4 takeaways as investors survey the tariff damage to markets: Morning Brief

This is The Takeaway from today's Morning Brief, which you can sign up to receive in your inbox every morning along with:

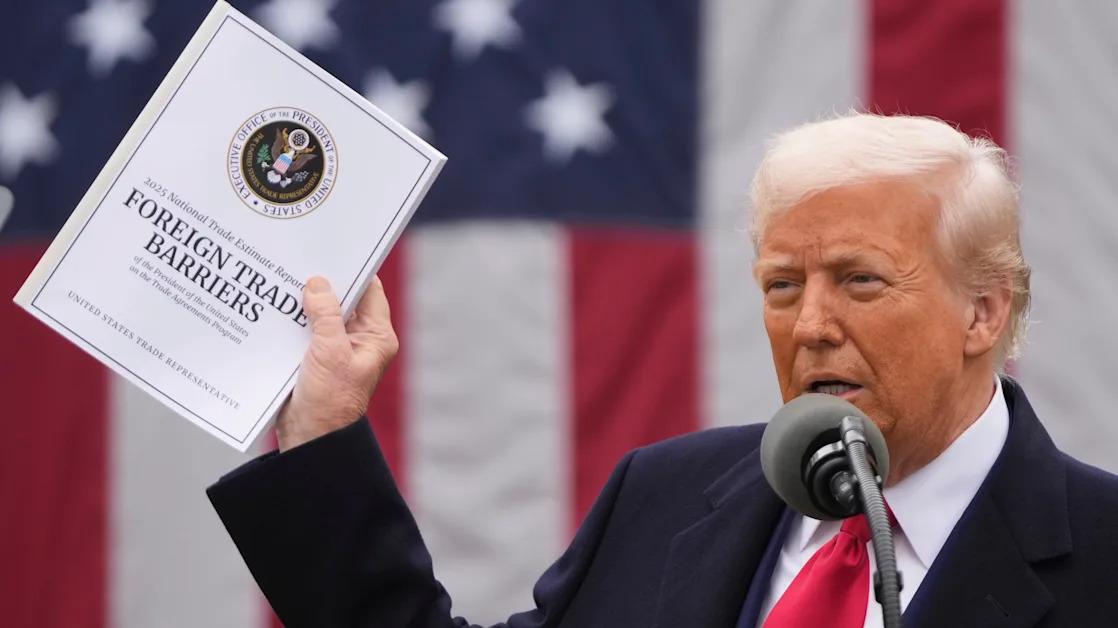

The first and most obvious takeaway from this week's tariff announcement was the stock market's instant reaction. Red was the color of the day as stock charts nosedived following the rollout of President Trump’s reciprocal tariffs. The S&P 500 ( ^GSPC ) fell 4.8%, its worst day since pandemic news roiled markets in 2020.

For weeks, investors and analysts tried to divine the size and scope of the levies, who exactly would be impacted, and by how much. That uncertainty partially ended once the policy was unveiled, and when the tide went out, it was clear that the market had utterly failed to price in the news.

Read more about the global market sell-off and today's market action.

Market observers were left in shock as the tariffs came in stiffer and more far-reaching than many had expected. On the one hand, tariffs may still be used as a negotiating tool to extract trade concessions from other governments. But their immediate impact sparked a panic in the markets as the prospects for higher prices, stalled growth, and escalating tensions were thrust into the spotlight.

The recession calculus has just changed dramatically. Wall Street economists are raising the alarm that an economic decline could be on the horizon. Part of the rush in reactions to the tariff policy was a recalibration by economists and strategists, paring down their growth forecasts as a new, protectionist regime could weigh heavily on US commerce.

As JPMorgan economist Michael Feroli put it in a note, the reciprocal tariffs can be seen as “the largest tax increase since the Revenue Act of 1968.”

The inflationary impact of the levies, he wrote, could turn disposable income growth negative and shrink consumer spending, noting, "This impact alone could take the economy perilously close to slipping into recession." Echoing those concerns, Oxford Economics economist Ryan Sweet said the economy has become "dangerously vulnerable" to a recession over the next 12 months.

Read more: How to protect your money during economic turmoil, stock market volatility

The Fed is between a rock and a hard place. "Wait and see" has been the mantra of the US central bank for the weeks leading up to “Liberation Day.” But deciding when to adjust rates is a harder job to do when sweeping tariffs can pressure both sides of the Fed’s mandate. (As a tax on imported goods, tariffs can raise prices and stall growth.) Traders predict that the tariffs will lead to more rate-cutting rather than less.