Winners And Losers Of Q4: Coinbase (NASDAQ:COIN) Vs The Rest Of The Consumer Internet Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how consumer internet stocks fared in Q4, starting with Coinbase (NASDAQ:COIN).

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18.3% since the latest earnings results.

Coinbase (NASDAQ:COIN)

Widely regarded as the face of crypto, Coinbase (NASDAQ:COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

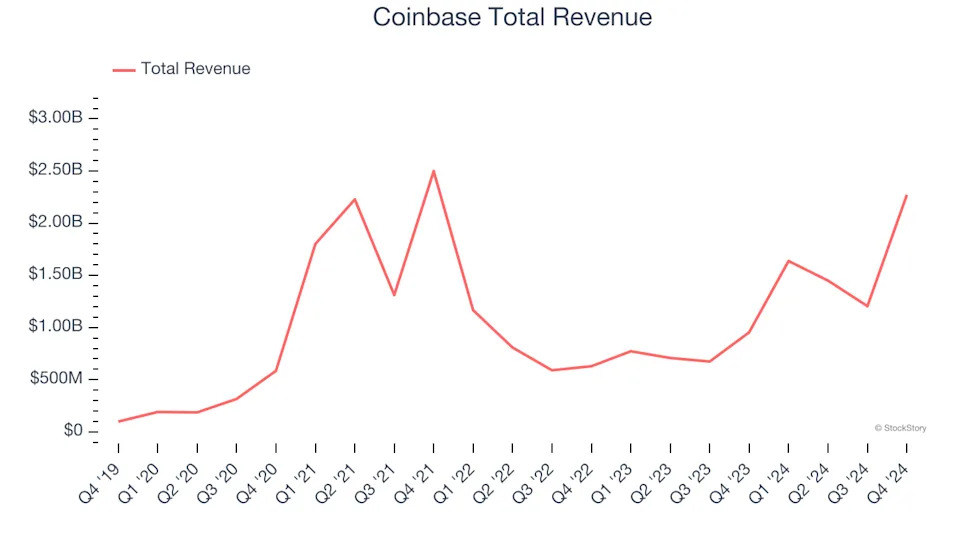

Coinbase reported revenues of $2.27 billion, up 138% year on year. This print exceeded analysts’ expectations by 22%. Overall, it was a very good quarter for the company with a solid beat of analysts’ EBITDA estimates and strong growth in its users.

Coinbase achieved the biggest analyst estimates beat of the whole group. The company reported 8.4 million monthly active users, up 20% year on year. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 41.3% since reporting and currently trades at $175.07.

Best Q4: Carvana (NYSE:CVNA)

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $3.55 billion, up 46.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and impressive growth in its units.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 24.1% since reporting. It currently trades at $213.97.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.