Gaming Solutions Stocks Q4 Results: Benchmarking Light & Wonder (NASDAQ:LNW)

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the gaming solutions stocks, including Light & Wonder (NASDAQ:LNW) and its peers.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 7 gaming solutions stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 14.5% since the latest earnings results.

Light & Wonder (NASDAQ:LNW)

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ:LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

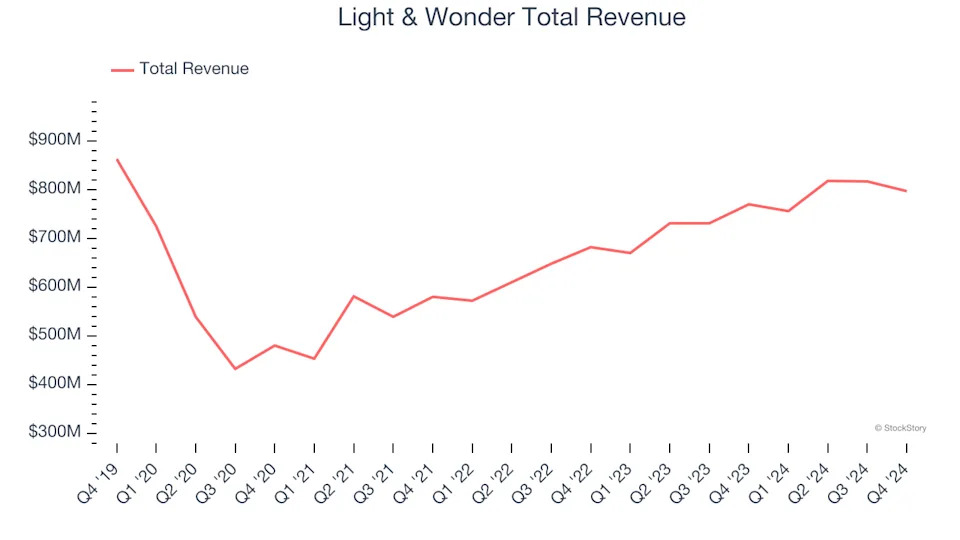

Light & Wonder reported revenues of $797 million, up 3.5% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EPS estimates but a miss of analysts’ iGaming revenue estimates.

The stock is down 11.3% since reporting and currently trades at $90.10.

Is now the time to buy Light & Wonder? Access our full analysis of the earnings results here, it’s free .

Best Q4: Rush Street Interactive (NYSE:RSI)

Specializing in online casino gaming and sports betting, Rush Street Interactive (NYSE:RSI) is an operator of digital gaming platforms.

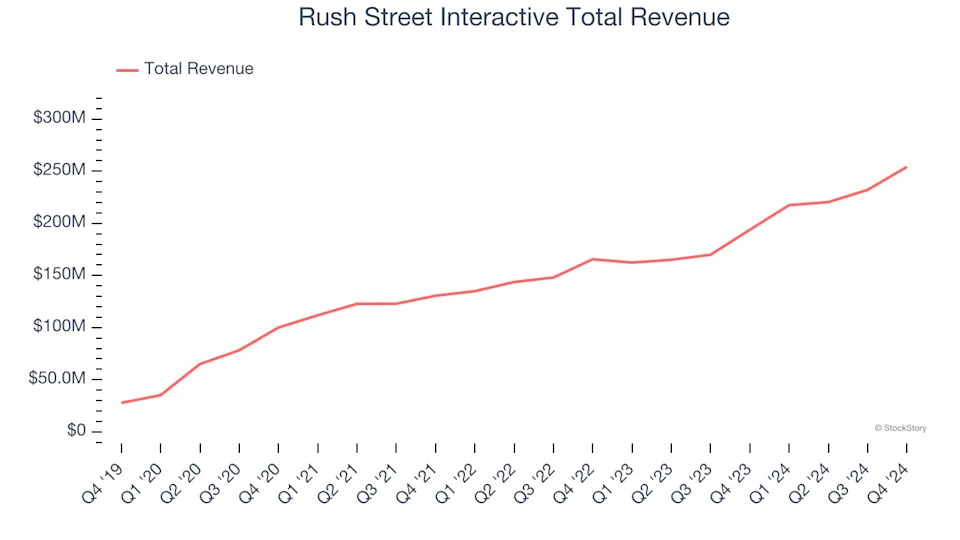

Rush Street Interactive reported revenues of $254.2 million, up 31.1% year on year, outperforming analysts’ expectations by 3.4%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

Rush Street Interactive achieved the fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 24.7% since reporting. It currently trades at $10.02.