Sit-Down Dining Stocks Q4 Recap: Benchmarking Bloomin' Brands (NASDAQ:BLMN)

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at sit-down dining stocks, starting with Bloomin' Brands (NASDAQ:BLMN).

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 13 sit-down dining stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was 2.4% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.9% since the latest earnings results.

Weakest Q4: Bloomin' Brands (NASDAQ:BLMN)

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ:BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

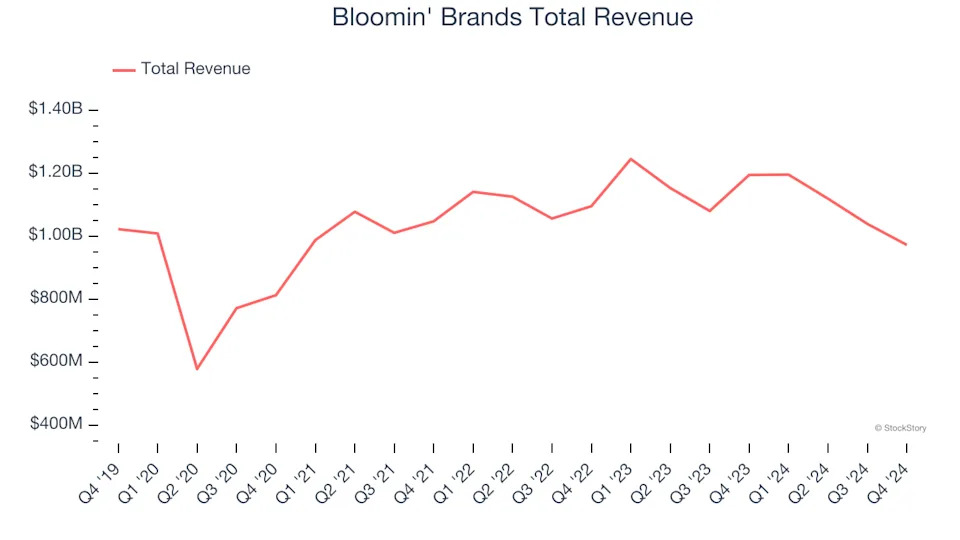

Bloomin' Brands reported revenues of $972 million, down 18.6% year on year. This print fell short of analysts’ expectations by 9.9%. Overall, it was a disappointing quarter for the company with full-year EPS guidance missing analysts’ expectations.

Bloomin' Brands delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is down 35.3% since reporting and currently trades at $7.70.

Read our full report on Bloomin' Brands here, it’s free .

Best Q4: Brinker International (NYSE:EAT)

Founded by Norman Brinker in Dallas, Brinker International (NYSE:EAT) is a casual restaurant chain that operates the Chili’s, Maggiano’s Little Italy, and It’s Just Wings banners.

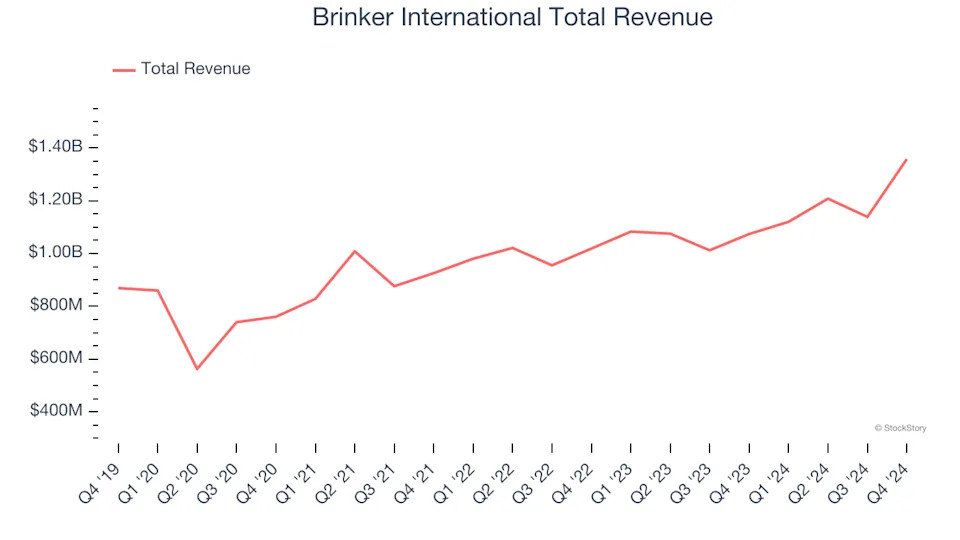

Brinker International reported revenues of $1.36 billion, up 26.5% year on year, outperforming analysts’ expectations by 9.6%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Brinker International scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 2.5% since reporting. It currently trades at $150.84.