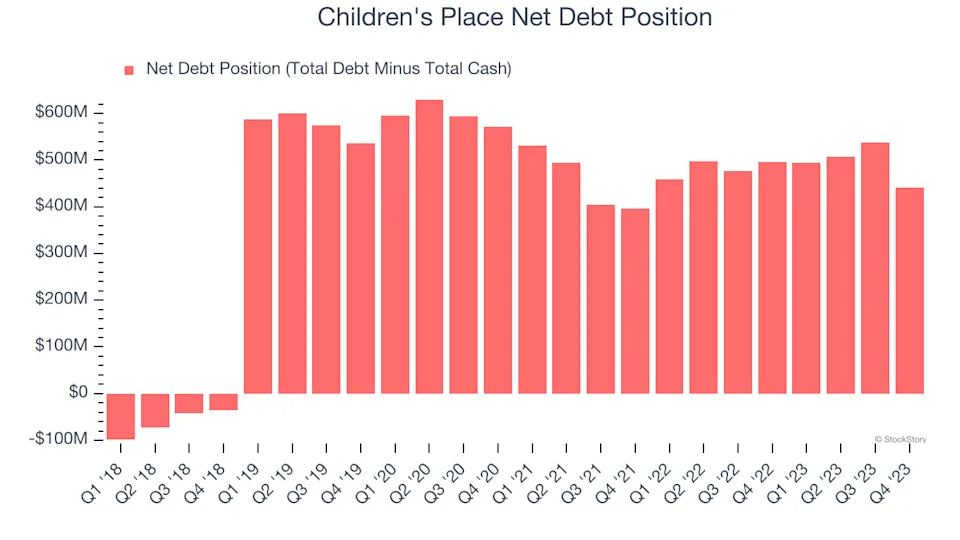

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Children's Place’s $454.2 million of debt exceeds the $13.64 million of cash on its balance sheet. Furthermore, its 78× net-debt-to-EBITDA ratio (based on its EBITDA of $5.63 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Children's Place could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Children's Place can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.